Saxo Stronghold EUR – Q1 2020 commentary

| Instruments traded | ETFs |

| Asset classes | Global equities, bonds and alternatives |

| Investment style | Quantitative portfolio management |

| Quarterly return | -8.6% (net of fees) |

| Annualised volatility (since inception) | 5.3% |

Market overview

The first quarter of 2020 will go into the history books as one of the most dramatic quarters for financial markets. The year started with markets pulling ahead until the news broke that a new SARS-CoV-2 coronavirus (COVID-19) had been observed in China. Initially, as market participants thought that it would remain a Chinese issue, global equities went to new highs. Eventually, the virus spread globally and intensified, forcing governments to lock down societies and the financial markets went into an extreme volatile regime eclipsing the 2008 meltdown.

Global equities declined 34% from the peak in February to the lows in March. Interest rates became extremely volatile as relative arbitrage trades caused margin calls. Liquidity disappeared across many markets and the European ETF market became dysfunctional with wide bid-ask spreads dramatically increasing the trading costs for a strategy such as Stronghold.

The Stronghold allocation model aggressively cut risk during the quarter, ending the quarter with 80% exposure to actual cash and the model’s synthetic cash positions (0-1Y and 1-3Y government bonds). Due to the speed of the declines and the dislocation in European ETF markets, the portfolio incurred higher trading costs and the portfolio is down 8.6% for the quarter.

Global equities are up 23% since the lows and credit bonds are almost unchanged as the Fed launched a historic policy program of buying secondary credit bonds, including fallen angels (bonds that have been downgraded into junk status). The large swings and especially the rebound have not benefitted Stronghold much, as the risk limit for taking further risk has been maximised for now.

Current projections are suggesting the US economy could see its biggest quarterly decline in economic activity ever, eclipsing the 1930s depression, and the unemployment rate is expected to hit somewhere between 20% and 30%. With unprecedented economic shocks and unprecedented policy response from fiscal and monetary authorities, nobody really knows what the future will look like. In the event that the recent rally in equities is unwound as the currently expected V-shape recovery does not materialise, then the Stronghold strategy should be well positioned.

Portfolio performance

| Jan | 0.6% |

| Feb | -2.8% |

| Mar | -6.5% |

| First Quarter 2020 - total | -8.6% |

| Inception (01.07.2017) | -0.5% |

- The best performing position this quarter has been the exposure to global minimum volatility equities. When the position was closed in the middle of February, it had contributed with +1.4%-pts.

- The exposure to global momentum equities was the worst position of the quarter. Even though the exposures were reduced to zero at the beginning of March, their combined contribution to the portfolio return was -3%-pts.

Portfolio changes

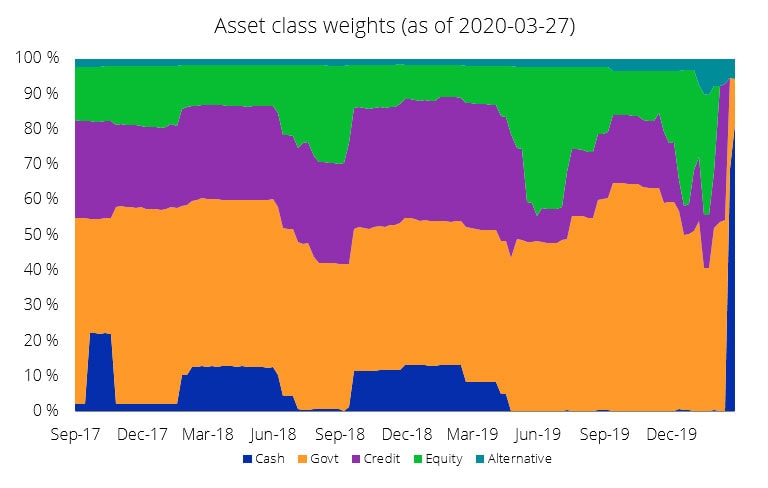

During the first quarter of 2020, the Stronghold EUR portfolio drastically decreased its exposure to equities and credit bonds to keep the expected portfolio risk low. The shift in asset classes is illustrated in the figure below.

Two new assets were added to the portfolio universe this quarter – Physical Gold and 0-1 year government bonds. Gold was included as a diversification play for the portfolio in these turbulent markets. Due to the significant price movements in the government bond ETFs, the 0-1 year government bond exposure was introduced to ensure that the expected portfolio risk could be kept within the strategy limits.

Portfolio weights (%)

| Asset class | Asset sub-class | As of 03-01-2020 | As of 31-03-2020 |

| Alternative | Global Properties Listed Private Equity 1.9 0.0 Physical Gold | 2.8 1.9 0.0 0.0 | 0.0 0.0 5.9 |

| Credit | EM Bonds (USD)* Global Corp Bonds* Euro High Yield Bonds Euro Covered Bonds | 0.0 1.5 5.2 0.0 | 0.0 0.0 0.0 0.0 |

| Equity | DM Equities* DM Momentum DM Minimum Volatility EM Equities Europe Small Cap | 2.2 0.0 23.2 10.0 9.9 | 0.0 0.0 0.0 0.0 0.0 |

| Government | Euro Govt Bonds 0-1Y Euro Govt Bonds 1-3Y Global Infl-linked Bonds* Global Govt Bonds 7-10Y* | 0.0 0.0 22.2 20.6 | 19.3 61.3 0.0 12.7 |

| Cash | Cash | 0.6 | 0.8 |

Outlook

Consensus macro economists are expecting the US economy to decline 2.5% q/q annualised in Q1 and then decline a staggering 25.1% q/q annualised, but then resume growth in Q3 and fully lost GDP by eight quarters. Our guess is that the contraction will be even worse and that the recovery will be slower, as it will turn out to be more difficult to open up society and get back to the same activity levels.

One instrument to monitor future market expectations is S&P 500 dividend futures, where market participants are betting on the amount of dividends S&P 500 companies will pay out in the future. Currently, the market is pricing in a 30% decline in dividends by 2021 and that corporate profitability will not recover until 2027. Financials continue to underperform other sectors and as the real economy (small and medium-sized businesses employing 80% of the labor force) sits on the banks’ balance sheet, the market is not optimistic on the real economy. Meanwhile, the volatility market (VIX spot and the futures curve) suggest elevated volatility throughout 2020.

The outlook is very uncertain at this point, and while Stronghold has not participated in the recent rally in equities, we have a good feeling about the current exposure as the capital is protected against adverse developments which could come with a second wave of the COVID-19 outbreak.