Lion Global Dynamic Growth USD Q3 2021 commentary

| Asset classes | Stocks (developed and emerging markets), bonds (investment grade and high yield) and commodities |

| Instruments traded | ETFs and mutual funds |

| Investment style | Bottom up research and selection of best in class ETFs and mutual funds |

| Quarterly return | -3.18% (net of fees) |

| Annualised volatility (since inception) | 9.6% |

Market overview

Global equities declined 4.2% in the month of September 2021 and global fixed income were also generally soft. The risk aversion in markets saw US dollar rising about 1.7% and the volatility index (VIX index) jumping 7 points to 23.1.

Asian equities followed the global equities sell-off and confusion around the Chinese second-largest developer by sales, Evergrande credit situation led to a lack of confidence for both investors and traders. Most market watchers expect no systemic risks with an orderly restructuring under the central authorities, but spillover effects into non-bank financials and consumption are likely. China’s power outage and rationing have brought another shock, hurting the production of key commodities. Downside risks for China have increased against the backdrop of a slowing in activity indicators and rising concern that recent regulatory policies will further weigh on growth.

Investors were also faced with concerns over the US debt ceiling as Republicans and Democrats debated to raise the US borrowing limit. While most investors remained optimistic that the US would not default on its debt, short-term traders took no chances and lightened or hedged their positions. After the September 2021 Federal Open Market Committee (FOMC) meeting, investors started to price in a faster pace of monetary tightening than previously expected. The Federal Reserve (Fed) signaled tapering would conclude around the mid of next year, alongside expectations of 6-7 rate hikes through 2024.

On the COVID-19 front, global vaccination efforts continued to make progress, however unevenly. Some countries managed to reach major inoculation milestones. For example, the UK has fully vaccinated more than 75% of adults to date. However, supply disruptions and anti-vaccination movements led to challenges in a number of countries. The fight against COVID-19 was further exacerbated by the Delta variant, which led to rising case numbers in countries such as the US. Consequently, the European Union announced that it will impose new restrictions on nonessential travel from the US due to increased case numbers in the country.

Portfolio performance (net of fees)*

| Jul | -0.63% |

| Aug | 0.84% |

| Sep | -3.38% |

| Since Jan 2016 | 88% |

Investment performance of the managed portfolio reflected for the period prior to the launch on 25/02/21 is simulated past performance, based on back-tested performance of portfolio components. For more detail information, see full disclosure in the disclaimer section of the commentary.

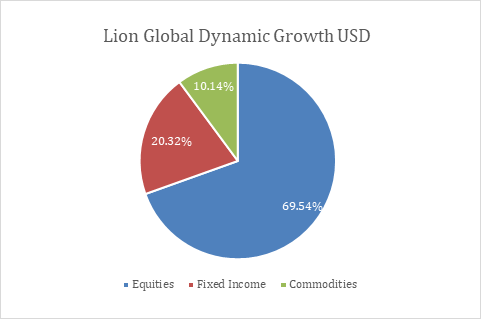

Portfolio Allocation (as of 30/09/21)

Outlook

Global economic growth momentum has peaked, with the slowdown also reflected in earnings momentum. In the recent FOMC meeting, while Fed officials voted unanimously to keep short term rates anchored near zero, their 2021 economic forecast was trimmed to 5.9% from the initial June 2021 projections of 7.0% Gross Domestic Product (GDP) growth. The Fed also indicated that tapering may begin as early as November 2021 and conclude by around mid-2022, suggesting the first rate hike in 2022, 3 more hikes in 2023, and 3 more hikes in 2024.

In China, worries about the pace of economic growth have also been building in recent months amid a Delta resurgence, stringent virus control and tight curbs on property and infrastructure. China’s real-estate developer Evergrande’s debt troubles will be a dampener on growth and employment. The Chinese government has pledged to accelerate fiscal spending in second half of 2021 and People’s Bank of China (PBoC) has signaled that it may step up monetary support such as cutting banks’ reserve requirement ratio (RRR) amid the sustained economic growth slowdown. Ahead of the 20th National Party Congress in 2022, the government may be further pressured to relax its regulatory policies.

Global financial markets are facing multiple headwinds including the ongoing uncertainty weighing down on China; more persistent than anticipated inflationary pressures and a compressed timeline for Fed tapering that could reduce liquidity and aggravate the economic slowdown. Inflation is likely to stay elevated with the holiday season approaching as factory shutdowns, chip shortages and port congestions are expected to continue into 2022.