Saxo Morningstar High Dividend USD Q1 2021 commentary

| Instruments traded | Stocks |

| Asset classes | Global equities (excluding emerging markets) |

| Investment style | High quality stocks offering attractive dividends |

| Dividend Yield | 3.96% |

| Quarterly return | 9.62% (net of fees) |

| Annualised volatility (since inception) | 19.2% |

Market overview

What a difference a quarter of a year makes. After a dramatic 2020, we have seen the green shoots of “reflation”, with several significant developments co-existing. The major market influences are:

- Inflation expectations are higher with central banks, for now, willing to let prices rise

- Economic growth forecasts increasing following solid vaccine progress

- Company reporting broadly exceeding expectations

- Geopolitical tensions and systemic risks softening, and

- Investors conditioned by strong returns through good news and bad.

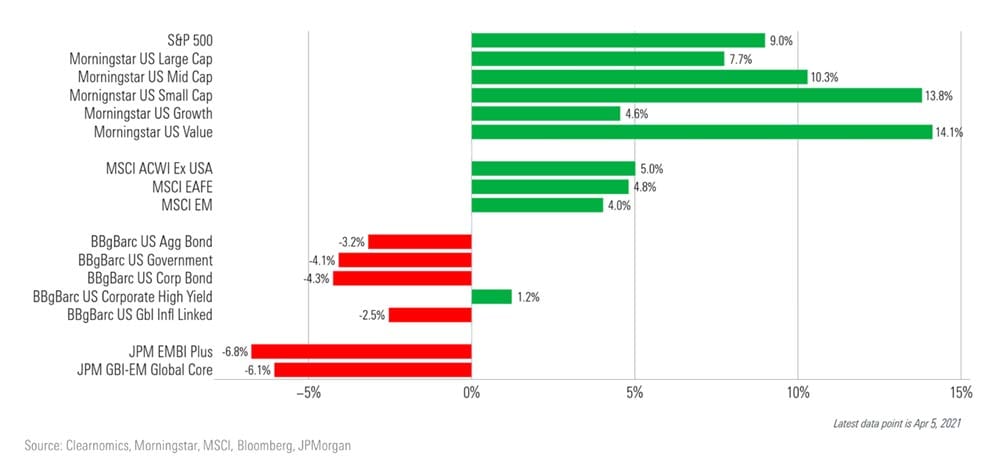

This culminated in strong returns for equities but weak returns for bonds in the first quarter. Among equities, the corners of the markets that had been hot—in some cases for years—turned cold. In fact, Morningstar investment team (the “investment team”) saw a remarkable change with value stocks at the top of the leaderboard, buoyed by energy and financial companies, and technology stocks landed in the unusual position of worst performers. Smaller companies more likely to have their fortunes tied to the strength of the economy were among the best performers. Dividend-payers, which struggled in 2020, also saw a first-quarter recovery.

In the bond market, dormant expectations for inflation began to emerge, leading to losses across interest-rate-sensitive sectors of the market even as central banks committed to easy-money policies. The first-quarter bond sell-off hit government bonds the hardest, followed by safer core and corporate bonds. Only high-yield bonds managed to end the quarter just in positive territory.

In the background, the yield curve (which looks at the effective interest rate for governments over different time periods) steepened severely from three months ago on expectations for stronger economic growth. For example, the 10-year yield in the U.S. has risen by 1.04 points since last year, reaching pre-pandemic levels near the end of the first quarter. But it was not just U.S. Treasuries that were hit hard—U.K. government bonds also saw a 7.2% decline and government bonds lost 6.2% globally.

Exhibit 1: The first quarter of 2021 saw equity market strength and bond market weakness.

Portfolio performance (net of fees)

| Jan | -0.55% |

| Feb | 3.75% |

| Mar | 6.25% |

| Inception (Jul 2018) | 17.7% (cumulative return) |

Top 10 portfolio holdings (as of 31/03/2021)

36.5% of total portfolio

| Name | Weight (%) |

| Maxim Integrated Products Inc | 4.86 |

| Hubbell Inc | 3.89 |

| Basf SE | 3.81 |

| Enterprise Products Partners LP | 3.51 |

| AbbVie Inc | 3.49 |

| Canadian Imperial Bank of Commerce | 3.48 |

| ING Groep NV | 3.44 |

| British American Tobacco PLC | 3.43 |

| National Bank of Canada | 3.33 |

| International Business Machines Corp | 3.28 |

Top Performers (Below performance figures are total return Q1 USD):

- ING Groep NV. Share price went up 32.4% and according to Morningstar proprietary analysis, the stock trades at a deep discount to fair value.

