Macro: It’s all about elections and keeping status quo

Markets are driven by election optimism, overshadowing growing debt and liquidity concerns. The 2024 elections loom large, but economic fundamentals and debt issues warrant cautious investment.

Senior Investment Editor

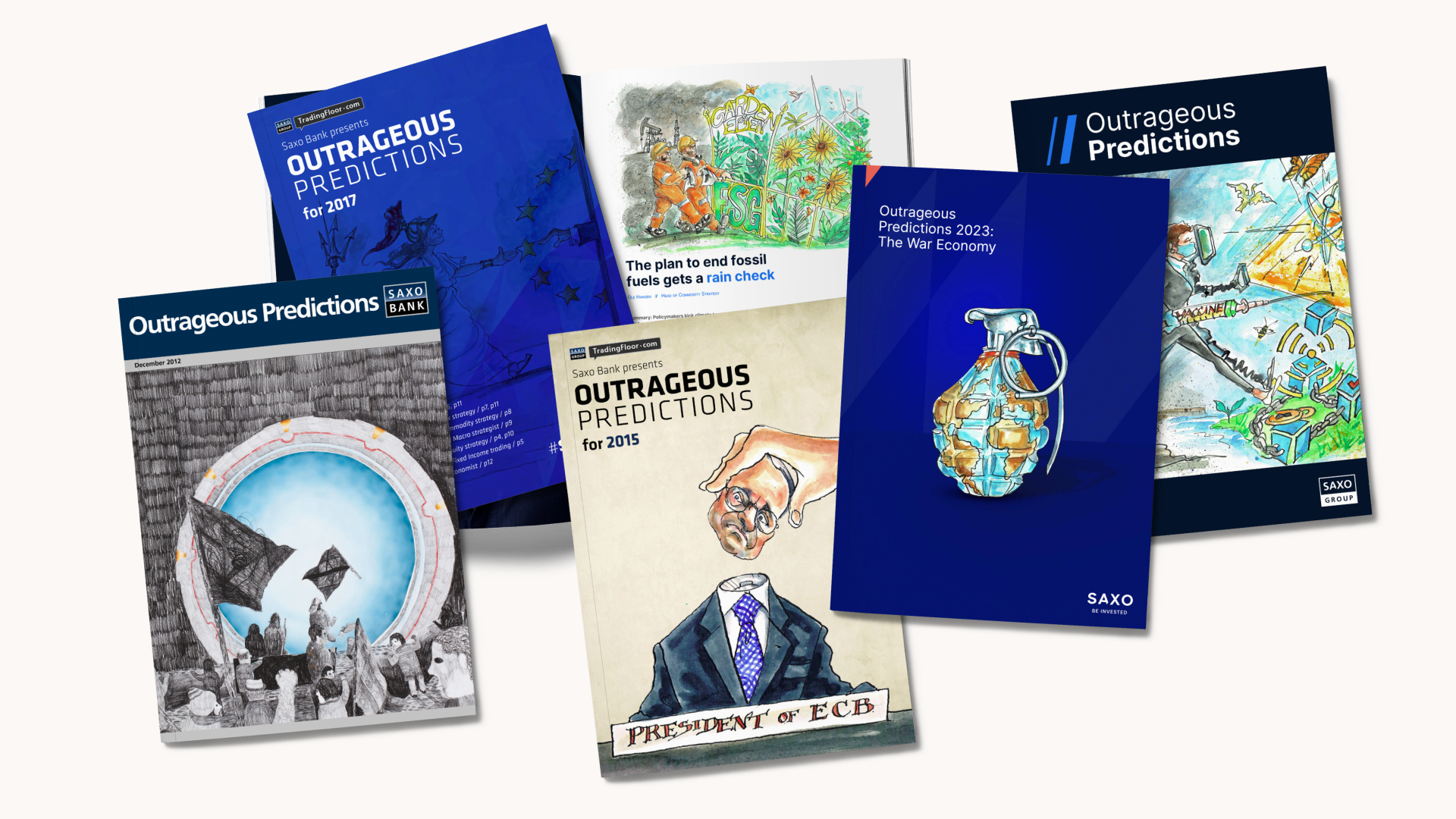

Summary: Saxo's annual Outrageous Predictions are never about being right - but they are always about being outrageous. Still, sometimes the world catches up and becomes just the right amount of outrageous for the predictions to become true. We've checked our archives to find out the Outrageous Predictions that were much closer to the truth than anticipated.

