Outrageous Predictions

Révolution Verte en Suisse : un projet de CHF 30 milliards d’ici 2050

Katrin Wagner

Head of Investment Content Switzerland

Chief Investment Strategist

After another round of blockbuster results from Big Tech, the same two questions are echoing across portfolios:

Both are fair concerns. The AI boom has pushed the “Magnificent” names to new highs, but under the surface, their stories have begun to diverge between companies monetising AI today and those still investing for tomorrow.

This Q&A unpacks what’s really changed after earnings, what’s priced in, and how investors can think about trimming, rotating, or holding their positions as Big Tech enters its next phase.

Because the numbers tell only part of the story. While all five companies — Microsoft, Amazon, Google, Apple, and Meta — benefited from AI momentum, they are at very different stages of turning that excitement into earnings.

Some firms are already generating substantial cash flow from AI-related businesses, while others are still scaling up or absorbing heavy infrastructure costs.

The divergence is healthy: it means Big Tech is no longer a single trade, but a set of distinct investment stories. That means investors finally have room to be selective by trimming exposure where valuations are full, or adding where visibility is strengthening.

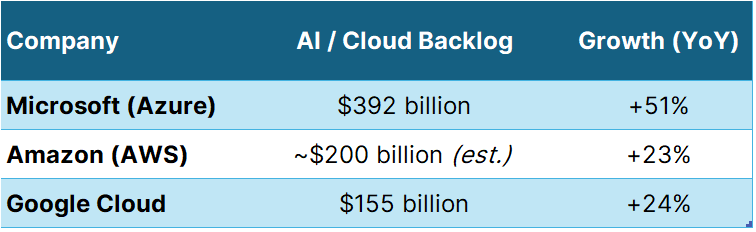

An AI backlog (or Remaining Performance Obligation, RPO) represents the value of cloud and AI service contracts already signed but not yet delivered. It’s a strong indicator of future revenue visibility, showing how much demand is already secured, regardless of short-term market swings.

Source: Company reports, Saxo. Data as of 3 Nov 2025. Past performance is not indicative of future results. Figures in USD unless stated otherwise.

A rising backlog signals that customers are locking in multi-year AI and cloud contracts.

Microsoft’s surge shows accelerating enterprise adoption, while Google’s steady climb reflects new workloads tied to AI training and data analytics. Amazon’s backlog growth, though more modest, underscores the depth and renewal strength of its client base.

For long-term investors, backlog matters more than quarterly beats — it tells you who already has future growth in the bag.

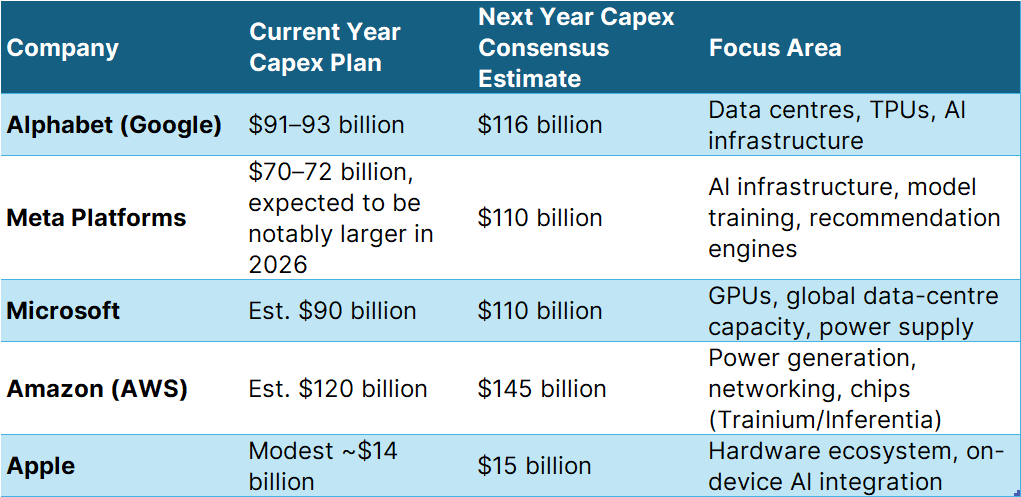

AI investment has become a capital-intensive race. These are the latest annual spending plans based on company guidance and disclosures:

Source: Company reports, Bloomberg, Saxo. Data as of 3 Nov 2025. Past performance is not indicative of future results. Figures in USD unless stated otherwise.

