Balanced ETF portfolios GBP Q2 2023 commentary

| Asset classes | Stocks (developed and emerging equity), bonds, non-traditional |

| Instruments | ETFs |

| Investment style | Macro, diversified investment focus |

Quarterly return (net of fees)

| Defensive | -0.45% |

| Moderate | 0.83% |

| Aggressive | 1.71% |

Market overview

The second quarter of 2023 was characterised by significant divergence in the performance of financial assets. While news of persistent inflation, slowing growth and interest rates remaining higher for longer led to underperformance of safe-haven assets including government bonds, the excitement around Artificial Intelligence benefitted giant-cap Technology names which outperformed over the quarter.

Equity returns within the major U.S. indices were led by the enthusiasm and potential for artificial intelligence to boost economic growth. A small group of 8 giant-cap technology stocks accounted for the majority of returns within the NASDAQ and S&P 500, which both outperformed. A surprisingly solid economy, low interest rates and a weak currency within Japan drove the local market higher and resulted in Japanese Equities being among the top-performing assets of the quarter.

Emerging Market Equities broadly underperformed Developed Market peers but did close the quarter in positive territory. While continued geopolitical tensions and surprisingly weak manufacturing data out of China hurt performance, Equities within certain Latin American countries, including Mexico and Brazil, outperformed Developed Markets, counterbalancing the negative contribution to returns out of China.

Despite slowing growth, corporate balance sheets remained healthy, earnings resilient and default rates manageable, creating a favourable environment for riskier Fixed Income assets.

Performance within the Commodities space was mixed over the quarter. While several Soft Commodities produced double digit returns, Hard Commodities including Copper, Brent Crude Oil and Gold were challenged, in part, by slowing global growth and a weaker-than-expected demand recovery out of China.

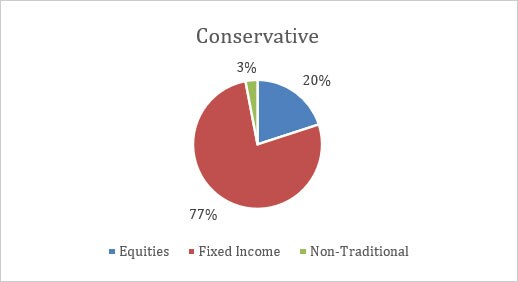

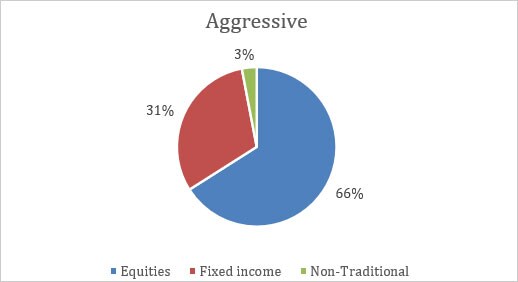

Portfolio Allocation (28/06/2023)

Performance

During Q2 2023, the portfolios with the higher risk profiles outperformed the lower risk profiles, as equities were the top performing assets of the quarter.

In June, within equities, U.S. equities (both unhedged and GBP hedged) were the top contributors to performance, given that mega-cap tech stocks continued to rally. European, EM and Asia-Pacific equities contributed positively as well, although global clean energy equities delivered a small negative contribution. Within the fixed income sleeve, government bonds continued to come under pressure as Central Banks kept a firm stance on curbing inflation by continuing to hike interest rates. On the other hand, hard and local currency emerging-market debt assets contributed to performance. Lastly, the performance contribution of the commodities sleeve was flat as performance within the asset class remained mixed.

Latest rebalance rationale

With the latest rebalance, the allocation to emerging market ESG enhanced equities was reduced on the back of unfavourable earnings data in the region. Macro-economic data out of China has been surprising on the downside, casting doubts on the durability of the recovery of the Chinese economy. In turn, more weight was allocated to European equities on the back of favourable valuations. In addition, more weight was also added to Japanese ESG equities due to attractive valuations relative to global equities. This allocation also acts as a diversifier in the portfolio, as rising inflation in Japan is likely a tailwind for the region if it may finally lead to increased wages and improved pricing power. There has also been an adjustment to the allocation to UK and U.S. (GBP hedged and unhedged) equities in the higher risk profiles to maintain their weight as a proportion of the total equity exposure. Within fixed income, there has been an addition to local currency emerging-market debt assets on the back of attractive yields.