Saxo Morningstar Moat USD Q1 2021 commentary

| Instruments traded | Stocks |

| Asset classes | Global equities (excluding emerging markets) |

| Investment style | High quality stocks offering attractive dividends |

| Dividend Yield | 1.98% |

| Quarterly return | 15.7% (net of fees) |

| Annualised volatility (since inception) | 23.6% |

Market overview

What a difference a quarter of a year makes. After a dramatic 2020, we have seen the green shoots of “reflation”, with several significant developments co-existing. The major market influences are:

- Inflation expectations are higher with central banks, for now, willing to let prices rise

- Economic growth forecasts increasing following solid vaccine progress

- Company reporting broadly exceeding expectations

- Geopolitical tensions and systemic risks softening, and

- Investors conditioned by strong returns through good news and bad.

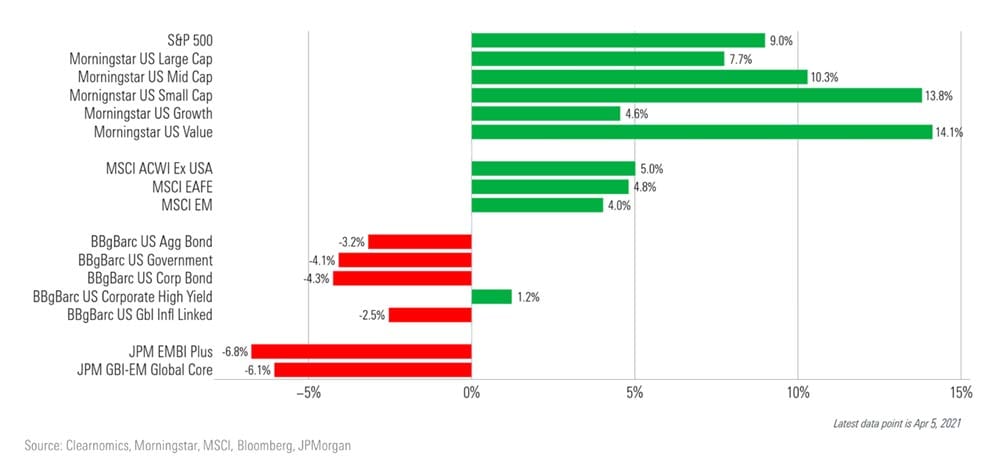

This culminated in strong returns for equities but weak returns for bonds in the first quarter. Among equities, the corners of the markets that had been hot—in some cases for years—turned cold. In fact, Morningstar investment team (the “investment team”) saw a remarkable change with value stocks at the top of the leaderboard, buoyed by energy and financial companies, and technology stocks landed in the unusual position of worst performers. Smaller companies more likely to have their fortunes tied to the strength of the economy were among the best performers. Dividend-payers, which struggled in 2020, also saw a first-quarter recovery.

In the bond market, dormant expectations for inflation began to emerge, leading to losses across interest-rate-sensitive sectors of the market even as central banks committed to easy-money policies. The first-quarter bond sell-off hit government bonds the hardest, followed by safer core and corporate bonds. Only high-yield bonds managed to end the quarter just in positive territory.

In the background, the yield curve (which looks at the effective interest rate for governments over different time periods) steepened severely from three months ago on expectations for stronger economic growth. For example, the 10-year yield in the U.S. has risen by 1.04 points since last year, reaching pre-pandemic levels near the end of the first quarter. But it was not just U.S. Treasuries that were hit hard—U.K. government bonds also saw a 7.2% decline and government bonds lost 6.2% globally.

Exhibit 1: The first quarter of 2021 saw equity market strength and bond market weakness.

Portfolio performance (net of fees)

| Jan | 3.03% |

| Feb | 9.24% |

| Mar | 2.79% |

| Inception (Jan 2017) | 97.2% (cumulative return) |

Top 10 portfolio holdings (as of 31/03/2021)

40.6% of total portfolio

| Name | Weight (%) |

| Sabre Corp | 5.32 |

| Lyft Inc Class A | 4.84 |

| Adient PLC | 4.54 |

| ING Groep NV | 4.00 |

| WESCO International Inc | 3.71 |

| Bayerische Motoren Werke AG | 3.69 |

| Tapestry Inc | 3.65 |

| Schlumberger Ltd | 3.63 |

| BorgWarner Inc | 3.59 |

| Lloyds Banking Group PLC | 3.58 |

Top Performers (Below performance figures are total return Q1):

- Tapestry Inc. Share price went up 32.6% and according to Morningstar proprietary analysis, the stock trades at a slight discount to fair value.

Coach, Kate Spade, and Stuart Weitzman are the fashion and accessory brands that comprise Tapestry. The firm’s products are sold through about 1,500 company-operated stores, wholesale channels, and e-commerce in North America (62% of fiscal 2020 sales), Europe, Asia (32% of fiscal 2020 sales), and elsewhere. Coach (71% of fiscal 2020 sales) is best known for affordable luxury leather products. Kate Spade (23% of fiscal 2020 sales) is known for colorful patterns and graphics. Women’s handbags and accessories produced 68% of Tapestry's sales in fiscal 2020. Stuart Weitzman, Tapestry's smallest brand, generates nearly all (98%) of its revenue from women’s footwear.

- ING Groep NV. Share price went up 32.4% and according to Morningstar proprietary analysis, the stock trades at a discount to fair value.

