Outrageous Predictions

Executive Summary: Outrageous Predictions 2026

Saxo Group

Head of Commodity Strategy

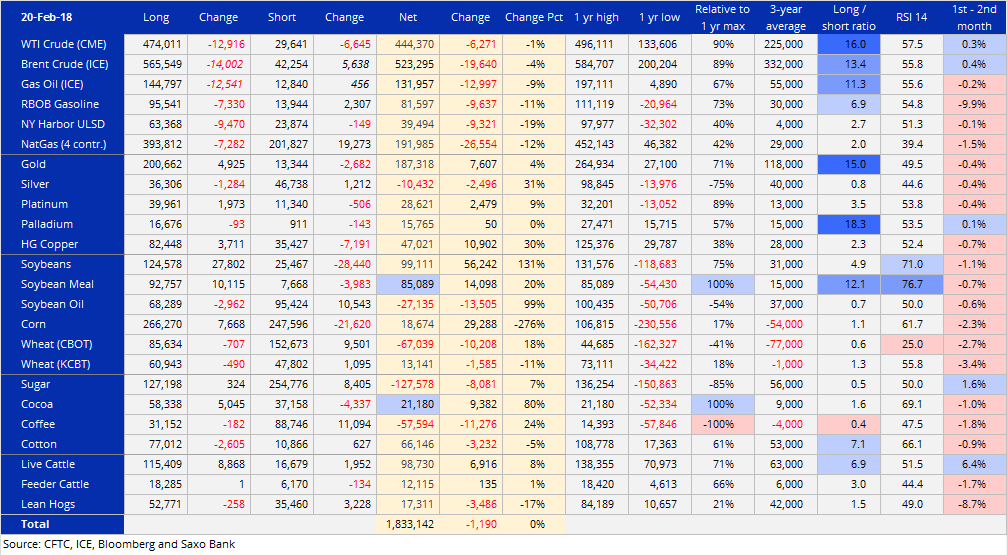

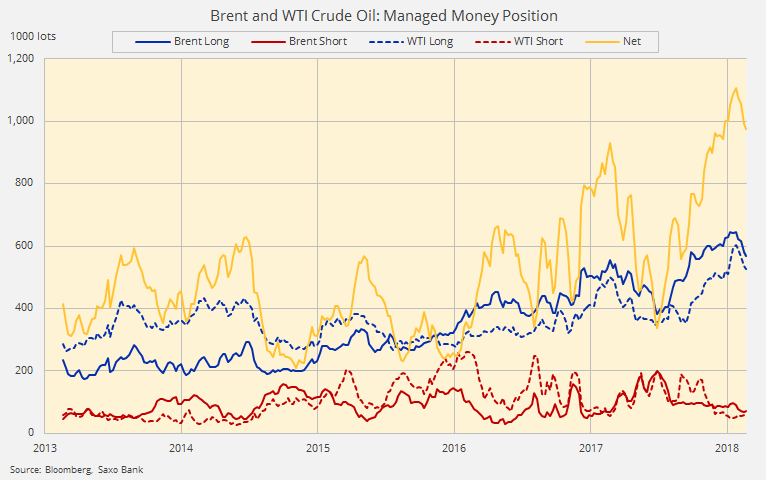

Hedge funds maintained an overall unchanged position measured in lots across 24 major commodities futures in the week to February 20. Continued selling across the energy and soft sectors was countered by renewed buying of metals and continued buying of grains.

The combined crude oil long was reduced for a fourth week despite seeing oil in recovery mode for the past couple of weeks. A triple whammy of price-supportive data provided by the EIA on its latest inventory report helped support a strong close on the week.

Natural gas net-longs were cut further as the price stayed precariously close to key support at $2.5/therm.

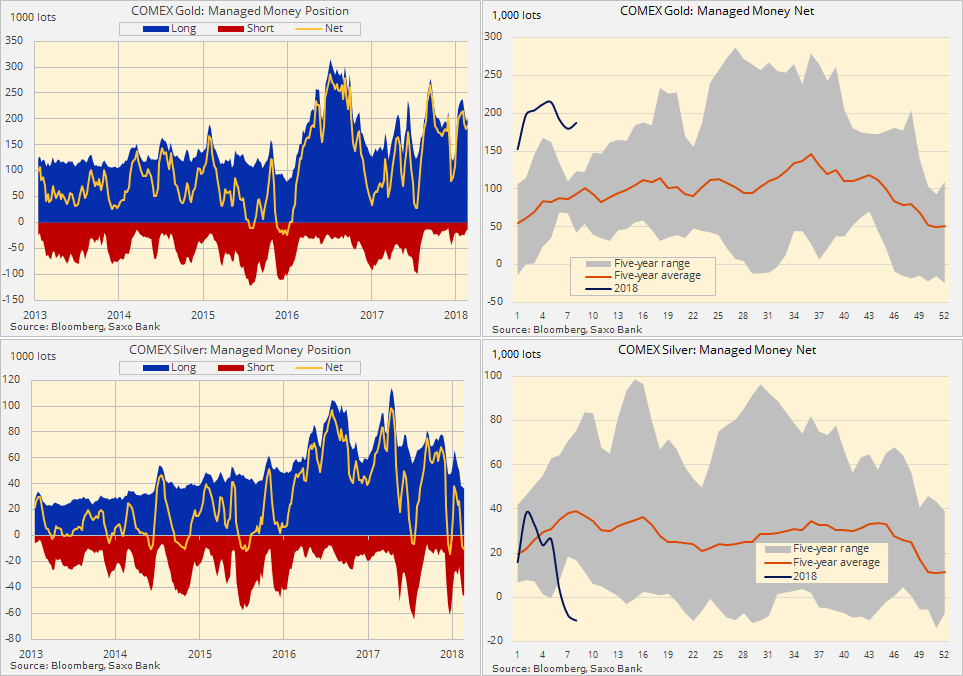

Gold buyers returned to add 4%, which brought the net-long to 71% of the September record. The net-short in silver, meanwhile, extended further to reach 75% of the record 14,000 lots reached on December 19.

