Outrageous Predictions

Révolution Verte en Suisse : un projet de CHF 30 milliards d’ici 2050

Katrin Wagner

Head of Investment Content Switzerland

Chief Investment Strategist

In a world where markets remain gripped by the AI narrative and the momentum of U.S. mega-cap stocks, European equities often sit in the shadows. Yet for long-term investors seeking stable income, diversification, and value, European dividend-paying stocks may warrant a closer look.

Dividend payments are more than just a financial decision in Europe—they’re often a reflection of company philosophy. Unlike the U.S., where share buybacks are the dominant method of returning capital to shareholders, European firms have long prioritised dividend payouts. In several countries—such as the UK, France, Switzerland, and the Nordic nations—stable or growing dividends are embedded in corporate culture.

Many firms even include dividend policy as part of their long-term capital allocation framework. Nestlé, TotalEnergies, Novartis, and Allianz are just a few examples of companies that have maintained generous and consistent payouts over time, supported by strong cash flow generation and relatively conservative balance sheets.

This cultural commitment to rewarding shareholders through regular income streams provides a level of predictability that can appeal to long-term investors, especially in volatile environments.

If you’re investing for income, Europe delivers—literally.

As markets continue to navigate inflation concerns, slowing growth, and geopolitical tensions, dividend income has become an increasingly important component of total return. European dividend-paying stocks often operate in defensive sectors such as healthcare, consumer staples, and utilities, offering some insulation from economic shocks.

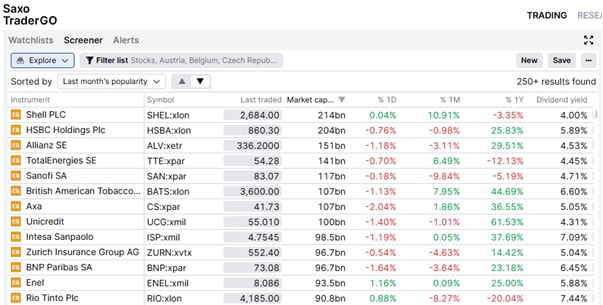

For example, companies like:

This mix of income stability and sectoral defensiveness positions many European dividend stocks as useful components in a diversified, income-generating portfolio.

Another overlooked feature of Europe’s dividend story is how global many of these companies really are. While they may be headquartered in Europe, firms such as Nestlé, Siemens, LVMH, and HSBC derive a significant portion of their revenues from outside the region.

This means investors are not just gaining exposure to European economic fundamentals—they are also accessing global consumption trends, industrial cycles, and emerging market growth. The result is a form of geographic diversification that may complement other regional exposures within a long-term portfolio.

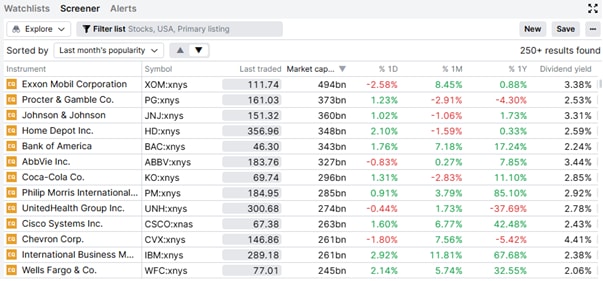

European equities continue to trade at a significant discount to US stocks:

Yet Europe offers higher payout ratios, lower leverage, and more stable free cash flows in many sectors. For income-focused investors, that’s a powerful combination. While the US tech names may continue to dominate headlines, European dividend payers could offer a more measured, income-oriented approach—one that can be particularly attractive during periods of uncertainty or when investors are looking to rebalance toward value and income.

Why chase growth at high multiples when you can earn income at value prices?

For investors looking to access this theme without selecting individual stocks, a number of exchange-traded funds offer diversified exposure to European dividend payers. These include:

These ETFs typically track baskets of companies with consistent or high dividend yields, often applying quality or payout sustainability filters. They can serve as income-focused building blocks within broader equity allocations.

A side-by-side comparison of the top dividend stocks on the Saxo platform tells an interesting story:

Europe may not be the first stop for investors chasing the next wave of growth or innovation. But in a world where interest rates remain volatile, market leadership is narrow, and global risks are rising, the case for allocating to high-quality dividend-paying stocks in Europe is gaining traction.

These companies combine strong fundamentals, global reach, and shareholder-friendly policies—all at valuations that remain reasonable compared to their U.S. counterparts. In the broader search for balanced returns, Europe’s dividend edge may offer something both familiar and surprisingly overlooked.