Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

Head of Commodity Strategy

As we approach the end of the first full week of trading in the Bitcoin future offered by the Cboe exchange we take a look at the early developments.

Elevated spread between future and spot

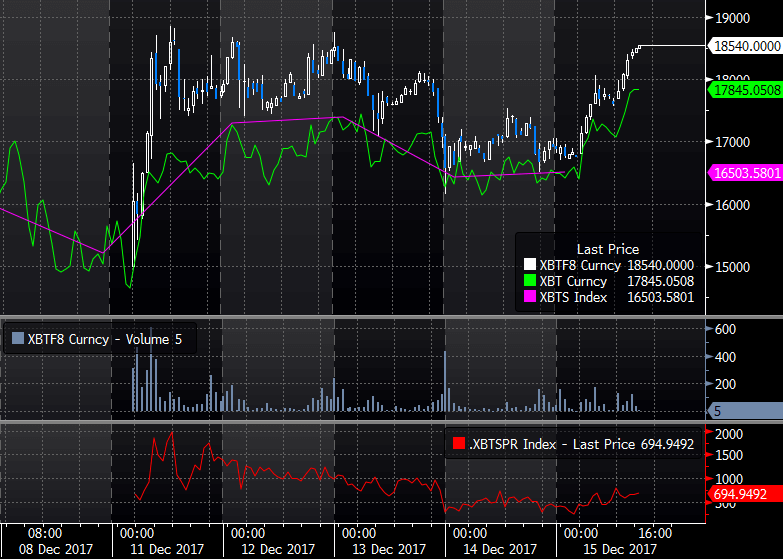

The future has so far maintained a premium to the underlying price which is the daily 4 pm ET auction price (pink line) on the Gemini Digital Exchange. The future should, with the exception of a small spread between spot and the forward settlement date on the future, closely track the Bloomberg spot price (green line). This discrepancy is among others a sign of the market being out of balance. Something that most likely has been caused by the initial decision by several brokers to limit or prohibit short selling.

However, the premium has started to come down on news that some brokers will begin to allow short selling albeit at a much higher required margin than the one outlined by the exchange. Only a handful of brokers cleared futures upon the debut last Monday.

Liquidity and volatility

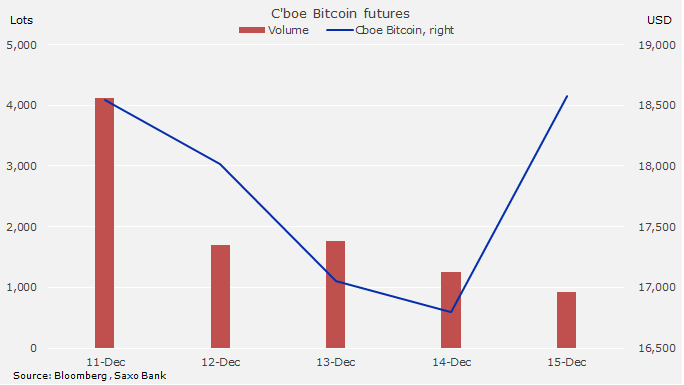

Based on the very short sample period we find that the price has been exhibiting signs of stability this past week with the 5-day historical volatility halving from 150% a week ago to 75% today. The traded volume however, has been a disappointment. After trading 4000 lots on Monday the volume has since then moved closer to 1500 lots/day.

With the CME being a more recognised exchange for futures trading we need to wait and see the impact when they launch their 5X contract next week.