Key points:

- Market highs often create hesitation for investors on the sidelines, but history shows that long-term investing at these levels can still deliver strong returns.

- With tools like limit orders, thematic diversification, and dollar cost averaging, there are still smart ways to put money to work—even at elevated levels.

- Instead of trying to time the top, focus on building a resilient, well-diversified portfolio that can navigate different economic scenarios.

- Long-term success comes from consistency and discipline, not perfect timing.

Markets continue to print record highs, and with them, investor uncertainty.

Some worry that valuations have run too far. Others fear missing out on the next leg higher. And somewhere in between are those asking, “Should I wait for a correction before putting money to work?”

It’s a fair question, but history suggests it’s the wrong one.

The myth of waiting for the perfect entry

In theory, “buy low, sell high” sounds perfect. In practice, most investors struggle to do either.

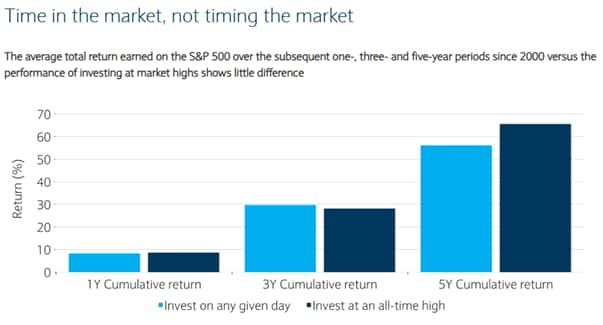

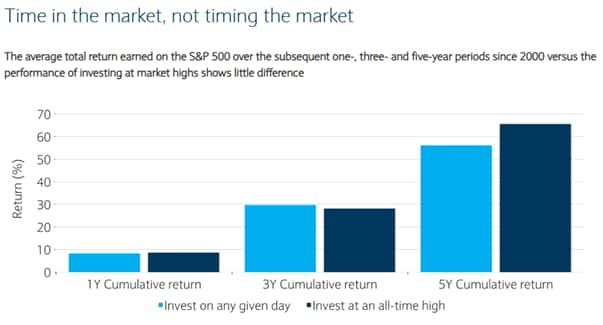

In fact, if you only invested on days when the S&P 500 hit an all-time high, your long-term returns would often be higher than if you invested on any random day.

Source: Bloomberg, Barclays Private Bank, March 2024

That’s because record highs typically happen during bull markets, and bull markets tend to last longer than expected.

The real challenge isn’t timing the market. It’s having a strategy that works when prices feel high, and sticking to it.

What to do instead: smart moves at market highs

1. Make pullbacks work for you

Even when the overall market is rising, individual stocks and sectors often face short-term dips. Those can be opportunities.

What you can do:

- If you’ve got cash on the sidelines, set price alerts for stocks or ETFs you want to own at better value.

- Use limit orders to automate discipline. These let you set a specific price you're willing to pay, and the order only executes if the market reaches that level. This helps avoid buying in a rush or at inflated prices.

- Keep a watchlist of high-conviction investments and gradually add to them during short-term weakness.

- Consider selling a put option (if you're familiar with options), which can let you earn income while waiting to buy at a lower price.

2. Look for what hasn’t rallied yet

While technology and AI stocks have led the charge, many parts of the market have lagged, and may offer better value and catch-up potential if the rally broadens out.

What to consider:

- Small-cap stocks and value-oriented sectors (like banks, energy, or healthcare) have underperformed and may benefit from stronger economic growth or a shift in investor focus.

- Dividend stocks can provide a steady income stream and may become more appealing if interest rates begin to fall.

- Rather than trying to pick individual stocks, consider broad-based ETFs that offer exposure to these less-loved areas of the market, helping you diversify while keeping costs low.

3. Diversify based on what drives markets

Market leadership today is shaped less by geography or sector, and more by macro forces like interest rates, trade policies, and geopolitical risk. Traditional diversification alone may not be enough. It’s time to think about how different parts of your portfolio respond to shifting policy and economic drivers.

How to position:

- Tariff-sensitive sectors like autos and semiconductors may benefit if global trade tensions ease, but could struggle in a more protectionist environment. On the other hand, utilities, healthcare, and defense tend to be more insulated from global supply chains and policy swings.

- Utilities and real estate often perform well when interest rates fall, as their steady income becomes more attractive relative to bonds and cash.

- Defense stocks, commodities, and gold can help cushion your portfolio during periods of geopolitical uncertainty or broad market volatility.

- Consider thematic funds that align with long-term structural trends such as clean energy, digital infrastructure, and healthcare innovation. These can offer growth potential across different macro cycles.

Even if some of these areas have gained attention recently, their relevance over the long term means they may still be underrepresented in many portfolios.

4. Stay consistent with a plan

Waiting for the “perfect moment” to invest often leads to missed opportunities. Even when markets dip, fear and uncertainty can prevent action, leaving cash on the sidelines and long-term goals unmet.

What works better:

- Adopt a dollar-cost averaging (DCA) approach – invest a fixed amount at regular intervals (monthly or quarterly), regardless of market levels. This helps reduce the impact of short-term volatility and takes the emotion out of decision-making.

- Set calendar reminders to review and top up your investments, just like you would with other recurring commitments like bill payments or insurance.

- Stay focused on your long-term goals, not the day-to-day headlines. Markets will fluctuate, but a consistent, disciplined approach tends to win over time.

Final thought

Buying at market highs can feel uncomfortable, but history shows that long-term investors are often rewarded for staying the course.

If you diversify smartly, lean into underappreciated areas, and stay consistent with your investing plan, you won’t need to worry about whether you’re “too late.”

Because long-term wealth isn’t built by picking the perfect moment.

It’s built by showing up, again and again.