Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

Head of Commodity Strategy

The grains sector has run into profit-taking ahead of today's monthly supply and demand report (WASDE) from the US Department of Agriculture. The report should give us an idea on whether the strong surge seen in recent weeks due to drought conditions in Argentina and the US plains has been justified.

While the market is expecting downward revisions to ending stocks and production, the key question remains whether the market has fully priced in these current weather risks.

The WASDE report aside, the subdued mood seen this week has also been driven by growing worries that a trade war could impact the US' major exports of soybeans to China and corn to Mexico.

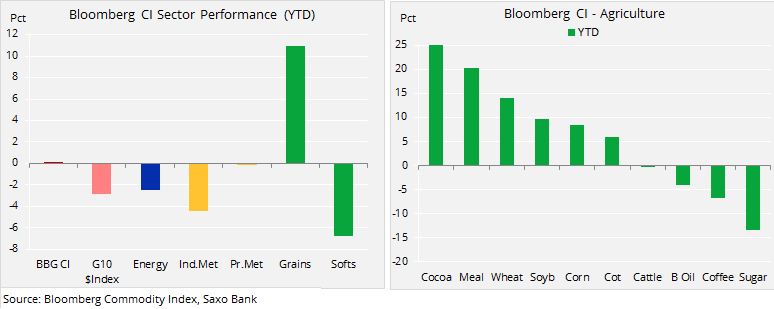

The Bloomberg Commodity Index is up a fraction on the year with grains being the only sector showing a strong year-to-date return.

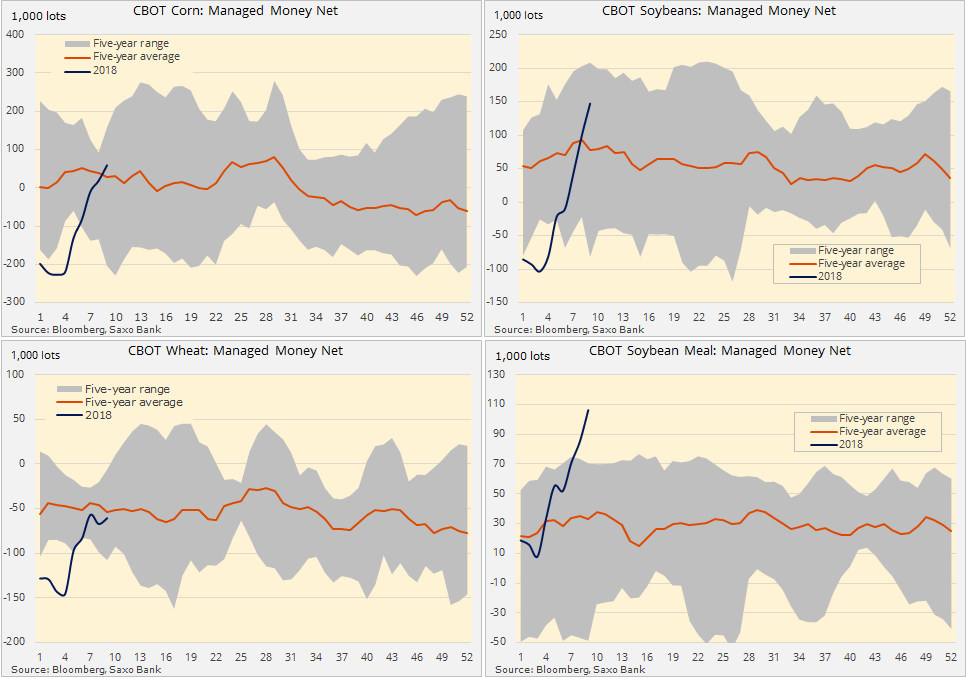

The dramatic rally since mid-January has to a large extent been speculatively driven. During a six week period from January 16 to February 27, funds went from holding a combined record short across six grain and soy futures of 483,000 lots to a net-long of 254,000 lots.

With so many recently established longs the risk of a correction is high should the report fail to deliver the expected drop in stocks and production.

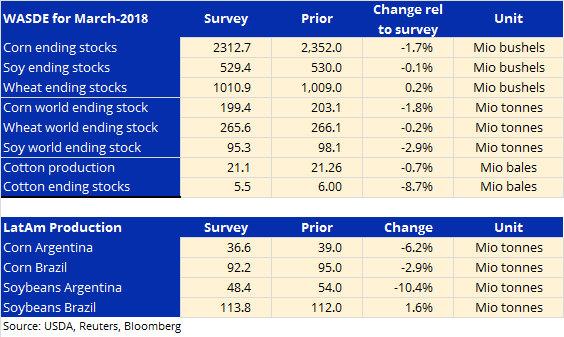

The report will be released at 17:00 GMT and according to surveys from Reuters and Bloomberg, small reductions are expected across US ending stocks while bigger reductions in world stocks are likely.

Both corn and not least soybean production in Argentina are expected to be negatively impacted by recent and persistent drought, although losses may be partially offset by increases in Brazilian soy output.

No matter what, raised volatility post- the report is almost a given, particularly considering the sheer amount of fresh longs that has been added within a relative short period of time.