Quarterly Outlook

Q3 Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Global Macro Strategist

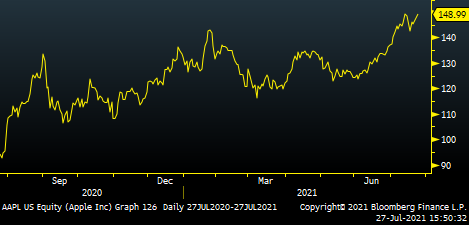

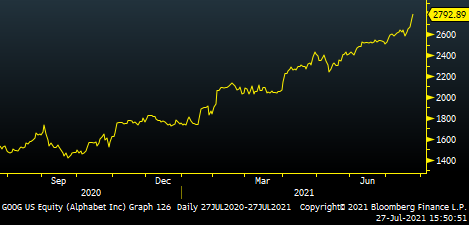

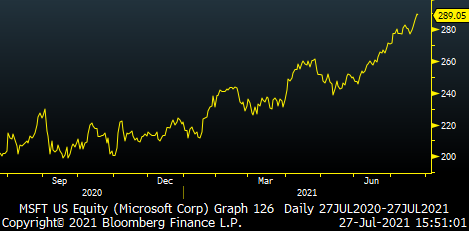

Summary: Earnings Watch aims to highlight some of the key names that are in heavy rotation on investors' & traders' radars. We check in on Apple, Microsoft & Google (Alphabet).

-

-

Who would have thought that after years of Bill Gates topping the Billionaire Charts as Numero Uno, today finds him at the #4 slot yet with an ATH of wealth of $151B. The 3-2-1 top slots go to Bernaud Arnault $175B, Elon Musk $180B, Jeff Bezos $212B.

Microsoft is one of the few companies that can boast being part of the +$2 trillion dollar club (Along with Apple) & at a fwd P/E of 35x could be considered pricey. Yet as per a quip from our equity strategist, the name was also expensive back in the 80s... so this could be an example of company where you get what you pay for.

-

Start-to-End = Gratitude + Integrity + Vision + Tenacity. Process > Outcome. Sizing > Idea.

This is the way

KVP