These numbers show where the balance lies:

Meta and Alphabet are leading the spending cycle, Microsoft and Amazon expanding capacity in lockstep with monetisation, and Apple remains disciplined, investing selectively within its ecosystem.

High capex isn’t a red flag, but it does raise volatility. For investors sitting on gains, it’s a cue to trim size, not conviction.

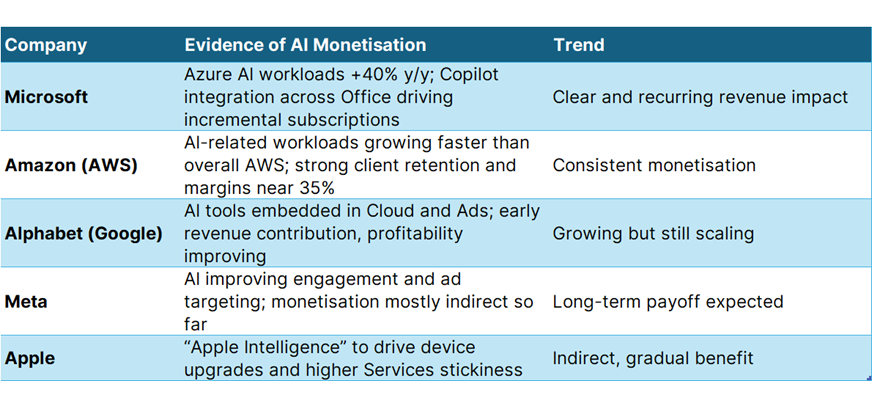

While everyone is investing, the financial pay-off varies sharply. Monetisation separates today’s compounding from tomorrow’s potential.

Source: Company reports, Saxo. Data as of 3 Nov 2025. Past performance is not indicative of future results.

The early payoff is concentrated in just two names: Microsoft and Amazon.

The key distinction: some are monetising AI today, others are building for tomorrow.

Each company dominates a different layer of the cloud stack — and understanding those differences helps explain their performance and prospects.

In our view (forward-looking opinion), Microsoft is likely to offer relatively greater earnings visibility, Amazon stronger current profitability, and Google potential valuation upside.

However, each faces distinct execution and market-cycle risks that could impair these outcomes.

In our opinion, Apple remains a 'quiet compounder'. We believe its services revenue, which just hit a record high, could offset hardware slowdowns. The ecosystem is its moat, and the steady buyback program (over $110B in 2024 alone) rewards patience. Its AI rollout, through “Apple Intelligence,” will likely strengthen rather than disrupt existing products.

Meta is a different kind of story. It’s profitable, yes — but it’s entering a heavy investment cycle. The company’s AI push into recommendation engines and infrastructure will take time to monetize. Long-term believers see it as the next phase of digital engagement; skeptics see a risk of overspending.

Both companies offer stability of brand and user base, but with different time horizons: Apple for consistency, Meta for optionality.

It could. Google’s AI Overviews summarize search results for users, reducing the need to click through — which may lower ad impressions and publisher traffic. So far, Google’s ad revenue continues to grow, but investors are watching whether AI cannibalizes the very cash engine funding its future.

This risk explains why Alphabet’s stock, while cheaper, also trades with a “show-me” discount. It must prove AI is additive, not erosive, to its core business.

