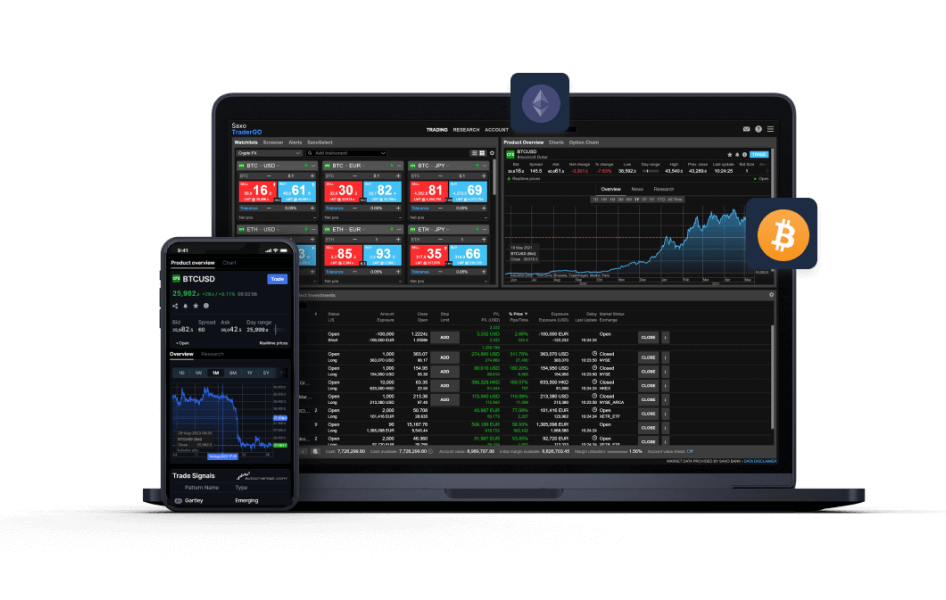

Wide choice of crypto crosses

Trade bitcoin, ethereum and more against the major fiat currencies. Trading Crypto FX pairs means you don’t have to exchange between currencies when it’s time to cash out. We offer BTC and ETH against USD, EUR or JPY.

Take advantage of rising and falling markets

Don't limit yourself to bull markets. Using CFDs, go long or short on Crypto FX pairs and trade the market in either direction.

Increase your buying power

By trading CFDs on Crypto FX pairs, you can utilise leverage to increase your purchasing power and maximise your exposure to potential gains. Please note that leverage also amplifies potential losses as well as gains.