Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

Head of Macroeconomic Research

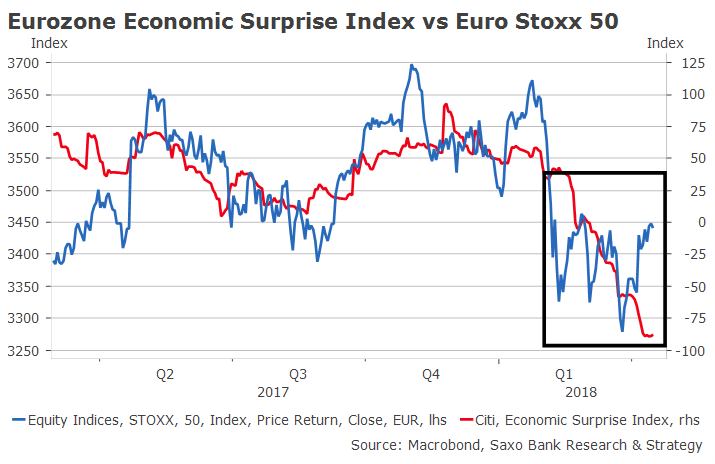

The rosy "strong euro area growth" narrative is done. As a result of a lower than expected ZEW index (-8.2 points in April versus 5.1 points in March), Citi Economic Surprise Index for the Eurozone is sinking further into negative territory, reaching its lowest level since 2012.

The index is currently the worst performer among G10, at -87.8. This collapse added downward pressure on European stocks during Q1 and the risk is high that it will happen again in Q2 or Q3 if economic indicators continue to disappoint.

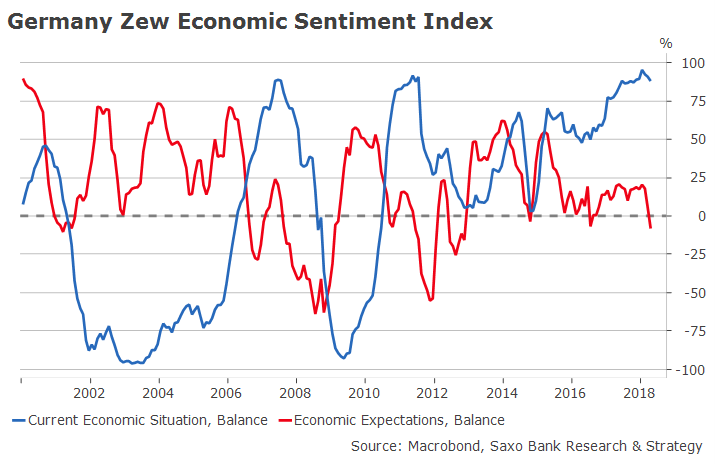

The sharp drop in the ZEW index confirms that soft data are rapidly adjusting to weak hard data recently released by Markit and the European Commission. All of them send the same message: euro area growth has reached a plateau. Even Germany, which is often considered Europe’s locomotive and has been fairly immune to previous European crises, is losing momentum.

One of the most important points to highlight from April's ZEW survey is that economic expectations, which are usually a reliable indicator of economic growth in Germany, are now in negative territory. This clearly indicates a higher degree of pessimism about trade which is well-illustrated by year-on-year exports data.

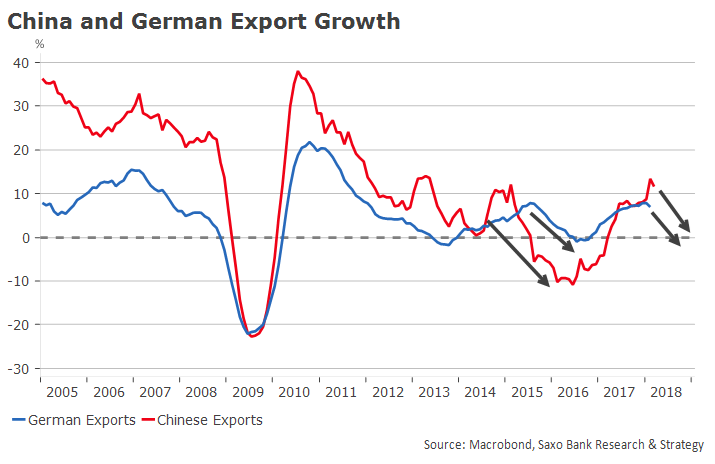

In the graph below, we see very well that German exports and Chinese exports are interlinked. The risk for Germany is that it experiences a new bearish export cycle similar to that of the 2014-2015 period, but that could be potentially worse due to the unique combination between negative China credit impulse, higher trade tensions, and liquidity withdrawal from the international financial system.

All of this tends to indicate that Germany is heading straight for slowdown, like the rest of the euro area.

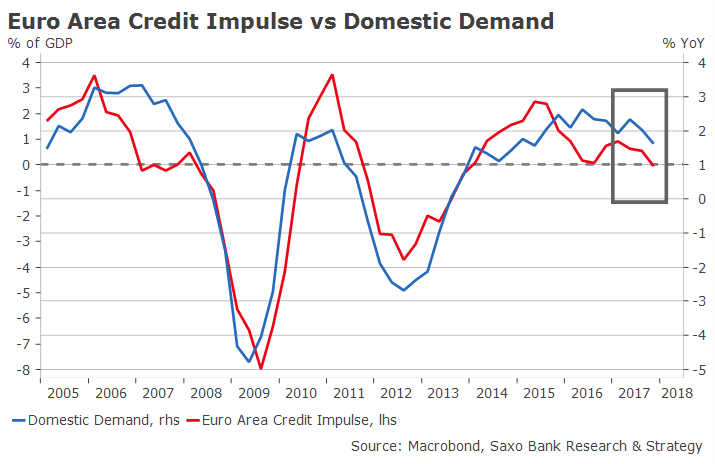

Contrary to what has been written here and there, the euro area is still dependent on the evolution of global growth and trade. Domestic demand, mainly pushed by European Central Bank measures, has been a major driver of growth in the post-crisis years. The ECB's accommodative stance gave easiest access to consumer credit to households, thus enabling domestic demand to run well ahead of the pace that income growth would have allowed.

