Quarterly Outlook

Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: Bank of England, Norges Bank, Australian Employment (Aug), US Initial Jobless Claims (w/e 14th Aug), Philadelphia Fed (Sep), Existing Home Sales (Aug)

Earnings: Factset, Endava, MoneyHero, FedEx, Lennar

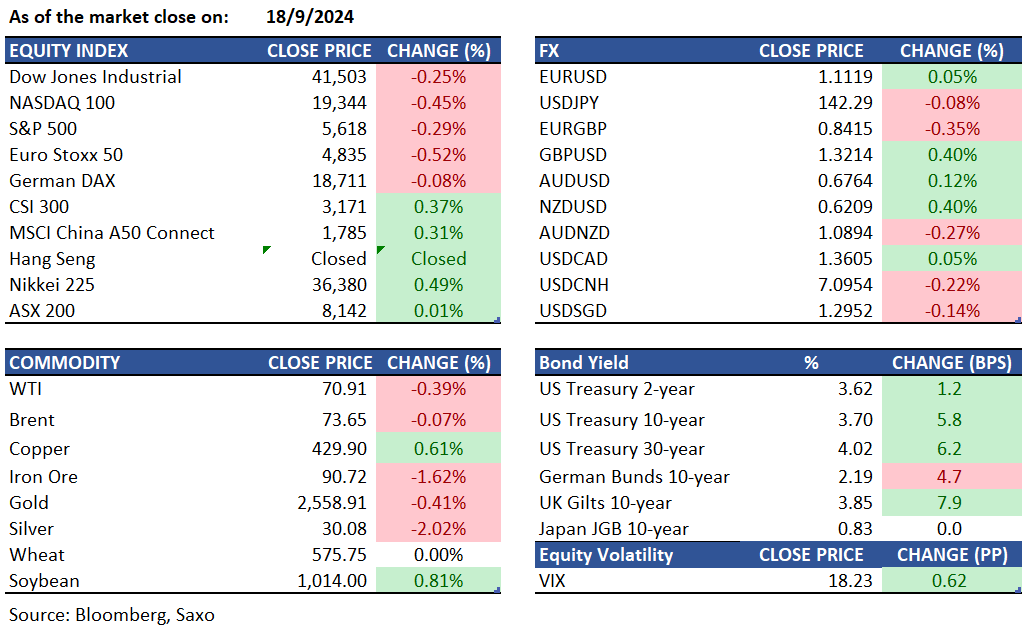

Equities: US stocks ended a volatile session lower following the Fed's unexpected 50bps rate cut, its first since 2020 and double the anticipated 25bps. The S&P 500 and Nasdaq 100 each dropped 0.3%, while the Dow lost 102 points, even though it had gained over 375 points earlier in the day. Initial rallies in equities and bonds reversed after Fed Chair Powell reiterated the strength of the US economy and indicated no urgency for further easing, clarifying that today's substantial cut should not set a precedent. Despite this, FOMC projections suggest a total of 100bps in rate cuts this year, implying further 25bps reductions at each meeting in November and December. Among the large caps, Nvidia, Microsoft, Oracle, and AMD declined by over 1%, whereas Apple rose 1.8% and Meta hovered just above flat.

Fixed income: Treasuries couldn't maintain the gains from the Fed's unexpected 50 basis point rate cut, although the front end of the yield curve outperformed, making the curve steeper. Most gains were reversed during Fed Chair Powell’s press conference, where he clarified that half-point cuts shouldn't be the new norm. Front-end yields had risen by about 1 basis point after recovering from an almost 7 basis point drop, while longer-dated yields were up by 2 to 6 basis points. The curve-steepening move widened the 2s10s and 5s30s spreads by approximately 5 and 3 basis points, respectively. Fed-dated OIS contracts priced in around 70 basis points of cuts over the two remaining meetings this year, indicating at least one more half-point reduction. SOFR options activity suggested the unwinding of dovish bets as Powell dismissed extended half-point rate cuts. In July, total foreign holdings of US Treasuries rose for the third consecutive month, despite slight decreases in China’s and Japan’s stockpiles.

Commodities: Oil prices fell, with U.S. WTI crude down 0.39% to $70.91 per barrel and Brent crude down $0.05 to $73.65 per barrel, following an API report of rising U.S. crude and fuel inventories. The U.S. plans to buy up to 6 million barrels of oil to replenish the Strategic Petroleum Reserve. U.S. crude stocks rose by 1.96 million barrels, while gasoline and distillate inventories also increased. EIA data showed a 1.6 million barrel decrease in crude stocks, a 69,000 barrel increase in gasoline stocks, and a 125,000 barrel rise in distillate stocks. Gold prices rose $6.20 to $2,598.60, with futures hitting record highs post-FOMC rate cut before reversing in volatile trading. Gold prices dropped 0.41% to $2,558 after nearing a record high of $2,600, as investors reacted to the latest Federal Reserve decision. Further, silver fell 2.02% to $30.08.

FX: The forex markets saw choppy trading with the US dollar slipping significantly initially on the Fed’s jumbo rate cut but retracing the losses quickly after as the vote split and Powell’s comments weakened the dovish impact. In early Asian morning, the US dollar continues to trade higher, with Japanese yen weakening past the 143 level against the USD for the first time in ten days. Focus will turn to Bank of Japan announcement due on Friday where plans for further hiking could bring another leg of support for the yen. Kiwi dollar and British pound outperformed despite USD gains, given the extensive emphasis on a soft-landing target, and the latter faces its central bank decision due which could further reaffirm its resilience. Australian dollar also closed in gains and Aussie employment data is on the radar in the day ahead.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.

Q3 Macro Outlook: Less chaos, and hopefully a bit more clarity