Quarterly Outlook

Q3 Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: Bank of Canada Policy Announcement, Australia GDP (Q2), China Caixin Services PMI (Aug), EZ & UK Composite/Services Final PMIs (Aug), US Durables Revised & Factory Orders (Jul), JOLTS (Jul)

Earnings: Dick’s Sporting Goods, Dollar Tree, C3 AI, Casey’s

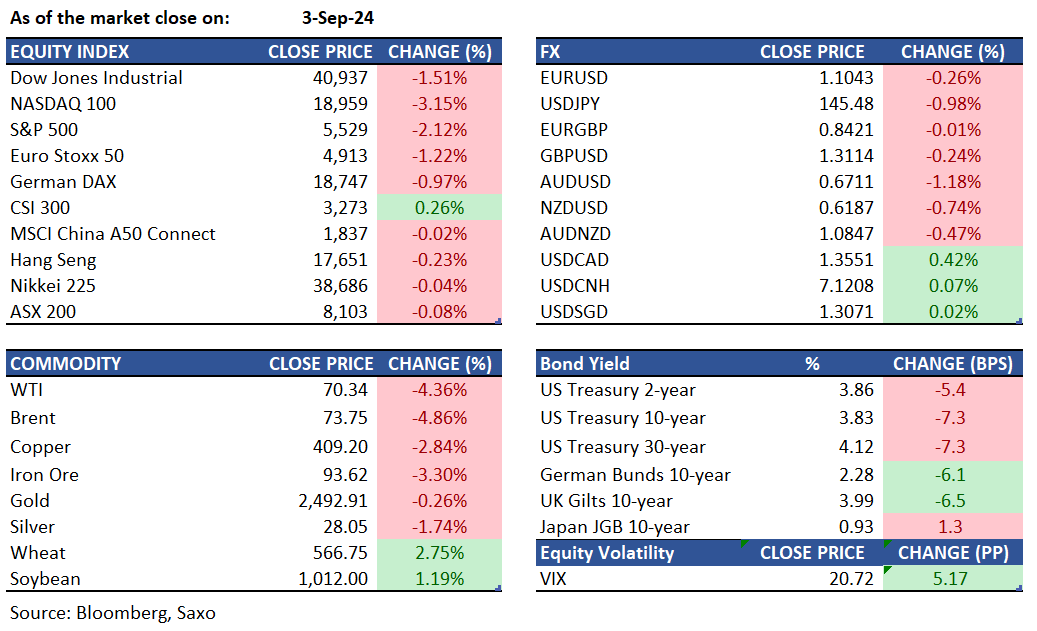

Equities: US stocks experienced a sharp decline on Tuesday, marking their worst day since August 5, due to economic concerns and a major selloff in tech stocks. The S&P 500 dropped 2.1%, the tech-heavy Nasdaq 100 fell 3.1%, and the Dow Jones lost 625 points. Technology stocks, especially in the semiconductor industry led the downturn. Nvidia, a key player in the AI market plunged 9.5%, impacting other chipmakers like Broadcom (-6.2%), Qualcomm (-6.9%), and Micron (-8%). Communication services also struggled, with Alphabet and Netflix each losing 3.7%. Weak ISM Manufacturing PMI activity in August further fueled economic concerns as investors remain cautious ahead of a series of labor market reports due later in the week, which could affect the Federal Reserve's monetary policy decisions.

Fixed income: Treasury futures surged sharply during the early U.S. session as WTI futures continued to decline and stocks fell after the cash open. These gains reversed the month-end losses seen late in Friday's session and were largely sustained through a quiet U.S. afternoon. Following the Labor Day holiday in the U.S., a record 29 corporate bond issuers entered the market. Treasury yields had risen by 4 to 7 basis points across the curve, with the long end leading the gains. This resulted in a flattening of the 2s10s and 5s30s spreads by 3 basis points and 2 basis points, respectively. U.S. 10-year yields ended around 3.84%, slightly outperforming both bunds and gilts in the sector.

Commodities: Gold dipped 0.26% to $2,492 after soft Manufacturing PMI data but recovered slightly. Silver fell 1.7% to $28.05, its lowest close in over a week, as the US Dollar index rose. Investors are anticipating payroll data and the upcoming Fed meeting. WTI crude futures dropped 4.36% to $70.34, and Brent fell 4.86% to $73.75, the lowest since the start of January, as muted demand magnified the impact of relatively ample supply. New data from China exacerbated concerns that economic growth from one of the world’s largest oil consumers is unlikely to bounce back this year, with key gauges of domestic factory demand dropping more than expected in August.

FX: The US dollar continued to strengthen from its late-August lows, but gains still remained modest. We discussed the US dollar dynamics in this article yesterday, and noted some catalysts that could prompt a sharper reversal in the greenback. Labor market focus continues this week and JOLTS job openings numbers will be key today. Bank of Canada also announces its policy decision and there is a slim chance of a 50bps rate cut as well, which together with weakness in oil prices could make the Canadian dollar vulnerable. The underperformer in the major currency space yesterday was the Australian dollar, however, and GDP data is out today which will need to be resilient to support the RBA’s hawkish stance. The Australian dollar slipped 2% against the Japanese yen, indicating risk-off market behavior. The Swiss franc also gained, despite softer Swiss CPI hinting at another SNB rate cut in September.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.