Quarterly Outlook

Q3 Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

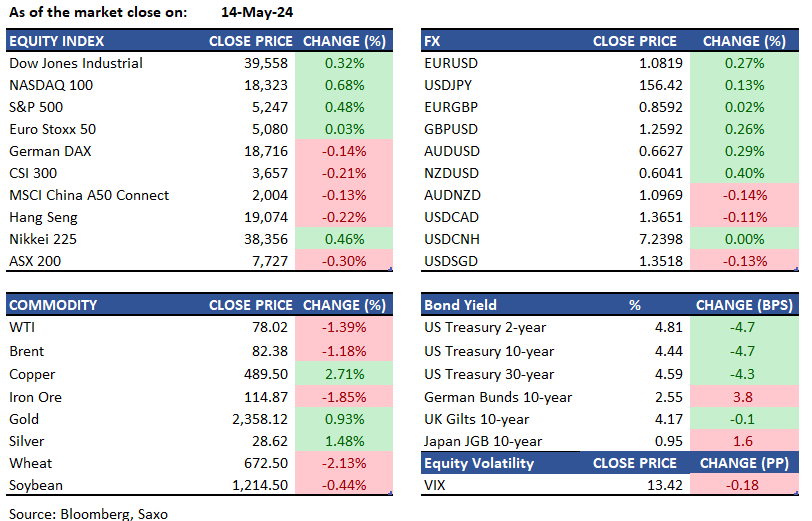

Equities: Major stock averages closed higher, with the Nasdaq approaching record levels, ahead of key inflation and retail sales data on Wednesday. Producer Price Index (PPI) showed a hotter reading on a month-over-month basis, but markets rebounded after year-over-year comparisons met expectations and prior month revisions were lower. Uncertainty remains about the Fed's next move on interest rates, and today's Consumer Price Index (CPI) report could determine whether U.S. stocks hit new highs or experience a reversal. Federal Reserve Chair Jerome Powell described the PPI report as more "mixed" than "hot" due to lower prior data revisions.

Alibaba (BABA) shares retreated 6.02% from their recent gains as Q1 profits declined despite increased sales, citing a net loss in investments due to mark-to-market changes. Sea (SE) reported Q1 revenues of $3.73 billion, exceeding estimates of $3.6 billion, and Ecommerce revenues of $2.75 billion, surpassing estimates of $2.49 billion. The company affirmed its outlook for FY24. Amazon (AMZN) shares fell after the announcement of the departure of the CEO of Amazon Web Services (AWS). Tencent' ADRs surged up to 5.9% following the Chinese internet giant's report of revenue and profitability surpassing estimates. The growth in online advertising and the increasing popularity of its short-form video offerings contributed to this boost. Sony (6758) announced a stock buyback and a 5-for-1 stock split alongside better-than-expected Q4 results, with a net profit of Y189.00 billion surpassing estimates of Y149.71 billion. Sony ADR shares up 6.67%.

FX: The DXY index saw sharp move higher on PPI beat, but the move reversed quickly and the USD ended the day lower ahead of US inflation release today. USDJPY extended its upside to 156.50, but the move in yen crosses was even more pronounced. NZDJPY moved to fresh highs of 94.65 since the first leg of intervention a few weeks back, while AUDJPY surged back towards 104. AUDUSD continued to rise towards recent resistance at 0.6640 despite Australia’s budget announcement yesterday not stoking inflation concerns. We discussed the tailwinds for AUD in this article. GBPUSD dropped sharply to lows of 1.2510 on dovish comments from BOE’s Chief Economist Pill who kept a June rate cut clearly on the table, but pair reversed and rose back to 1.2590 in the US session. EURUSD also back above 1.08.

Commodities: Oil prices increased as US stockpiles reportedly diminished and the market anticipates the International Energy Agency's report, which will provide insight on future market dynamics. After a significant drop due to high US inflation affecting demand expectations, West Texas Intermediate crude recovered to over $78 a barrel, while Brent settled near $82. The American Petroleum Institute indicated a substantial 3.1 million barrel decrease in US crude inventories, corroborating a reduction at the key Cushing storage hub. An upcoming report from the Paris-based IEA follows OPEC's recent findings that member countries surpassed their production cut quotas. Copper prices surged to $5.026 a pound, a 5.5% increase due to a short squeeze, nearly hitting March 2022's record. Active contracts traded at premium rates. Backwardation in Comex points to increasing supply pressures.Gold steadies near $2,356/oz after a near 1% rise as markets await US core CPI data. The metal has seen a modest range of trade recently after setting records in March and April.

Fixed income: Bond markets rebounded following the release of high producer price data, with investors looking towards an upcoming key inflation report. The anticipation of easing inflation bolsters the likelihood of Fed rate cuts. Initially reacting with a jump to 4.89%, two-year yields, highly responsive to Fed rate adjustments, quickly reversed the gains, settling near daily lows by late morning.Wednesday's Treasury one-year bill auction drew heavy interest from buyers as a more stable interest rate outlook from the Federal Reserve made the tenor appealing again. The Treasury sold $46 billion worth of 52-week bills at a rate of 4.895%, a slight decrease from the 4.915% seen in the previous month's sale.

Macro:

Macro events: Australia Wage Price Index, Eurozone Industrial Production, US CPI, US Retail Sales, US NAHB Housing Market Index, PBoC MLF

Earnings: Nubank, Hoya, Merck, Sumitomo Mitsui Financial, Recruit, Mizuho Financial Group, Cisco, Allianz, Compass, Experian, E.ON, Hapag-Lloyd, RWE, Commerzbank

News:

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.