Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

Head of Commodity Strategy

The geopolitical stage looks increasingly awful following President Trump's decision to slap tariffs on $50 billion of China-made goods. China immediately responded by targeting $3bn of US exports while contemplating additional retaliatory measures.

The appointments of Iran hawks to Trump's inner circle has further raised the risk of the US re-introducing sanctions against Iran no later than May 12. The two most recent appointments being Pompeo replacing Tillerson as Secretary of State and Bolton stepping into the important job of National Security Adviser instead of McMaster.

The market responded to these developments by sending stocks sharply lower while bonds and the Japanese yen received a bid as short positions were pared back.

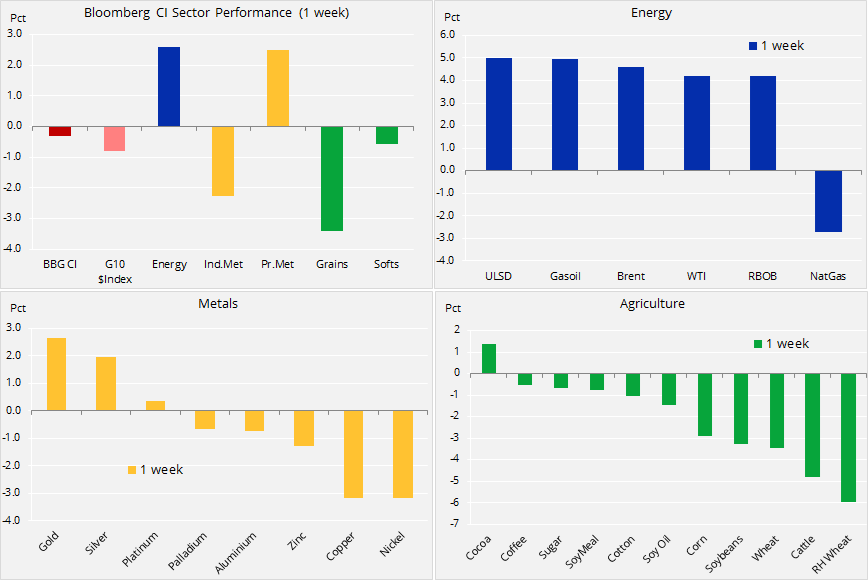

The Bloomberg Commodity Index traded softer on the week with the reaction to the week's events resulting in crude oil trading higher on the Iran threat to supplies and industrial metals lower on the risk that global growth projections could derail. Gold was supported by both of these developments with short-covering following another dovish US rate hike providing an additional boost.

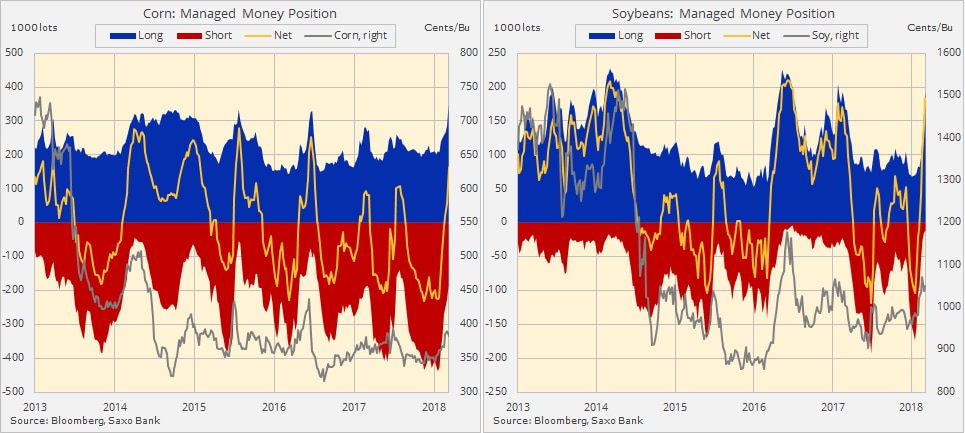

Agricultural commodities were generally weaker with the grain sector left reeling after trade war concerns and softening fundamentals helped trigger profit-taking from speculative traders. During an eight week period up until March 13, funds had swung their position in the three main crops of wheat, corn, and soybeans from a record short of 473,000 lots to a 406,000 long.

The net-longs in corn and soybeans both exceeded 200,000 lots, the highest level in almost four years. A position this size has according to recent history been difficult to sustain and often led to sharp reversals.

China is the biggest buyer of US-produced soybeans, a trade that is worth close to $15bn/year. Any escalation of the trade war could see China try to source more beans from South American suppliers. However such a scenario seems highly unlikely on a major scale simply because there are not enough non-US supplies to meet China’s demand.

Crude oil surged higher after emerging from several weeks of hibernation. The rally began after both WTI and Brent crude oil broke through key technical levels and after receiving fundamental support through the renewed focus on supply disruptions.

