Balanced ETF portfolios USD Q2 2022 commentary

| Asset classes | Stocks (developed and emerging equity), bonds, non-traditional |

| Instruments | ETFs |

| Investment style | Macro, diversified investment focus |

| Quarterly return (net of fees) | |

| Defensive | -7.97% |

| Moderate | -11.62% |

| Aggressive | -13.70% |

Market overview

The second quarter of 2022 continued to be extraordinarily challenging for markets. Both global equities and fixed income continued to see further declines simultaneously—an unusual market regime historically. Volatility remained against the backdrop of multi-decade high inflation rates, hawkish central bank rhetoric and growth concerns, all in the space of a few months, weighing on investor sentiments. Geopolitical concerns around Russia and Ukraine continued to add additional uncertainty to markets.

The market narrative shifted somewhat from central banks rapid tightening to concerns of slowing growth and rising recession fears. The S&P500 ended the first half of the year down nearly 20 percent—the steepest first-half loss seen in more than five decades. Many equity indices have suffered a similar fate.

While outperforming broad equities, heightened volatility also dominated price action in developed market government bonds. Riskier parts of the fixed income markets also suffered: corporate bonds posted negative total returns, with high yield lagging investment grade. Notably, high yields spreads widened to their year-to-date highs.

Portfolio performance

| Returns net of fees | Defensive | Moderate | Aggressive |

| April | -4.5% | -5.3% | -6% |

| May | -0.3% | -1.1% | -1.4% |

| June | -3.4% | -5.7% | -6.9% |

| Since inception (Feb 2017) | 8% | 22% | 33% |

The multi-asset portfolios produced negative absolute returns. In relative terms, they underperformed their respective index benchmarks in Q2 while still outperforming year-to-date.

In an environment where market volatility remained elevated and weighed on both equities and bonds, the ultra-short duration exposures, which can be viewed as cash proxy, continued to be one of the most effective portfolio diversifiers to hedge against downside risk.

Within equities, from a relative perspective, allocations in DM were detrimental while EM was additive. Negative active contribution from DM was primarily driven by the overweight to Canada and allocations to Europe.

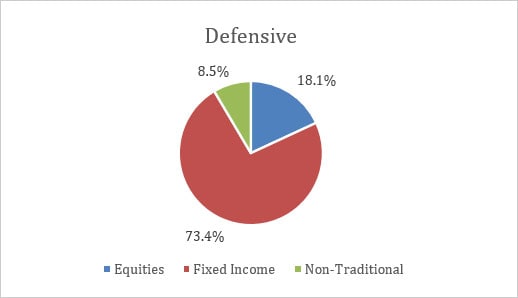

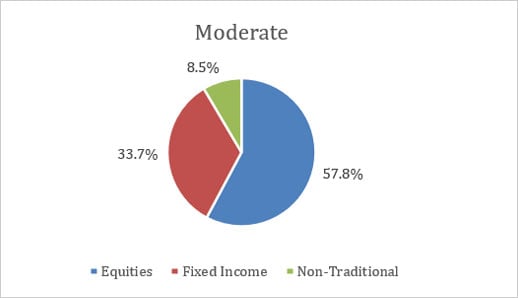

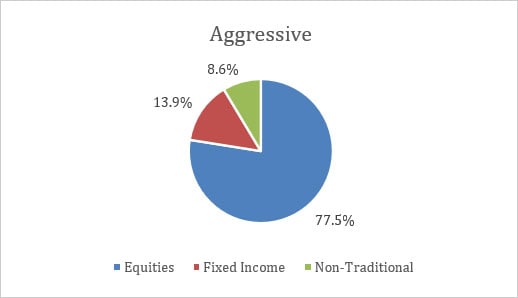

Portfolio allocation (as of 27th July 2022)