Quarterly Outlook

Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: Spanish Flash CPI (Aug), German State CPIs (Aug), EZ Sentiment Survey (Aug), US GDP (2nd) and PCE (Q2), US Initial Jobless Claims

Earnings: Marvell, Lululemon, Autodesk, Dell, Best Buy, MongoDB

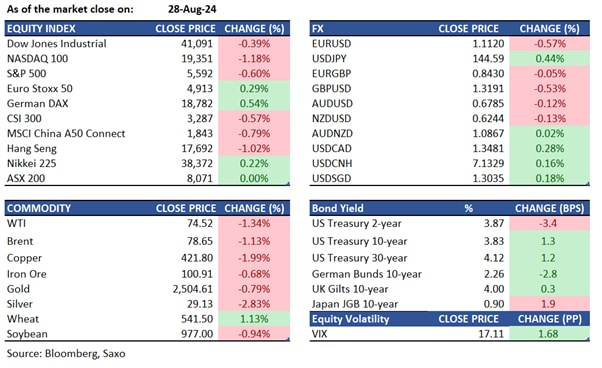

Equities: The S&P 500 fell 0.6%, the Nasdaq dropped 1.1%, and the Dow lost 159 points. Most sectors ended in the red, with tech leading the decline due to a 2.1% drop. The consumer discretionary sector also lagged, with Tesla and Amazon each falling over 1.3%. Super Micro Computer plunged 19% after delaying its annual report, while Nordstrom rose 4.2% on strong Q2 earnings, and Ambarella jumped 10.6% on robust Q3 revenue guidance. Nvidia shares fell more than 7% in extended trading despite surpassing revenue and earnings expectations, as its sales outlook for the current quarter disappointed investors. CrowdStrike dropped 2.6% after lowering its full-year outlook, while Salesforce gained 4.2% on positive quarterly results.

Fixed income: Treasury yields ended the day near session highs, cheaper by up to 2 basis points across the long end of the curve, which slightly underperformed. There was no significant catalyst for the price action during the US session, following a bund-led rally in the early London session that supported Treasuries, along with weaker oil prices. Treasuries edged lower ahead of Thursday’s $44 billion 7-year note auction. Yields were cheaper by 2 basis points from the 10-year sector out to the long end of the curve. The German curve bull flattened, with long-end yields closing richer by around 3.5 basis points, buoyed by Austria’s decision to cancel a plan for a syndicated tap of a 2086 bond. The Treasury's 5-year note auction was solid, with the auction tailing the WI by about 0.3 basis points. The 13.2% primary dealer award was slightly lower than previous auctions, as the indirect award increased to 70.5%, offsetting a drop in the direct award to 16.3%. US Treasury futures traded in a narrow range following Nvidia’s earnings and ahead of the second reading of US GDP. During Asian hours, Japan and New Zealand will both auction bonds. Japan’s Ministry of Finance will auction ¥2.6 trillion of new September 2026 notes.

Commodities: WTI crude oil futures declined by 1.3% to $74.50, while Brent crude also decreased by 1.13% to $78.65. Despite refineries increasing capacity utilization, EIA crude oil inventories fell less than expected, with supply concerns persisting into the Fall. Geopolitical issues continue to provide some support. Gold fell by 0.59% to $2,537.80, while silver dropped to around $29.50 in late August, retreating from six-week highs as the dollar strengthened ahead of key US inflation data. This data could impact the Federal Reserve's interest rate decisions. The Gold Fear and Greed Index remains in the Greed category, but a stronger US Dollar and a slight rise in rates prompted some profit-taking.

FX: The US dollar saw a strong recovery as markets were in risk-off mood ahead of chip giant Nvidia’s earnings results after-market. Month-end may also have contributed to some USD strength. Swiss franc outperformed on haven demand, but it was still down against the US dollar. The other safe-haven Japanese yen saw a steeper decline, but was in gains earlier in the Asian session. The Australian dollar was also one of the outperformers with Australia’s July inflation report yesterday potentially ruling out an RBA pivot in September before more key quarterly inflation data is reported in October. We discussed the impact of the Aussie inflation report on Australian dollar in this article. The Canadian dollar also reversed lower from over five-month highs, as we discussed in this article that the rally remains at odds with fundamentals. The euro had most to lose on a stronger US dollar after its recent gains, and focus will be on CPI from Spain and German states ahead of the Eurozone print due on Friday.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.

Q3 Macro Outlook: Less chaos, and hopefully a bit more clarity