Lion Global Dynamic Growth SGD Q3 2022 commentary

| Asset classes | Stocks (developed and emerging markets), bonds (investment grade and high yield) and commodities |

| Instruments | ETFs and mutual funds |

| Investment style | Bottom-up research and selection of best-in-class ETFs and mutual funds |

| Quarterly return | -6.1% (net of fees |

| Annualised volatility (since inception) | 9.1% |

Market overview

Global equities markets fell (MSCI World Index down 6.6 percent) in the third quarter of 2022 as fears of aggressive tightening and imminent recession kept investors away from risk assets. The USD was the only safe haven, appreciating against major currencies like EUR, JPY, CNY and GBP. The Fed chair made it clear that curbing inflation might necessitate taking drastic measures and that the Fed would continue to hike interest rates even in a recessionary environment. Bond spreads continued to widen as investors started worrying about corporate debt defaults.

The S&P500 Index outperformed global equities and fell 5.3 percent. The tech-heavy Nasdaq Index surprisingly held up relatively better and fell only 4.1 percent.

MSCI Asia Pacific ex Japan markets fell 13.6 percent, driven by China (CSI 300 Index down 20.1 percent) and other export-oriented markets like Korea and Taiwan. In China, the fragile economic recovery has been hampered by a re-tightened COVID-19 policy, headwinds from recent power shortages caused by extreme weather and the continuing drag from the housing sector. The property sector remains troubled as government support measures are not sufficient to fix systemic issues in the market.

Portfolio performance (net of fees)*

| July | 2.22% |

| August | -1.16% |

| September | -7.07% |

| Since inception (Jan 2016) | 43% |

Investment performance of the managed portfolio reflected for the period prior to the launch on 25/02/21 is simulated past performance, based on back-tested performance of portfolio components. For more detailed information, see full disclosure in the disclaimer section of the commentary.

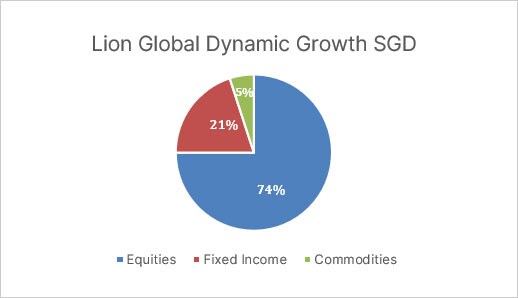

Portfolio allocation (as of 30/09/22)

Outlook

With the current elevated inflation levels, central banks must hike policy rates aggressively to curb demand.

US consumer spending remains resilient, supported by a robust labour market with households increasing their discretionary purchases even as the cost of spending rose. The US manufacturing industry remains firmly in expansionary territory, but business surveys show that spending plans as well as new orders have started to slow down.

In Europe, both business and consumer confidence have posted sharp declines. The indefinite suspension of gas flows through the Nord Stream 1 pipeline increases the risk of a gas rationing scenario that threatens to have severe implications on economic output in Europe. While EU countries have made efforts to increase storage and diversify away from Russian supplies, there is a wide margin of uncertainty depending on winter temperatures, continuity of remaining supplies and the degree of voluntary demand destruction.

Concerns about China’s economy have centred on the moment when the authorities will abolish the zero-COVID-19 policy. For now, controls might even become more stringent ahead of the 20th Party Congress. Local leaders might be motivated to tighten rather than loosen controls out of a concern that failing to subdue COVID-19 resurgence would be extremely costly for them politically.