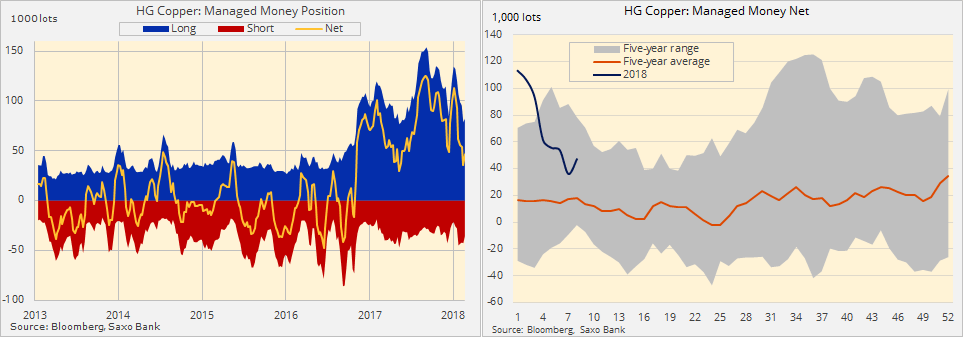

The copper net-long jumped by 30% ahead of the re-opening of the Chinese market with most of the change being driven by short-covering. While investors await an expected post holiday pick-up in Chinese demand, the downside risk for now seems limited with HG Copper currently trading within a $3 to $3.3/lb range.

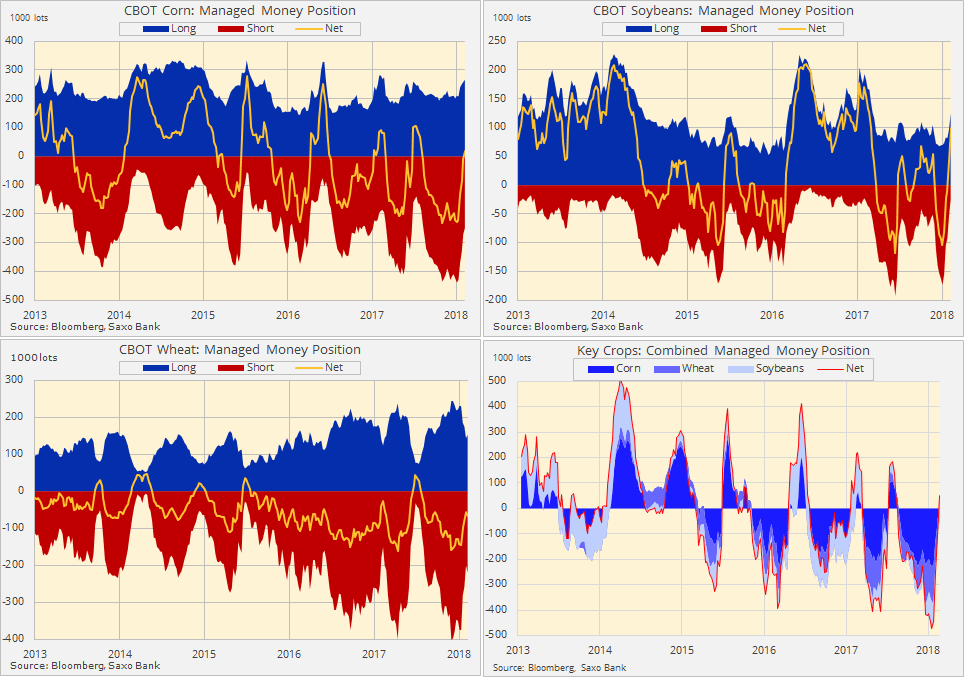

Overall, the agriculture sector led by grains seems to have woken up from a multi-year snooze with record high stock levels increasingly being challenged by an uncertain production outlook. During the past month, a rising weather premium has emerged after extreme heat in the southern hemisphere and extreme cold across the northern hemisphere impacted a variety of food commodities from soybeans to wheat and cocoa.

Additional support has come from the weaker dollar, strong demand, and rising energy prices as well as short covering from hedge funds, which have been reducing a record grain short back to neutral during the past four weeks.

Funds turned net bullish on the three major crops for the first time in six months after having covered a record short of close to 500,000 lots in just five weeks.

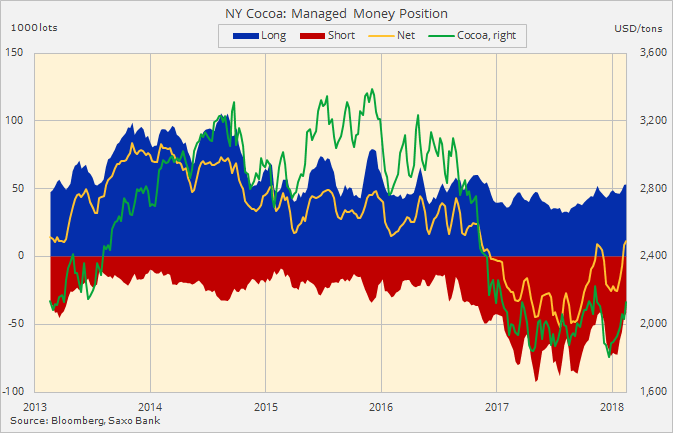

In cocoa, a 16% rally this year continues to attract fresh fund buying with the net-long reaching a 16-month high. Crop quality concerns combined with robust demand has left the market relatively tight with the bulk of West Africa’s main harvest almost completed.