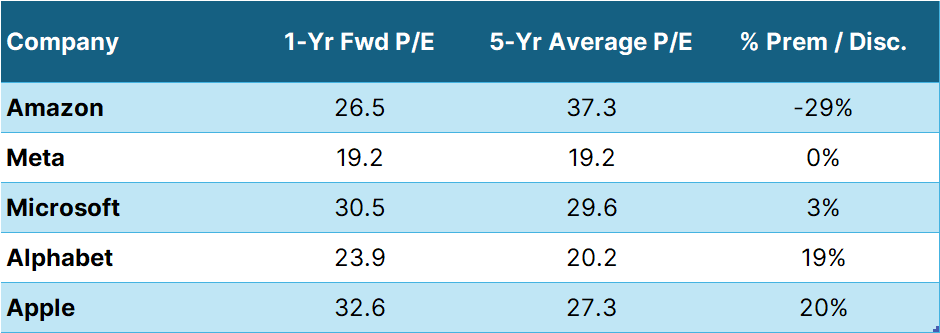

Source: Bloomberg, Saxo. Data as of 3 Nov 2025. Past performance is not indicative of future results.

Valuations tell a nuanced story.

In short: Microsoft and Apple trade on trust; Alphabet and Amazon on potential; Meta on skepticism.

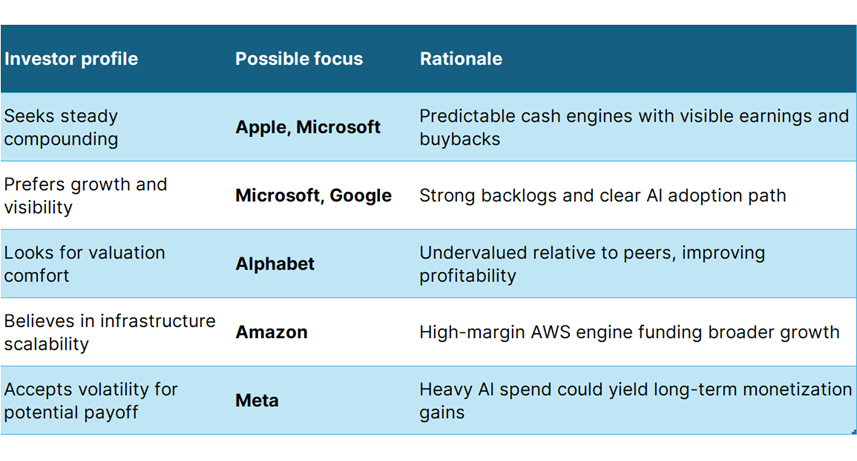

After such large gains, this is a sensible question, not a sign of doubt. Below are some considerations for investors. This information is provided for general discussion only and does not constitute investment advice. Investors should assess their individual circumstances or consult a qualified advisor.

The key is position management, not prediction by staying exposed to AI’s long-term compounding while managing near-term exuberance.

Much of the easy upside has already been captured. The next leg is about earnings delivery, not multiple expansion.

The AI trade has shifted from “fear of missing out” to “fear of missing earnings.” There’s still opportunity, but now it rewards patience over speed.

Those numbers will reveal who’s turning AI from narrative into compounding.

Each company has a distinct role to play in a balanced, long-term portfolio:

Big Tech is entering its second act of the AI cycle — less hype, more execution.

The easy money from multiple expansion has been made; the next phase belongs to disciplined holders who manage exposure, not just conviction.

Their fundamentals are diverging — and that’s good news for investors who can distinguish between growth that earns its cost and growth that still needs to prove itself.

Microsoft and Amazon could remain the clearest cash engines, Alphabet and Meta may offer selective opportunity, and Apple could continue to anchor stability.

Whether you’re protecting profits or catching up, the right move isn’t all-in or all-out — it’s staying intentionally invested in the parts of Big Tech that still have earnings power ahead of them.

Disclosure: The author(s) and/or connected persons may hold positions in one or more of the securities mentioned above at the time of publication. These holdings are subject to change without notice, and no trading intent should be inferred.