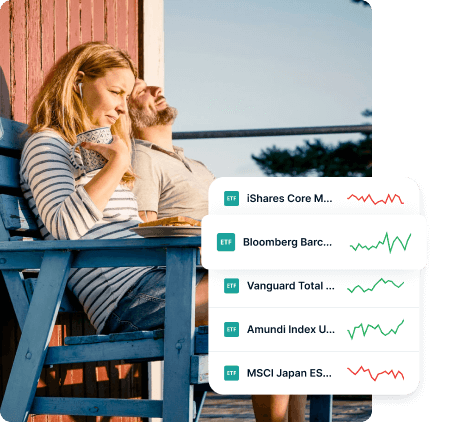

Market insights

Find your next investment through our comprehensive screener and explore curated investment themes

Saxo offers pre-market and after-hours trading access to the major US exchanges, including New York Stock Exchange, Nasdaq, American Stock Exchange and Bats BZX.

Most stocks listed on these exchanges are eligible for pre-market and after-hours trading, however their availability is determined by the order volume.

Pre-market and after-hours trading lets you react to events happening outside of the exchange’s opening hours. Financial earnings reports, company news and events in other time zones often take place when the main exchange is closed.

You should also be aware that trading pre-market and after-hours comes with additional volatility and larger price movements for many securities, in part due to lower liquidity in the market.

Yes, all Saxo clients have access to pre-market and after-hours trading through all our trading platforms. Once your account is active, you can enable and disable extended trading hours directly in the platform settings.

The FX conversion fees only apply when you transfer money in or out of your foreign currency sub-account. Depending on your account tier, the currency conversion fee ranges from 0.45% to 0.75%.

It is free to open a sub-account in another currency for Saxo clients. Receive more control over your international investment and FX cost by using a sub-account.

Yes. Transfer position to your Saxo account is free of charge. The stock transfer can be registered on the platform. However, there is an exit fee of AUD50 per ISN (max AUD 200) when transferring securities to your account outside Saxo.

Yes, you can transfer a stock and/or bond position from one sub-account to another. A Position movement between Sub-accounts ticket is required. Saxo does not charge for the service.

See instructions to transfer positions here.

CHESS (Clearing House Electronic Sub-register) is ASX’s share transaction and settlement system. A unique Holder Identification Number (HIN) is allocated to anyone with CHESS-sponsored shares.

Custody means when trading ASX Stocks, ETFs, ETCs and Bonds with Saxo Markets (Australia) Limited in a custody share trading account, Saxo Bank A/S is acting as the custodian of the assets. These assets are held on your behalf by Saxo Bank’s sub-custodian Citibank, under Saxo Markets (Australia) Limited.

See the full comparison on CHESS/HIN and Custody here.

Daily trades

Clients

USD client assets

USD daily trade volume