Outrageous Predictions

Switzerland's Green Revolution: CHF 30 Billion Initiative by 2050

Katrin Wagner

Head of Investment Content Switzerland

Chief Investment Strategist

Alphabet’s second-quarter earnings delivered robust results across key business segments, but also brought a new wave of scrutiny around the cost of building its AI future. Investors got what they wanted in terms of top- and bottom-line beats, but the stock’s reaction was tempered by a steep rise in capital expenditures, which reignited investor concerns about the cost—and timeline—of monetizing AI.

Despite that, Alphabet remains in a strong position, with a sticky user base, accelerating cloud deals and a relatively attractive valuation. Below are the five key takeaways we had from Alphabet’s Q2 2025 earnings.

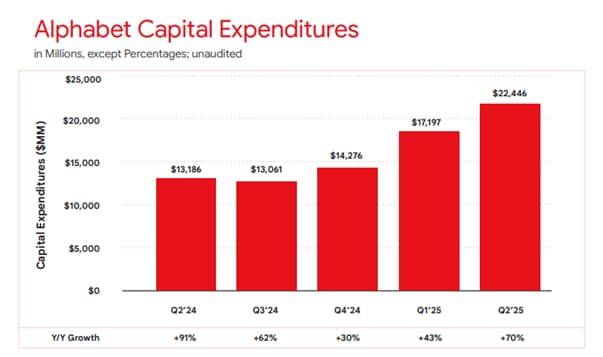

Alphabet reported capital expenditures of $22.4 billion, far above the $18.2 billion analysts had expected. Even more notable was the company’s decision to raise its 2025 full-year capex guidance from roughly $75 billion three-months ago to $85 billion, underlining just how aggressively it’s spending on data centers, AI chips, and infrastructure to power the next wave of artificial intelligence.

Source: Alphabet

The capex surprise initially reversed a post-earnings rally in Alphabet shares after hours, showing that investors—even those bullish on AI—are beginning to scrutinize the timelines and return on investment. While Alphabet reported operating margins of 32%, broadly in line with last year, investors were reminded that even a strong profit engine can face pressure if investments don’t pay off soon.

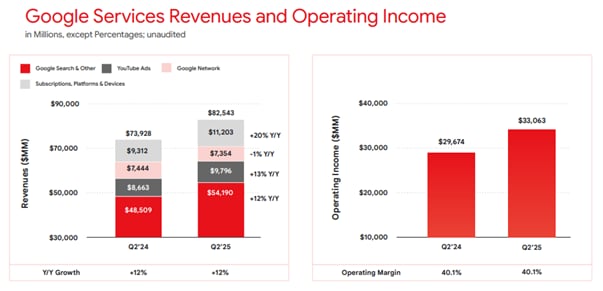

The heart of Alphabet’s business—Search—remains resilient for now, despite rising competition from generative AI tools like ChatGPT and Perplexity. Google Search still commands nearly 90% global market share (outside China), and in Q2, Search ad revenue grew 12% year-on-year, beating expectations for 9% growth.

Google’s Search remains incredibly sticky—Google is used by 5 billion people each month—and its performance helped drive a strong top and bottom-line result.

Alphabet is testing AI-generated summaries at the top of some search results, offering a glimpse into how the company might counter threats from ChatGPT and other generative AI tools. But those summaries don’t yet include monetizable links, which means Alphabet hasn’t figured out how to directly generate ad revenue from that interface. While that raises valid long-term questions about cannibalization, the current impact is limited as Google remains the default search engine for billions—and that stickiness is hard to displace.