The merger of the Dutch postal bank and NN Insurance in 1991 created ING. Through a series of further acquisitions ING build up a global footprint. The 2008 financial crisis forced ING to seek government support -a precondition of which- was that ING should separate its banking and insurance activities, which saw ING revert to being solely a bank. ING has market-leading banking operations in the Netherlands and Belgium, and a range of digital banks across Europe and Australia. Its global wholesale banking operation is primarily focused on lending.

- Comerica Inc. Share price went up 29.6% and according to Morningstar proprietary analysis, the stock trades at a discount to fair value.

Comerica is a financial services company headquartered in Dallas. Comerica is primarily focused on relationship-based commercial banking. In addition to Texas, other primary geographies are California and Michigan, with locations also found in Arizona and Florida, with select businesses operating in several other states as well as in Canada.

- Lyft Inc Class A. Share price went up 28.6% and according to Morningstar proprietary analysis, the stock trades at fair value.

Lyft is the second-largest ride-sharing service provider in the U.S., connecting riders and drivers over the Lyft app. Lyft recently entered the Canadian market in an effort to expand its market outside the U.S.

Incorporated in 2013, Lyft offers a variety of rides via private vehicles, including traditional private rides, shared rides, and luxury ones. Besides ride-share, Lyft also has entered the bike- and scooter-share market to bring multimodal transportation options to users.

- Adient PLC. Share price went up 27.1% and according to Morningstar proprietary analysis, the stock trades at a deep discount to fair value.

Adient began trading Oct. 31, 2016, when Johnson Controls spun off its automotive experience segment into this new company. Adient is the leading seating supplier to the industry with about one third of the global market as well as a dominant share in China of about 45% which should decline after Adient sells its main Chinese joint venture in calendar 2021. Operations in China are for now accounted for under the equity method so most revenue there is unconsolidated. Unconsolidated seating revenue from joint ventures totaled $9.5 billion in fiscal 2020. The company is headquartered in Ireland but has corporate offices in the Detroit area. Fiscal 2020 consolidated revenue, excluding joint venture sales, was $12.7 billion.

Worst Performers:

- Credit Suisse Group.Share price went down 18.4% and according to Morningstar proprietary analysis, the stock trades at a deep discount to fair value.

Credit Suisse runs a global wealth management business, a global investment bank and is one of the two dominant Swiss retail and commercial banks. Geographically its business is tilted toward Europe and the Asia-Pacific.

- Link Administration Holdings Ltd. Share price went down 7.97% and according to Morningstar proprietary analysis, the stock trades at a deep discount to fair value.

Link provides administration services to the financial services sector in Australia and the U.K., predominantly in the share registry and investment fund sectors. The company is the largest provider of super-annuation administration services and the second-largest provider of share registry services in Australia. Link acquired U.K.-based Capita Asset Services in 2017; this provides a range of administration services to financial services firms and comprises around 40% of group revenue. Link’s clients are usually contracted for between two and five years but are relatively sticky, which results in a high proportion of recurring revenue. The business model's capital-light nature means cash conversion is relatively strong.

- Millicom International Cellular SA SDR. Share price went down 2.23% and according to Morningstar proprietary analysis, the stock trades at a deep discount to fair value.

Millicom offers wireless and fixed-line telecom services primarily in smaller, less congested markets or in less developed countries in Latin America. Countries served include Bolivia, Honduras, Nicaragua, Panama, El Salvador, Guatemala, Paraguay, Colombia, and Costa Rica. It also operates in Africa but has been selling out of African markets over the past couple years. Increasingly, it offers a converged package that may include fixed-line phone, broadband, and pay television in conjunction with wireless services.

- Alexion Pharmaceuticals Inc. Share price went down 2.13% and according to Morningstar proprietary analysis, the stock trades at a discount to fair value.

AstraZeneca acquired Alexion Pharmaceuticals in Dec 2020. With the acquisition, AstraZeneca gains a strong new rare disease platform and this should diversify its cash flows. The merger between Astra of Sweden and Zeneca Group of the United Kingdom formed AstraZeneca in 1999. The company sells branded drugs across several major therapeutic classes, including gastrointestinal, diabetes, cardiovascular, respiratory, cancer, and immunology. The majority of sales come from international markets with the United States representing close to one third of its sales.

The remaining securities all had positive performances during the quarter.

Outlook

On a year-over-year basis, a more compelling story emerges as the scope of the bounce back from the depth of last year’s brutal bear market becomes clear. From where it ended in the first quarter of 2020, stocks are up significantly.

Meanwhile, under the hood of the stock market, the investment team continues to see significant changes in leadership. Perhaps most notable is the recent strength in value stocks, which have been lagging significantly in recent years. Still, the longer-term performance gaps in preference of growth stocks remains wide. While losing the least in the bear market, wide-moat stocks have lagged in the recovery. At a sector level, despite the dismal quarter, consumer cyclical stocks have gained the most of any sector from a year ago, rising over 100% from last March. Utilities have been the slowest to recover, only gaining 19% in the same period.

Turning to bonds, the decline in government bonds has muted total returns for more cautious investors, while corporate bonds have done slightly better. Over the past year, though, high-yield and emerging-markets bonds have staged the largest recovery, with high-yields bonds up approximately 24% and emerging-markets bonds recording double-digit returns.