Quarterly Outlook

Q3 Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: Fed Kashkari Speech, Fed Waller Speech, China September Trade

Earnings: Karo

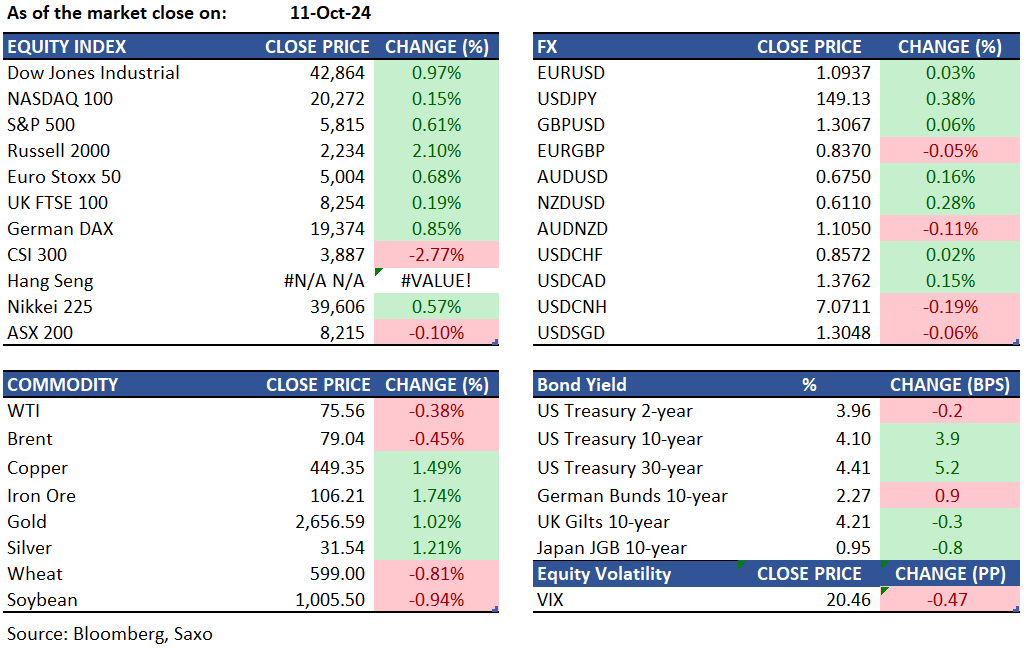

Equities: On Friday, US stocks surged, driven by robust earnings reports from major banks, setting an upbeat tone for the third-quarter earnings season. The S&P 500 and the Dow Jones both reached new peaks, rising 0.6% and 1%, respectively, thanks to strong earnings from JPMorgan (4.4%) and Wells Fargo (5.6%). Despite an 8.8% drop in Tesla shares due to a disappointing robotaxi event, the tech-centric Nasdaq still closed 0.1% higher. Economic data provided additional support, with steady wholesale inflation indicating progress in controlling inflation, although a spike in inflation on Wednesday kept some uncertainty regarding the Fed's future rate cuts. We will expect more earnings this week with more banks reporting tomorrow – Citi, Bank of America, Goldman Sachs and State Street. During a weekend briefing, China's Finance Ministry did not specify the total amount of fiscal stimulus, even though officials pledged additional support for the property sector and financially strapped local governments, which some markets participants deemed weaker than expected.

Fixed income: Treasuries ended Friday mixed, with the yield curve steepening for the second day. The 2s10s and 5s30s spreads neared session highs, aided by benign September PPI data and options flows targeting higher yields for longer tenors. Front-end yields fell by 1-2 basis points, while long-end yields rose by about 3 basis points, steepening the 2s10s and 5s30s curves by 3-4 basis points. The 10-year yield increased by 2 basis points to around 4.08%. The 2s10s spread peaked at 14.5 basis points, and the 5s30s spread exceeded 50 basis points, the widest since October 4. Canada’s yield curve bull-steepened after September employment data, maintaining expectations for Bank of Canada rate cuts. Around 38 basis points of cuts are priced in for the October 23 decision, with 75 basis points expected for the year’s remaining meetings. For the Federal Reserve, about 21 basis points of cuts are priced in for the November 7 decision, with 45 basis points expected for the year’s remaining meetings. Hedge funds reduced net long positions in SOFR futures, while asset managers remained bullish on ultra 10-year note futures.

Commodities: WTI crude oil futures dipped by 0.38% to $75.56 and Brent crude oil futures fell by 0.45% to $79.04 due to concerns over potential supply disruptions from the Middle East conflict and the impact of Hurricane Milton on Florida's fuel demand. Despite this, WTI crude marked its second consecutive weekly gain, surging over 10% since Iran's missile attack on Israel, driven by geopolitical tensions and fears of further supply issues. Hurricane Milton has temporarily boosted fuel demand in Florida, though long-term consumption may be affected by the storm's aftermath. Meanwhile, gold rose by 1.02% to $2,656 and silver increased by 1.21% to $31.54, extending gains as traders assess the Federal Reserve’s policy direction amidst mixed economic data. Copper futures also climbed 1.49% to $4.49 per pound, marking their second consecutive session of gains amid optimism that top consumer China will announce additional stimulus measures at a finance ministry press conference scheduled for Saturday.

FX: USD was flat on Friday as markets digested economic data supporting the Fed's current policy. U.S. producer prices were unchanged in September, hinting at a possible rate cut next month. Consumer prices rose 0.3%, and jobless claims surged due to Hurricane Helene, with next week's data to be affected by Hurricane Milton. USDJPY rose 0.35% to 149.12, DXY was flat at 102.91 after reaching its highest since mid-August. Markets predict a 91% chance of a 25-basis-point rate cut at the Fed's next meeting. The Australian dollar gained 0.22% to $0.6753, and the New Zealand dollar was at $0.611 after a rate cut.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.