Reviewing last year's predictions, it's evident that they were more outrageous than they were correct. A fan favourite was Market Strategist Charu Chanana's prediction about a country agreeing to ban all meat production by 2030. It didn't turn out that way and it would be a stretch to say that it was close. But, at a supranational level, meat, as an important part of fighting climate change, was spotted on the agenda at the UN-arranged climate change-focused COP28 in the latter part of the year. Here, the UN was, in time of writing, expected to publish a road map for global food systems with a focus on lowering meat consumption.

"While we didn't see any country banning meat production, we did see a growing recognition that meat (and the consumption of it) needs to be in focus when talking about climate change. So, picking a topic that turns out to get attention and taking it a step further than reality is really what this exercise is about," says Chanana.

As we headed into 2022, Ole S. Hansen, Head of Commodity Strategy, wrote that policymakers would kick climate targets down the road and support fossil fuel investment to fight inflation and the risk of social unrest, while rethinking the path to a low-carbon future.

The overarching prediction came to fruition, but it was regrettably fueled by the unforeseen invasion of Ukraine by Russia.

"Little did we know last November that the world was galloping into an energy crisis triggered by Russia’s war in Ukraine," says Ole S. Hansen, Head of Commodity Strategy, who explains how he then caught on to the idea that fossil fuels would become relevant again in 2022: "Lack of investments and an increasingly urgent need to support gas over coal led us to come up with this idea, which basically envisaged a more investor friendly environment for (up until then) shamed investment in so-called 'dirty' energy production. A move that led to the decision by the EU to classify gas and nuclear as green investments," he says.

"We did not get a 25% drop in a single 1987-like event, but we did get two dramatic events in 2018 that vindicated our point," says Peter Garnry, Head of SaxoStrats.

He further explains how the prediction came about: "We got the idea about this Outrageous Prediction in late 2017, as the year was about to end with astonishingly low volatility and Bitcoin had gone from just below $1,000 in late 2016 to around USD 10,000 in November 2017 (Bitcoin eventually rose to almost USD 20,000 before year end). Everyone speculated in Bitcoin and selling volatility in currencies and equities was heralded as easy predictable money. That's where we got this super awkward feeling that the entire euphoria and these types of positions can have dramatic outcomes if conditions change even the slightest."

Garnry says that the volatility kicked in during February and ended in dramatic fashion over Christmas: "The ‘Volmageddon’ event in February 2018 almost completely wiped out short volatility funds including some famous ETFs in these strategies as the VIX Index exploded from 13.64 to 50.30 in just two trading sessions. The event changed the short volatility complex in the subsequent years. Later in 2018, the market was trying to tell the Fed that it was doing a policy mistake by hiking its policy rates because the economy was deteriorating. It led to a selloff of 20% from the peak in October to the intraday bottom on 26 December 2018 with the most dramatic trading sessions happening over the Christmas holiday period when liquidity was drying up. Dramatic events that set the stage for the crazy bull-run in 2019 as investors again forgot everything about risk."

In the Outrageous Predictions for 2015, our SaxoStrats wrote that the UK Independence Party (UKIP) would win 25% of the national vote in Britain’s general election on 7 May, 2015, sensationally becoming the third largest party in parliament. UKIP would then join David Cameron’s Conservatives in a coalition government and call for the planned referendum on Britain’s membership of the EU in 2017. As a result, UK government debt suffers a sharp rise in yields.

The timing was a bit off, but the circumstances around it were pretty accurate. “We had a very strong sense that ‘protest votes’ would be coming both in the US election and also ultimately in a vote on Brexit” said Steen Jakobsen, CIO at Saxo. “We, to some extent, correctly talked about the ‘social-contract being broken’ – meaning society no longer benefitted as a whole from monetary policy, which created an increased gap in equality.

“This call was too early, but the context and reasoning was spot on. The split in the Tory Party could not be healed and the modus operandi of ‘Talking down to the voters’ was a blatant mistake, which we used for this call,” Jakobsen said.

"Our $1,200 call, at the time of writing, signaled a one-third drop in the price," says Head of Commodity Strategy, Ole S. Hansen who, in 2013, had the first correct Outrageous Prediction.

Here's what he had to say about it: "Gold corrected to and actually went below USD 1,200 per ounce in 2013, as investors increasingly turned their attention to stocks and the dollar. A major trigger was the April 2013 break below key support at $1,525 - a move that in our mind raised the risk of a bear market taking the price down towards $1,100," says Hansen.