Quarterly Outlook

Q3 Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Head of Commodity Strategy

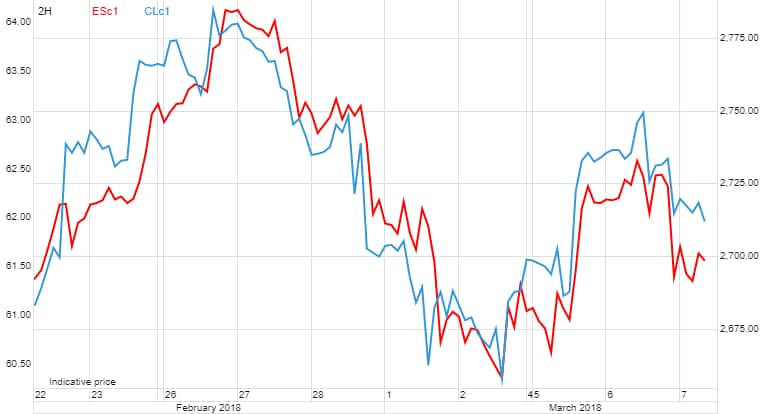

Crude oil has settled into a range as the price ebbs and flows with developments in global stocks. While oil fundamentals have softened, speculators maintain a strong belief in higher prices. This belief risks being tested should US president Donald Trump go ahead with planned tariffs on steel and aluminium as it raises the risk of a trade war that would damage growth and punish stocks.

During the past few weeks crude oil has been focusing more on yo-yoing stocks than oil fundamentals, which have been showing signs of weakening.

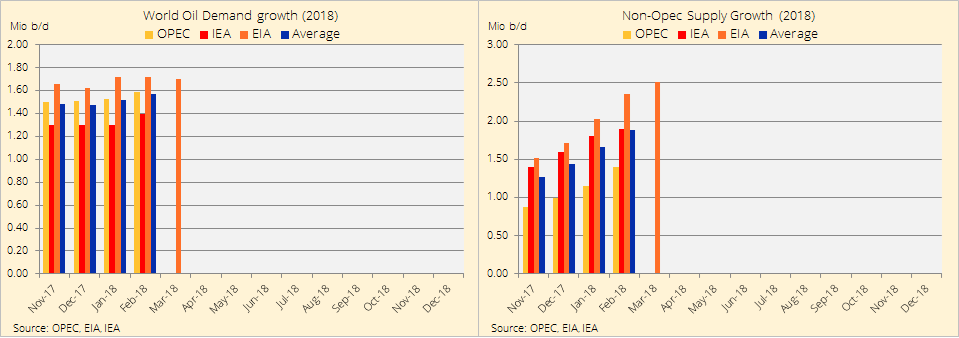

Strong non-Opec oil production growth looks set to challenge Opec and Russia's ability to maintain price stability, at least in the short term. In its latest Short Term Energy Outlook the Energy Information Administration sees US oil production averaging 10.7 million barrels/day in 2018, an increase of 1.4 million b/d from 2017.

The International Energy Agency added to the unease with its Oil 2018 report , which said that oil production growth from the US, Brazil, Canada, and Norway would more than meet global oil demand growth through 2020.

An escalating trade war should Trump decides to go ahead with his tariffs and other measures risks putting global growth projections in jeopardy and crude oil demand growth may suffer as a consequence.

The EIA continues to raise 2018 non-Opec supply growth while keeping demand growth steady. Monthly reports from Opec and IEA are due on March 14 and 15.

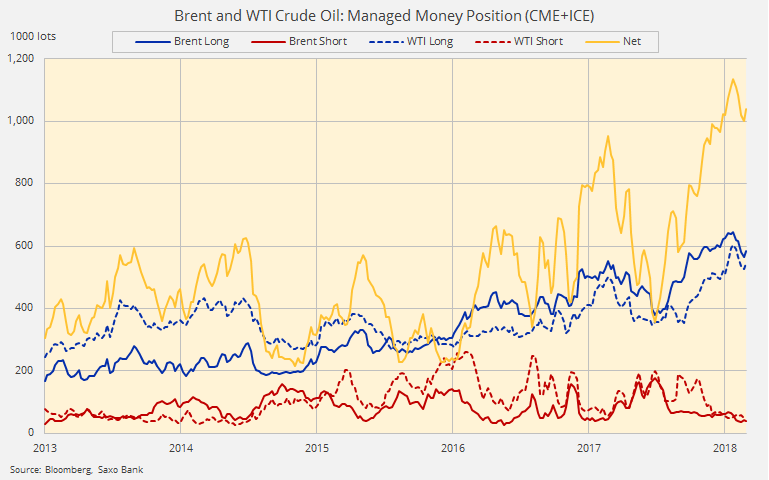

Last week, funds increased the combined long oil bet in WTI and Brent for the first time in five weeks by 36,000 lots to 1 million lots. This after cutting it by a total of 133,000 lots during the previous four weeks. The dwindling short base led to another rise in the long/short ratio to a record 12.6. This highlights a continued downside risk to oil should the technical and/or fundamental outlook turn less favourable.

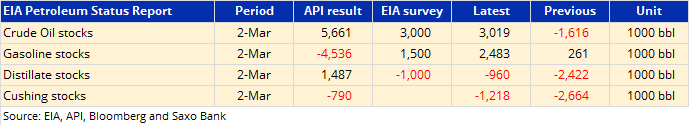

The overnight weakness in crude oil was driven by the double blow of a bigger-than-expected crude oil inventory build being reported by the API and stock market weakness following the news of Gary Cohn's departure from the White House. His exit is seen as a victory for figures within Trump's inner circle who advocate against free trade and globalisation.

Given the recent resilience among speculative investors, they are unlikely to worry about a deeper correction as long as prices stay above $61/b on Brent crude oil and $57.50/b on WTI crude. These levels represent the 38.2% correction of the June-January rally and while above the current price action, will be viewed only as a weak correction within a strong uptrend.

For now WTI crude oil has settled into a $60 to $65/b range with outside market events providing most of the input for daily price swings.

Q3 Macro Outlook: Less chaos, and hopefully a bit more clarity