As we can see in the graph below, credit generation is highly correlated with final domestic demand in the euro area (R^2 0.86). Our leading in-house indicator credit impulse has reached a post-crisis peak in Q2-Q3 2015 but the positive effects of the ECB’s monetary policy continued to spread throughout the economy for slightly more than a couple of years thereafter. However, due to monetary policy normalisation, credit impulse is currently running close to zero, indicating that a new and more restrictive credit cycle has just begun.

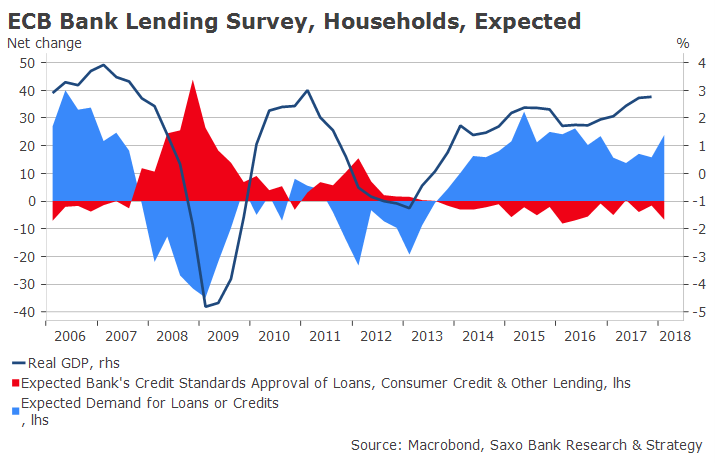

Based on the ECB bank lending survey, in the short- and medium-term, household demand for loans should remain supportive of growth.

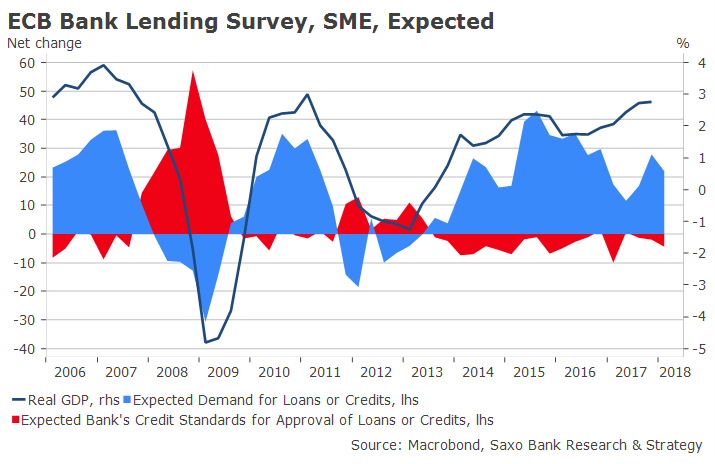

However, this is not the case for SMEs whose expected demand for loans continues to fall, putting at risk investment, job, wage growth and hence activity.

Monetary policy normalisation in the euro area was certainly unavoidable due to technical reasons (bond scarcity) and political reasons (growing German opposition to ECB chief Mario Draghi). Yet, the market has been trying to ignore the ECB for as long as possible and the awakening is consequently now a rude one.

In a rather rough summary, the ECB’s accommodative monetary policy saved the PIIGS, and especially Italy, from speculation but it did not clearly solve the structural problems of most of these countries. It has mostly consisted in buying time while waiting for growth to return and market pressure to ease. Looking closely at the PIIGS trade balance, we quickly realise that their economic renaissance has been greatly exaggerated. Especially for Spain and Italy, the improvement in trade balance is essentially due to higher extra-euro area demand and a weak currency. The restoration of competitiveness is still a work in progress.

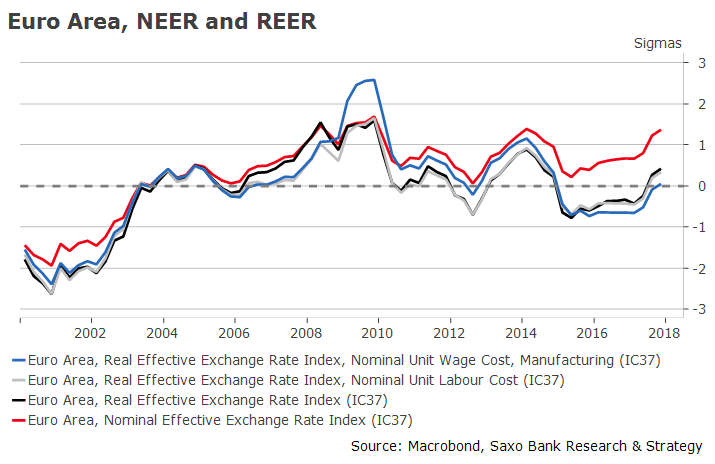

Now that demand is doomed to fall because of lower credit impulse in the euro area, the US and China, the only driver left is a “weak” euro. In nominal terms, the euro exchange rate is rather high but, in real terms, it is quite balanced (graph below) and, so far, it has not seemed to add too much pain to periphery countries.

It is too early to know if the ongoing slowdown will have a significant impact on policy. But what we know for sure is that, looking back, 2017 will certainly be considered as this cycle’s peak year for the EMU growth and that the market and the ECB were ill-prepared for lower growth.