Quarterly Outlook

Q4 Outlook for Investors: Diversify like it’s 2025 – don’t fall for déjà vu

Jacob Falkencrone

Global Head of Investment Strategy

Chief Investment Strategist

Emerging markets extended their edge over developed peers in Q3, with the MSCI EM Index climbing around 11% versus ~7% for developed markets.

Several factors explain the outperformance:

Looking at one-month sector returns (local currency), the EM rally was distinctly cyclical:

This suggests investors are leaning into growth-sensitive sectors tied to AI, consumption, and commodities, while defensives have lagged.

Several factors will determine whether EM outperformance can be sustained:

1. Earnings expectations

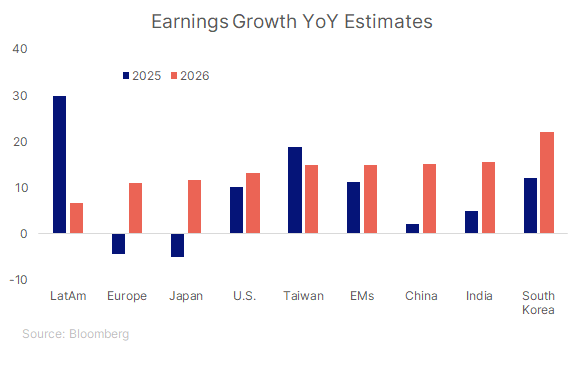

Bloomberg consensus shows EM maintaining a strong lead: +11.3% in 2025 and +15.0% in 2026, compared to lower U.S. and Europe outcomes. Sustained revision breadth will be important to watch.

2. Valuations and flows

EM equities continue to trade at a discount versus DMs (12.4x forward earnings, near the 25-year average). With global AUM share in EM down to 5% from 8% in 2017, the asset class remains under-owned and could benefit from rotation away from past winners into less favored markets.

3. Trajectory of the US dollar

The trajectory of the U.S. dollar remains critical. A softer or stable dollar historically supports EM performance and flows, while renewed strength could challenge returns. Many EMs also maintain positive real yields, providing scope for selective policy easing.

4. Domestic policy and reform momentum

Structural reforms—from capex incentives and friendshoring policies to improvements in market plumbing—can enhance medium-term earnings resilience. Markets such as India, Mexico, and parts of EMEA have policy stories that underpin longer-term investor interest.

5. Commodities and terms-of-trade

Resource-rich LatAm and EMEA benefit from elevated metals and energy cycles, while importers in Asia gain from softer energy prices. This divergence argues for active, region-specific allocation.

6. Sector leadership durability

AI-linked supply chains in North Asia, the EM consumer boom, and commodity cycles provide potential long-run drivers. Yet late-cycle rotation into defensives could alter the leadership balance.

7. Positioning and liquidity

Under-ownership suggests room for inflows, but flows can be lumpy and smaller EMs may see disproportionate swings on incremental moves. This creates both opportunity and volatility.

Overall, these factors suggest the rally can continue, but its sustainability will depend on earnings breadth, the dollar’s path, policy progress, and global risk appetite.

Explore our EM Stocks Shortlist here for more insights into specific market opportunities.

EM remains under-owned, with its global AUM share dropping to 5% from 8% in 2017, and stands to benefit from powerful rotation trades from past winners to less favored markets. Leadership has also shifted within EM—from regions with stellar returns in 2022–24, like Taiwan and India, to laggards such as Korea and LATAM now taking the lead. Each year tells a different story and EM companies face unique domestic and external challenges. A long-term and active approach, focusing on structural trends such as friendshoring, technological innovation and the EM consumer boom, remains crucial.

Emerging markets are enjoying a structural and cyclical tailwind, with earnings momentum and sector leadership in their favor. But investors should remain alert to macro headwinds such as tariffs and dollar swings that could test EM resilience into year-end.