Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

Chief Investment Strategist

As we've frequently pointed out in seminars, client meetings, and webinars, bull markets rarely expire from age or valuation concerns. In most cases, the real trigger is an economic recession. So the most important question for any investor remains: is a recession coming or not?

February was interesting...

Last month sure was something. Equity markets were virtually comatose in terms of downside volatility while the momentum bullet train propelled global indices to new highs. As February approached, the global equity market has had its longest winning streak since the MSCI ACWI Index was created in 1988. On all parameters the market was looking red hot. In response to what we were observing in financial markets we published our Q1 Outlook based on the theme of bubbles. We even highlighted that we expected a correction in equity markets.

But it was not an ordinary correction. The S&P 500 futures fell 12% from peak to bottom in only six trading sessions. The selloff was amplified by short-volatility funds (and ETNs) scrambling to hedge short VIX futures positions that were blowing up in their faces as the VIX had its largest one-day move in the past 10 years, eclipsing all one-day moves during the meltdown in 2008 after Lehman Brothers' bankruptcy. Short-volatility funds had in themselves grown to an immense size in the market with investors lured into a strategy based on 66% annualised returns since Q3 2011.

To make things even worse, the selloff happened while inflation expectations were rising fast following a much better than expected US hourly earnings print for January. Interest rates were soaring and the USD, which normally is bid during selloffs, was sold off as well. Classic defensive equity sectors were actually the biggest losers because rising interest rates hit rate-sensitive sectors such as telecoms, utilities, energy and real estate. Balanced portfolio and risk parity funds saw sharp drawdowns in a matter of days.

Credit markets stayed calm and as the weeks passed equity markets bounced back before the trade war torpedo hit markets. The recent selloff (second wave) was more normal with equities down on trade war concerns while bonds were bid. The classic defensive sectors were back acting as bulwarks against downside volatility. Concerns about the economic expansion have suddenly risen, but in fact credit markets have shown some nervousness already with the yield curve flattening dramatically.

The second-longest economic expansion since 1900

With recessions driving everything on the downside, let us assess where the economy is headed. The current US economic expansion has lasted for 103 months compared to the expansion from 1991 to 2001 that lasted 118 months. It has even eclipsed the expansion in 1960s making this post-GFC expansion the second longest on record since 1900. If the current expansion can extend to June 2019 it will at time be the longest economic expansion in modern history.

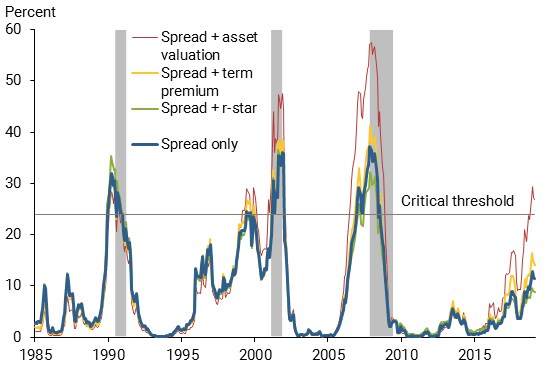

The term premium in government bonds has historically been a good guidance for where things are headed. In a recent economic letter by Bauer and Mertens from the San Francisco Fed, the authors highlight that lower term premium is associated with a slowdown and beyond a certain point the likelihood of a recession is high. The plot below shows the current state of affairs in the US economy.

Now this is only one indicator and the economy is almost infinitely complex so many factors are important to gauge before making conclusions – otherwise we risk being fooled by randomness in data. But higher interest rates on the USD, which is the world's currency, means the price of money is going up, which will have a negative effect over time as the world is saturated in debt.

But when does it end?

High growth rates in themselves are not an argument for why things cannot change fast. The euro area went from 0.5% quarter-on-quarter growth in Q1 2008 to -0.4% in Q2 and -0.6% in Q3, so basically from around trend growth to severe recession in a matter of months.Such a scenario could happen again, but it would require a big shock to the economy or financial system. Otherwise, a gradual slowdown into recession is the more likely scenario.

Our main scenario remains that the global economy will expand throughout 2018 and that judgment day will be sometime in 2019. Two things, however, could derail our forecast...

1. Rhetoric escalates to a trade war, causing economic activity to plummet as investments are halted and consumer sentiment tanks. Trade wars are complex and they have no winner, so the probability of a full-fledged trade war is still low at this point.

2. China experiences an uncontrolled debt implosion as credit growth has far surpassed income growth since 2008, inflating a debt mountain that has to be dealt with at some point. It will surely lead to lower growth over time but that's probably good for China as the pollution problem is the single biggest risk for social unrest.

One final leg up

Our base case scenario in global equities is that we will see a final leg up, exhausting global investors' risk appetite before the recession approaches. Equity markets will likely experience sideways markets in Q2 but if the trade war can be contained to only minor actions and words, then equities could extend one last time before the party ends.

MSCI ACWI Index (weekly prices 2009-2018):

But for now, as communicated in our recent Morning Calls, we remain defensive in equities. Let time be on your side. Do not rush into equities for fear of missing out. There are real risks out there and we need more clarity and another earnings season to convince investors to bid up prices. For global equities, this means that the current gap of 6% needs to be closed.