Quarterly Outlook

Q3 Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Sales Trader

Summary: Apple has faced challenges that have contributed to its stock trading sideways. Despite declining iPhone demand and regulatory scrutiny, investors holding a long-term stake in Apple can consider selling covered calls to earn premiums and navigate stagnant markets. While this strategy offers advantages such as passive income, it's important to be aware of potential risks, including capping the stock's upside potential.

Why has Apple been trading sideways?

Apple, formerly the uncontested leader of the technology realm, is now encountering challenges from various directions. There has been a global decline in demand for the iPhone, which has facilitated the entry of Chinese brands into the market. The App Store, a significant revenue source for Apple, is currently the subject of a lawsuit filed by the Department of Justice, and the company is facing regulatory scrutiny in Europe.

Additionally, Apple recently terminated a high-profile EV car project that was once touted as a major upcoming venture for the company. As a result of these developments, the company's valuation has suffered. Despite reaching a historic $3 trillion in 2023, its market capitalization plummeted by hundreds of billions of dollars in early 2024, allowing Microsoft Corp. to surpass Apple as the world's most valuable tech company. These are the various challenges that Apple is currently confronting on a global scale.

What can you do?

Investors who have a long-term stake in Apple and aim to sell the shares at a higher price, even in a sideways or downward market, may opt to sell call options on Apple. This strategy allows them to earn premiums from the call options, thereby generating extra income while awaiting a rise in Apple's share price to your desired target.

Steps:

1. With Apple’s stock price at $165.84 on 22 April 2024, sell a call option on Apple with a $170 strike price (if you are comfortable selling your apple shares at $170) for 2-week expiry (10 days). You receive a total premium of $222 ($2.22 x 100 shares).

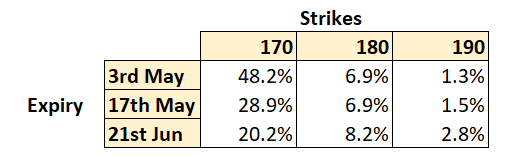

2.This is annualized yield of 48.2% (2.22/165.84) x (360/10).

3. If Apple’s price falls below $170 (strike price of the call option) at expiry, the option may expire worthless, and the investor retains the premium.

4. If Apple’s price rises above $170 strike price, the investor may be obliged to sell the Apple share at $170, but the investor will still retain the option premium.

When comparing it to a longer maturity, you can observe how this alters the premium you receive and the distance over which you will be able to set the strike.

Advantages of covered calls

1. Generates passive income. Selling a covered call generates an income via premiums that can supplement the overall return of a portfolio.

2. Relatively low risk. As the risk of being short a call is covered with your stock position, this is a relatively low risk way to trade options.

3. No extra margin required to sell covered calls. As you hold the underlying stock for delivery, there is no extra margin required to sell the same number of covered calls at Saxo.

Risks of trading covered calls

1. Capping your stock’s upside potential. One key risk is the loss of opportunity to profit from your stock’s potential upside above the call option’s strike price.

2. Risk of using covered calls as a proxy for take profit orders: In the example above, it is possible that the stock trades well above $170 through the course of the option but on expiry falls back below $165. Without the option, the investor might have booked the profit at $170 but because the stock was covered by call options, the investor might have waited out until expiry.