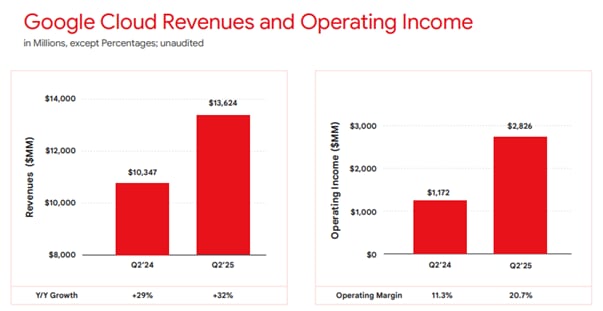

Google Cloud was the standout performer this quarter. Revenue climbed to $13.6 billion, up 32% year-on-year and ahead of the $13.1 billion consensus. The number of Cloud deals over $250 million doubled, and Alphabet signed as many as $1 billion+ deals in the first half of 2025 as it did in all of 2024. Operating income hit $2.83 billion, further establishing Cloud as a profitable growth driver.

AI continues to underpin this growth, with Alphabet’s Gemini model now embedded across the cloud portfolio and productivity tools. While it still trails OpenAI’s ChatGPT in adoption, Gemini is helping Alphabet win enterprise customers—and deepening its moat in the AI space.

Source: Alphabet

YouTube also continues to deliver. Ad revenues grew 13% year-on-year, and subscriptions are becoming an increasingly meaningful part of the business. As CEO Sundar Pichai noted, the platform is evolving with consumer behavior: “A generation that grew up with YouTube on their devices is now increasingly watching their favorite creators and content on their televisions.”

A lesser-discussed wild card in Alphabet’s portfolio is Waymo, its self-driving ride-hailing service. Waymo has now logged 71 million autonomous miles with passengers through March and is operating in five U.S. cities, including Phoenix, San Francisco, and Los Angeles. It is currently testing in over 10 new cities, such as New York and Philadelphia.

While Waymo remains part of the speculative “Other Bets” segment—which posted a $1.2 billion loss in the quarter—it stands out as one of the most advanced players in autonomous mobility. If the regulatory and adoption hurdles are cleared, Waymo could evolve into a material contributor to Alphabet’s future revenue.

Additionally, the weaker U.S. dollar provided a subtle but important boost this quarter. Alphabet generates about 50% of its revenue from international markets, and currency effects added a full percentage point to growth—a reversal from the 1-point drag seen last year. That tailwind could continue if the dollar remains under pressure amid shifting Fed policy.

Alphabet now trades at a forward price-to-earnings ratio below 20x, making it one of the more attractively priced names within the Magnificent Seven cohort. Coupled with its strong cash balance and continued profitability in Search and Cloud, Alphabet may be increasingly viewed as a defensive tech name—less reliant on speculative AI monetization, and more grounded in cash flow-generating businesses.

Until Alphabet can provide more clarity on how AI will transform the economics of its core segments—particularly Search—it’s unlikely to regain its former status as a pure growth play. But with interest rates likely to move lower, its combination of profitability, strong balance sheet, and reasonable valuation could make it increasingly attractive to investors looking for stable compounders with AI upside.

Alphabet’s results may have disappointed on capex, but they were still far more solid than those of some of its Magnificent Seven peers—particularly Tesla, which remains in reverse gear for now. The divergence within the Mag7 is becoming more pronounced: Meta, Microsoft, and Nvidia are up an average of 22% this year, while Alphabet and Amazon have been largely flat, and Apple and Tesla are down around 12%.

That divergence speaks to a broader truth: the Magnificent Seven is no longer a monolith. While some companies like Nvidia and Microsoft have articulated clear and credible strategies for monetizing AI, others—like Tesla and Apple—face growing skepticism. Tesla CEO Elon Musk insists that the company’s future lies in AI and autonomy, particularly through the yet-to-be-scaled Robotaxi business. But that future remains speculative, and current earnings continue to deteriorate.

Alphabet, by contrast, offers a more grounded AI story. Investors may question the cost, but at least there’s a visible infrastructure build-out and profitable core to support the vision. This is why Alphabet’s earnings matter beyond its own stock. They reinforce the idea that AI remains the dominant narrative for markets, but not all players will benefit equally. Execution, strategy, and monetization timelines are starting to separate the winners from the hopefuls.

These upcoming reports will help confirm whether Alphabet’s cautious optimism can be extended across the rest of the AI complex—or if market leadership will continue to narrow to the few with proven monetization paths.