Quarterly Outlook

Q3 Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: UK Retail Sales (Jul), US University of Michigan Prelim (Aug)

Earnings: Flowers Foods, CINT, OneConnec

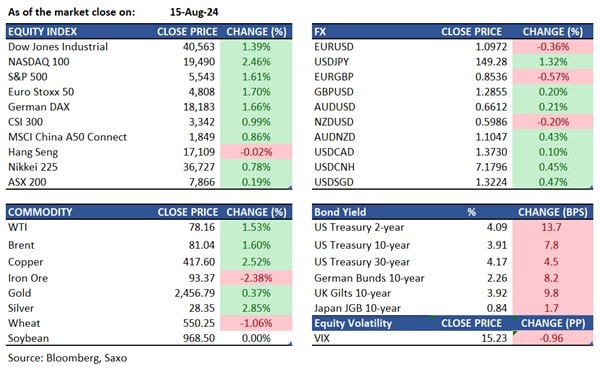

Equities: US stocks surged on Thursday as Wall Street responded positively to signs of strength in the US consumer and labor markets, easing recession worries. The S&P 500 and the Nasdaq extended their winning streak to six days, gaining 1.6% and 2.4%, respectively, while the Dow Jones rose by 555 points. The rally was driven by strong economic data, including retail sales that increased by 1% in July, far exceeding the expected 0.3% rise. Additionally, weekly jobless claims fell to their lowest level since early July, further boosting sentiment. All sectors closed in the green, with consumer discretionary leading, followed by tech and materials. On the earnings front, Cisco's optimistic revenue forecast pushed its shares up 6.8%, while Walmart advanced 6.6% after beating earnings and revenue expectations. In extended hours, Applied materials fell 3% despite beating earnings estimates and forecasting this quarter’s sales in line with its guidance.

Fixed income: Treasury futures dropped sharply, and the yield curve aggressively flattened after retail sales exceeded estimates and jobless claims came in below expectations. This bear-flattening trend persisted into a quiet afternoon, though yields later eased from their lowest levels. US yields were cheaper by up to 14 basis points on the front end, while 30-year yields rose by around 5 basis points. The 10-year yield ended the day at 3.92%, peaking at 3.95%. Futures volumes were 4% above the 20-day average, with the 5-year note contract seeing 10% higher activity. Following the data, Fed swaps reduced the likelihood of a half-point rate cut at the September meeting, with 29 basis points of easing priced in, down from 32. For December, 92 basis points of easing were priced in, down from 102. Money-market fund assets hit a record high as $28.4 billion flowed in, reaching $6.22 trillion. China's US Treasuries holdings rose to the highest level since the start of the year, while Japanese investors sold the most Treasuries since September 2022.

Commodities: Oil prices fell as the market weighed strong US economic data and the potential threat of an attack by Iran or its proxies on Israel against weak demand in China. West Texas Intermediate dropped below $78 a barrel after a 1.5% rise on Thursday, while Brent crude closed just above $81. Robust US retail sales and employment figures mitigated concerns about sluggish investment and industrial activity in China. Global benchmark Brent is set for a second weekly gain, rebounding from a seven-month low. The market remains on alert for developments in the Middle East, as Israel entered talks about pausing the conflict in Gaza. Gold prices fluctuated as traders processed US retail spending data, considering the outlook for the Federal Reserve’s expected interest-rate cuts next month. Copper prices rose for the second day, balancing weak Chinese economic data against labor disruptions at the world’s largest mine. London prices increased by roughly 2%, building on Wednesday’s gains. China’s economic downturn extended into the third quarter, while efforts to resolve a labor dispute at BHP Group’s Escondida mine in Chile stalled.

FX: The US dollar faced two opposing forces, with rising Treasury yields pushing it higher but offset by reduced recession concerns supporting a risk-on sentiment and pushing the US dollar lower. The Japanese yen, however, suffered on both accounts and has retraced all its gains since recession concerns first picked up with the July US jobs report on August 2. Activity currencies, however, saw a sharp rebound after the initial US retail sales-driven decline. UK’s pound as well as Australian dollar were eventually higher against the US dollar, while others like the euro stayed weak.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.