Quarterly Outlook

Q4 Outlook for Investors: Diversify like it’s 2025 – don’t fall for déjà vu

Jacob Falkencrone

Global Head of Investment Strategy

Head of Macroeconomic Research

The following is a new monthly publication from Saxo Bank covering the credit impulse. It will be published on the first trading day of every month.

France’s GDP growth has reached the level of 2% YoY in 2017, which corresponds to its best performance since 2011. In 2018, the momentum should still remain strong with a growth forecast of between 1.8% and 1.9% according to most international organisations (Bank of France, IMF and European Commission). However, early signs start to indicate that growth may have reached a peak and is doomed to decelerate in coming years. It seems that France’s best days are already behind us.

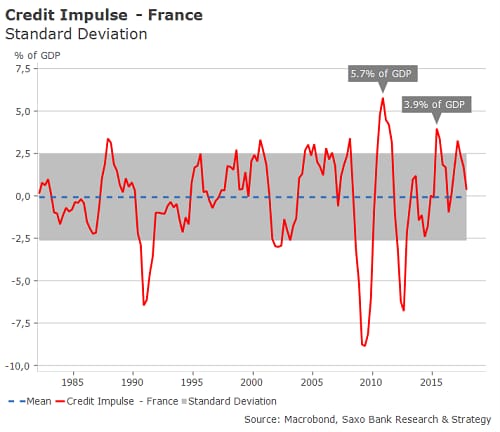

The current growth trend has little to do with Emmanuel Macron. Actually, over the past few years, France’s economy has benefited from a combination of favourable factors: concomitant decline of the euro exchange rate, of oil prices and of interest rates and a strong improvement in French credit growth which predates the 2017 presidential election. This is a direct consequence of the ECB’s accommodative monetary policy but also of pro-business reforms implemented from 2014 by François Hollande (2014 Responsibility and Solidarity Pact and consequent hiring subsidies that supported investment). As a result, the credit impulse (which represents the flow of new credit issued by the private sector in % of GDP) has reached its second highest quarterly level since the 1980s in Q2 2015 at 3.9% of GDP and a second peak at 3.2% in Q1 2017. Historically, the magnitude of the credit impulse in Q2 2015 has only been exceeded once in 2010 as a consequence of the measures decided to fight against the GFC.

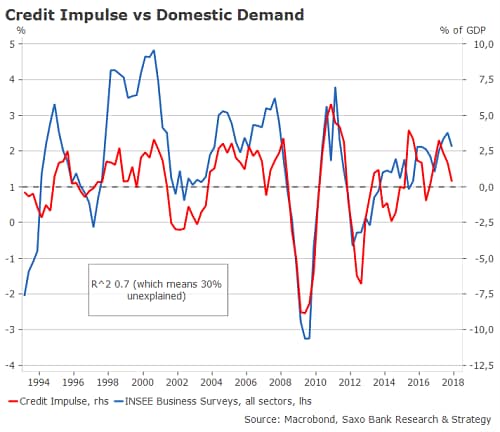

Pro-business reforms and the strong credit impulse, which leads the real economy by 9 to 12 months, translated into an overall improvement of French data: higher PMI, increased domestic demand and private investment getting back to its level of 2010. There is a high 0.70 correlation out of one between the French credit impulse and final domestic demand (and private fixed investment as well).

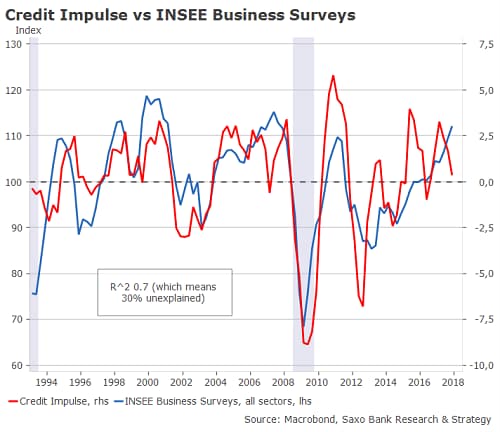

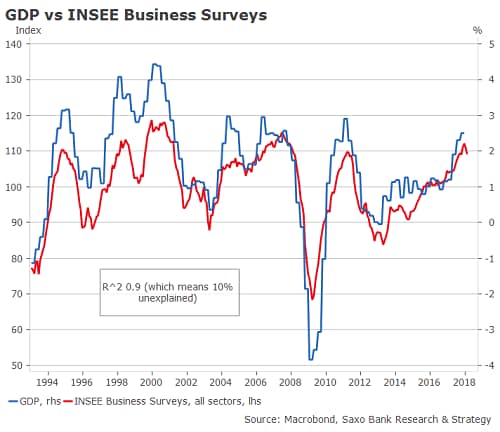

However, the most interesting correlation is with INSEE business survey which is itself one of the most reliable leading indicators of French GDP (R^2 0.90).

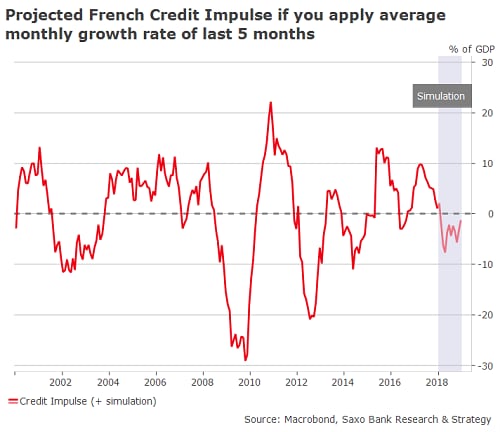

With the exception of private fixed investment, all of these indicators have reached a post-crisis peak at the end of 2017 and since then they have slightly dropped. The recent data published by INSEE, Markit and the European Commission have also confirmed a slight decline in the business climate since the beginning of the year. Thought it is not worrying at the moment, it indicates that growth has certainly reached a plateau. In addition, the credit impulse is currently running at only 0.3% of GDP driven by lower mortgage applications and tighter financial conditions. Even if you were to continue with monthly average credit growth of 0.25% (which is the five-month average), the credit impulse would go into contraction over the next twelve months, which would pose some significant headwind to GDP growth in the course of 2019-2020.

So far, what commentators commonly call the “Macron effect” has mostly been noticeable in industrial confidence but it has not had any real effect on hard economic data. The current strong growth results from the combination of an almost unprecedented jump in the credit impulse and the impact of Francois Hollande’s reforms. In the near future, the risk is very high that France’s growth disappoints those who believe that the country is back at the forefront of the European economy. We fear that the long-awaited “Macron effect” may be offset by cyclical and structural factors, notably euro area credit impulse weakness along with expected negative French credit impulse and very low potential GDP growth (estimated at 1.25% by the French Treasury).