Quarterly Outlook

Equity outlook: The high cost of global fragmentation for US portfolios

Charu Chanana

Chief Investment Strategist

Chief Investment Strategist

Note: This content is marketing material.

US equity markets have powered to fresh record highs, with the S&P 500 and Nasdaq leading the charge. The rally has reignited conversations about whether the “Buy America” trade is making a comeback.

After months of concerns over geopolitical tensions, tariff risks, and economic headwinds, the tone has clearly shifted. Relief on multiple fronts—both macro and micro—has helped reset sentiment and drive risk appetite.

Middle East tensions have eased significantly, reducing risk premiums and helping oil prices pull back. That’s provided some breathing room for inflation expectations and allowed investors to refocus on fundamentals rather than geopolitical tail risks.

Trade deals between the U.S. and both the EU and China look more plausible than they did earlier this year. The July 9 deadline for trade negotiations could be extended, and the absence of new tariffs is helping boost sentiment across industrials and global supply chain beneficiaries.

After a brief pause, AI enthusiasm has returned with full force. Investors are once again chasing productivity-driven themes, infrastructure plays, and the broader digital transformation story.

While tariff-related inflation has complicated the timing, the Fed remains expected to cut rates later this year. Markets are pricing in a soft-landing scenario, where the Fed can ease without the economy falling into recession—offering a sweet spot for risk assets.

Macro data continues to surprise to the upside. Consumer spending remains steady, labor markets are tight but cooling gradually, and inflation is easing. This resilience is allowing earnings to remain strong, especially in sectors like financials, industrials, and select consumer areas.

Markets are also cheering the decision to remove Section 899, the so-called "revenge tax" from the One Big Beautiful Bill. The clause had raised concerns among foreign investors about punitive US tax treatment, and its removal eases fears of capital flight and supports continued inflows into US assets.

Much of the rally’s credibility hinges on whether it’s broad-based or narrowly driven by a handful of mega-cap names. Encouragingly, market breadth has improved.

Looking at the YTD performance suggests that participation is widening beyond just the top names. Sectors such as industrials (+12% YTD), communication services (+11%), utilities (+9%) and financials (+8%) are all outperforming, indicating that this is not just a tech story anymore.

Source: Bloomberg

Source: Bloomberg

Consumer staples and materials are also in positive territory, adding to the case for a diversified rally. However, some key pockets of the market are still lagging. Consumer discretionary stocks have fallen over 3% year-to-date, while healthcare and energy are also underperforming the broader market.

This divergence raises the possibility that while the rally is broadening, it is not yet all-encompassing.

With so much good news already priced in, the market now faces a critical test: can the rally be sustained through July?

The proposed Republican tax bill—likely to add trillions to the federal debt—will be closely watched as it moves through the Senate. While markets may cheer lower taxes in the short term, the longer-term implications for the U.S. debt trajectory are becoming harder to ignore. The U.S. has already lost its last top-tier credit rating, and any signs of fiscal slippage could eventually put pressure on bond yields and risk appetite.

A key near-term risk for markets is the July 9 deadline set by Donald Trump to finalize trade agreements with major US partners. The UK stands out as an early mover, having already secured a deal. Meanwhile, negotiations with the European Union, India, Japan, Mexico, and Vietnam are ongoing. Optimism remains that some form of agreement can be reached in time, though investors are acutely aware that delays or breakdowns could inject fresh volatility into markets.

Without deals in place, tariffs on imports from countries without an agreement could jump significantly—well above the current 10% rate. The stakes are high, particularly for exporters and cyclical sectors. For now, hopes remain that the July 9 deadline may either lead to partial deals or be pushed out to allow more time for negotiation.

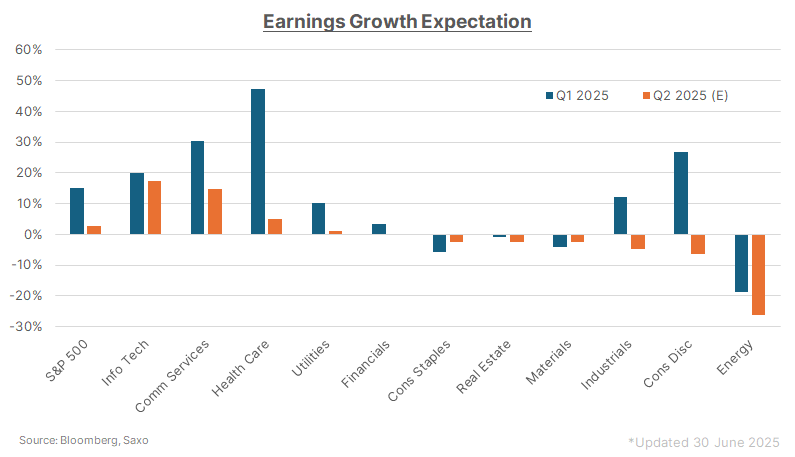

Earnings season kicks off in mid-July, and it could determine whether markets can justify record-high valuations or face a bout of recalibration. The S&P 500 is expected to deliver just +2.6% YoY EPS growth in Q2 2025, as per Bloomberg estimates, sharply lower than the +15.1% seen in Q1. Strength in likely tech (+17.5%) and comm services (+14.8%) masking deep declines in energy (-26.2%) and consumer discretionary (-6.2%) which suggests the rally could remain narrow—and a lot is riding on guidance.

While 12-month forward revisions are turning positive, Q2 revisions remain weak, with net momentum still negative. Investors will also watch:

With stretched valuations, this earnings season needs to confirm the second-half rebound story—or risk a market rethink.

The de-escalation between Israel and Iran has brought oil prices lower and briefly boosted risk sentiment. But the calm may be short-lived. Questions about Iran’s nuclear program persist, and the broader Middle East risk premium hasn’t fully faded.

At the same time, US-China relations remain tense. Investors will be watching for details on the trade framework the two sides claim to have reached. Key sticking points include:

Even a partial US-China deal could lift industrials by easing supply chain frictions and boosting export prospects, while select semis may face downside if tech restrictions are relaxed, reviving competition from Chinese peers.

Investors are closely watching for economic data that reinforces the “soft landing” narrative—where inflation continues to ease without derailing growth. If the data comes in too strong, it could prompt the Fed to delay rate cuts. But if it's too weak, it may reignite fears of an economic slowdown. The two key reports to watch are nonfarm payrolls on July 5 and CPI inflation on July 11, both of which could shape expectations for the Fed’s next move.

Fed Chair Powell’s term ends next year, and Trump has signaled he’s evaluating successors. Concerns are rising that a politically aligned appointee could undermine the Fed’s institutional credibility, especially as markets remain sensitive to any perceived threats to monetary independence. Some strategists have warned of a potential “U.S. Liz Truss moment” if fiscal dominance fears spiral.

With trade talks taking center stage for now, the next policy focus could shift toward corporate tax cuts and deregulation—a hallmark of Trump’s first term. Such a pivot would likely be supportive for US-centric firms, small caps, and sectors like energy, financials, and big tech, which historically gain from looser regulation and improved after-tax margins.

For now, the US market remains the clear global leader, buoyed by strong earnings momentum, macro resilience, and AI-driven enthusiasm. The rally has broadened beyond tech, but not uniformly. With critical political decisions, trade headlines, earnings results, and economic data all coming to a head in July, this month could very well decide whether the rally builds further—or begins to crack.

Staying diversified across quality cyclicals, AI infrastructure, and sectors that benefit from disinflation and dollar weakness may be the most balanced approach for investors navigating this high-stakes summer.