The merger of the Dutch postal bank and NN Insurance in 1991 created ING. Through a series of further acquisitions ING build up a global footprint. The 2008 financial crisis forced ING to seek government support -a precondition of which- was that ING should separate its banking and insurance activities, which saw ING revert to being solely a bank. ING has market-leading banking operations in the Netherlands and Belgium, and a range of digital banks across Europe and Australia. Its global wholesale banking operation is primarily focused on lending.

- Intel Corp. Share price went up 29.2% and according to Morningstar proprietary analysis, the stock trades at fair value.

Intel is one of the world's largest chipmakers. It designs and manufactures microprocessors for the global personal computer and data center markets. Intel pioneered the x86 architecture for microprocessors. It was the prime proponent of Moore's law for advances in semiconductor manufacturing, though the firm has recently faced manufacturing delays. While Intel's server processor business has benefited from the shift to the cloud, the firm has also been expanding into new adjacencies as the personal computer market has declined. These include areas such as the Internet of Things, memory, artificial intelligence, and automotive. Intel has been active on the merger and acquisitions front, acquiring Altera, Mobileye, Movidius, and Habana Labs in order to assist its efforts in non-PC arenas.

- National Bank of Canada. Share price went up 21.8% and according to Morningstar proprietary analysis, the stock trades at a slight discount to fair value.

National Bank of Canada is the sixth-largest Canadian bank. The bank offers integrated financial services, primarily in the province of Quebec as well as the city of Toronto. Operational segments include personal and commercial banking, wealth management, and a financial markets group.

- Hubbel Inc. Share price went up 19.8% and according to Morningstar proprietary analysis, the stock trades at a slight premium to fair value.

Hubbell is a diversified conglomerate industrial company that mostly competes in the electrical components market. Its products and services serve vital portions of the U.S. electrical supply chain, including transmission and distribution as well as the commercial, industrial, and residential end markets. The company organizes its business into two segments—electrical and power systems. The consolidated business sells about two thirds of its products via distributors, with the remainder sold via direct sales to utilities and contractors. The 2018 acquisition of Aclara, folded into the utility solutions segment, brought Hubbell a portfolio of smart meters and communication sensors that serves electrical, water, and gas utilities.

- Bank of Montreal. Share price went up 18.4% and according to Morningstar proprietary analysis, the stock trades at a slight discount to fair value.

Bank of Montreal is a diversified financial-services provider based in North America, operating four business segments: Canadian personal and commercial banking, U.S. P&C banking, wealth management, and capital markets. The bank's operations are primarily in Canada, with a material portion also in the U.S.

Worst Performers:

- Roche Holdings AG ADR. Share price went down 5.72% and according to Morningstar proprietary analysis, the stock trades at a deep discount to fair value.

Roche is a Swiss biopharmaceutical and diagnostic company. The firm's best-selling pharmaceutical products include a variety of oncology therapies from acquired partner Genentech, and its diagnostics group was bolstered by the acquisition of Ventana in 2008. Oncology products account for 60% of pharmaceutical sales, and centralized and point-of-care diagnostics for more than half of diagnostic-related sales.

The remaining securities all had positive performances over the quarter.

Outlook

On a year-over-year basis, a more compelling story emerges as the scope of the bounce back from the depth of last year’s brutal bear market becomes clear. From where it ended in the first quarter of 2020, stocks are up significantly.

Meanwhile, under the hood of the stock market, the investment team continues to see significant changes in leadership. Perhaps most notable is the recent strength in value stocks, which have been lagging significantly in recent years. Still, the longer-term performance gaps in preference of growth stocks remains wide. While losing the least in the bear market, wide-moat stocks have lagged in the recovery. At a sector level, despite the dismal quarter, consumer cyclical stocks have gained the most of any sector from a year ago, rising over 100% from last March. Utilities have been the slowest to recover, only gaining 19% in the same period.

Turning to bonds, the decline in government bonds has muted total returns for more cautious investors, while corporate bonds have done slightly better. Over the past year, though, high-yield and emerging-markets bonds have staged the largest recovery, with high-yields bonds up approximately 24% and emerging-markets bonds recording double-digit returns.