Washington, acting with the blessing of Saudi Arabia, looks increasingly likely to re-introduce sanctions against Iran on May 12, something that could hurt its ability to produce and export crude oil. The risk of the US walking away from the Iran nuclear deal this May rose following the meeting in Washington with Saudi crown prince Mohammed Bin Salman and after Trump replaced his Secretary of State and National Security Adviser with known hawks on Iran, Venezuela, and North Korea.

The Joint Comprehensive Plan of Action, also known as the Iran nuclear deal, is an agreement between China, France, Russia, the United Kingdom, the US, Germany, and the European Union. The market impact of US stepping away from a deal that all the other members still support is unlikely to lead to a significant reduction in Iranian exports. However, its ability to attract the additional foreign capital required to maintain, let alone expand, its production is likely to be impacted as foreign investors (with the possible exceptions of Russia and China) will stay away.

China's March 26 launch of its long awaited yuan-denominated oil futures contract could not occur at a more interesting time given current events. In our Outrageous Predictions for 2018, we tied the launch to a sharp appreciation of the yuan. China has already become the world’s largest crude oil importer and some key exporters, led by Iran and Russia, are probably more than happy to circumvent the petro-dollar. But as always with the launch of a new futures contract, its success very much depends on its ability to attract producers, hedgers, and speculators – all of which are needed to provide the necessary liquidity.

A technical buy signal was triggered following the breakout of the recently established triangle formation. The upside target for WTI could be as high as $71/barrel but first the 2018 high at $66.70/b has to be broken. The potential for this to happen depends on how much the market will continue to focus on supply disruptions compared with the continued rise in non-Opec production and the risk that future demand growth may end up being negatively impacted by a global trade war.

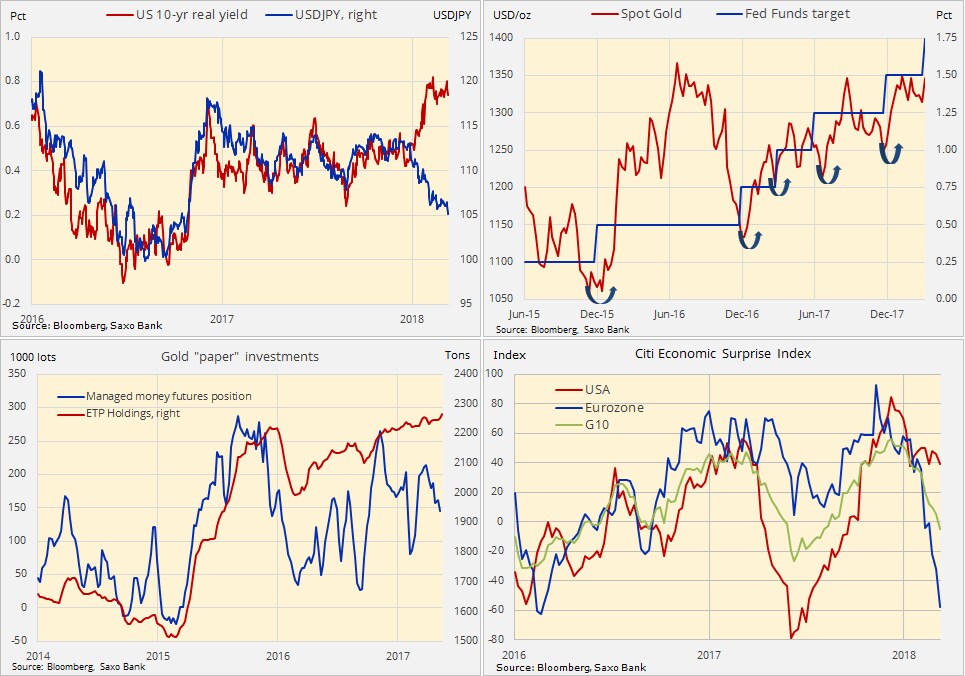

Once again gold, as seen on previous occasions, responded positively to another rate hike from the Federal Reserve. While analysts struggled to decide whether this was a dovish or a hawkish hike, the market voted firmly for "dovish" and gold raced higher on short-covering and renewed buying as dark clouds emerged over the global economy.

Rising trade tensions and a renewed focus on Middle East stability helped send investors towards gold as they took shelter from renewed stock market and dollar weakness, not least against the Japanese yen. A full blown trade war risks shrinking global trade, thereby creating headwinds for global growth and stocks that are ultimately likely to increase safe haven and diversification demand.

A stronger Japanese yen against the dollar has helped offset the gold-negative impact of rising real yields while another Fed hike provided the market with a fresh buying opportunity.

Gold holdings via exchange-traded products have reached a five-year high with long-term investors continuing to accumulate. Hedge funds were net-sellers of gold futures during the past six weeks and now have room to rebuild longs as the technical and fundamental outlook improves.

A sense of déjà vu hit the gold market as it once again returned to an area where the metal has been rejected on numerous occasions during the past four years. Short-covering post- the Fed rate hike has probably run its course and fresh buying is now required for the market to gain the momentum required to break above $1,375/oz.

No need to say that we maintain our positive outlook amid a deterioration outlook across other asset classes. Key support remains $1,300/oz while a break above $1,375/oz. could signal an extension towards $1,475/oz.