Balanced ETF portfolios USD Q4 2020 commentary

| Asset classes | Stocks (developed and emerging equity), bonds, non-traditional |

| Instruments | ETFs |

| Investment style | Macro, diversified investment focus |

| Quarterly return (net of fees) | |

| Defensive | 3.3% |

| Moderate | 8.4% |

| Aggressive | 10.4% |

Market overview

Global equities finished the year on a strong footing amidst positive vaccine news, and agreements regarding a Brexit deal and a pandemic relief plan in the US. Developed markets were up 3.5% in local currency terms and 4.3% in USD terms. Emerging markets gained 6.1% in local currency terms and 7.4% in USD terms. The USD ended the month down 2.1% as investors expect the Fed to keep interest rates low. Moreover, markets are optimistic regarding a recovery from the COVID-19 pandemic, which could make the greenback a laggard against other major currencies.

Amidst rising COVID-19 cases in the US, the composite PMI for December (an indicator of economic health for manufacturing and service sectors) came in at 55.3, below November’s 58.6. The latest reading signaled the slowest upturn in business activity for three months due to a slowdown in new business growth. On the political front, US lawmakers finally agreed on a pandemic relief plan that will extend many of the CARES support measures such as renewing direct payments to households and generous unemployment benefits. EU governments found a compromise regarding the EU’s recovery fund and seven-year budget. This paves the way for a EUR 1.8 trillion financial support package if ratified by national parliaments of the 27 member states. Services remained the principal drag on economic output for the eurozone while manufacturing continued to expand over the month.

On the equity side, the emerging markets performed the best. Asia ex Japan was the key driver and supported by China’s economic rebound and we saw generally strong performance across the global emerging markets. We can generally say that countries with a good handle of the pandemic were rewarded.

Within fixed income, 10-year government bond performance was muted in developed regions except for the US, UK and Italy. Hopes of economic recovery and an agreement regarding a stimulus deal led treasury yields to move modestly higher. With more stringent lockdown measures imposed in the UK, gilt yields declined as economic uncertainty heightened for the nation. Benchmark 10-year yields climbed by 7bps to 0.91% in the US, while they declined 11bps in the UK to 0.2% and 1bp in Japan to 0.02%. Bund yields remained flat over the month at -0.58%. The oil rally triggered by positive vaccine news continued into December. The commodity (Brent) ended the month up 8.8% at $52/barrel. Growing worries about the new strain of the coronavirus have boosted the appeal of safe havens such as gold. Furthermore, the weak dollar bolstered the demand for the precious metal. Gold finished the year strong, returning 24.8% YTD and 7% over December, ending the month at $1898/ ounce.

Portfolio performance

| Returns net of fees | Defensive | Moderate | Aggressive |

| Oct | -1.1% | -1.8% | -2.4% |

| Nov | 2.9% | 7.0% | 8.7% |

| Dec | 1.6% | 3.2% | 4.0% |

| 2020 | 7.2% | 10.0% | 9.8% |

| Since Inception (Feb 2017) | 20.0% | 29.4% | 38.9% |

The multi asset portfolios produced positive returns in Q4 but suffered in October.

Looking at October performance, all equity positions contributed negatively to performance. In absolute terms, allocations to US equity were most detrimental, giving up some of the gains made in the last months. This was followed by Japanese and UK equity. From a relative standpoint, the underweight to Europe and the UK paid off but the investment management team (the “team”) missed out on the positive performance in emerging market.

On the fixed income side, absolute contribution was rather mixed and generally favored exposures with shorter duration. Allocations to interest rate hedged credit and mortgage backed securities contributed, and an overweight to the former one was supportive. However, treasuries suffered across the board with long-dated tickers giving up the most.

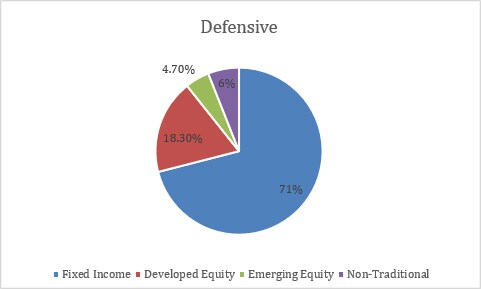

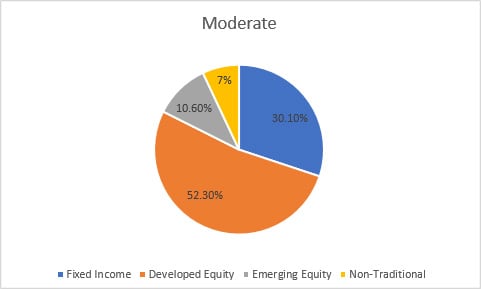

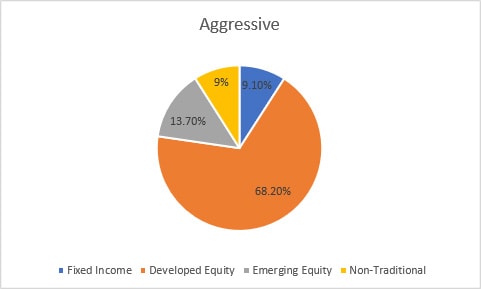

Portfolio Allocation and top portfolio holdings (as of 23 Nov 2020)

Rebalance Commentary and Outlook

Following the US election results and the promising announcements about COVID vaccines, sentiment signals have broadly turned positive and the investment management team (the “team”) is more optimistic on equities over fixed income. Therefore, the equity allocation was increased and hence the active risk of the model portfolios.

Within equities, the team continues its overweight in US equities which is driven by strong earnings growth forecast. The team increases allocation in emerging market equities because of decent earnings growth and improved valuation. The dollar depreciation will also be supportive for EM equities. The team is reducing the underweight to European equities. Although earning growth remains weak, valuation has improved significantly. The team believes that the impact from COVID will start to diminish in developed markets with expectations about vaccine availability at some point next year. Allocations to Japanese equities is reduced as valuation has deteriorated. The team is reducing the allocation to minimum volatility in the aggressive model to increase equity beta.

Within fixed income, the model duration is cut by about 0.4 years as yields are expected to rise (which is negative for bond performance). With a steepening yield curve, the team is reducing the allocation in the longer duration US Treasury. The team also reduces the allocation to US investment grade as credit spreads revert to their pre-COVID level, making the current valuation expensive. Spread momentum continued to be positive for high yield, therefore, and the allocation is being kept.

Within the alternative sleeve, the team is adding another 1% to REITS. REITS had underperformed YTD, but the positive announcements about COVID vaccines could be supportive for the recovery of the sector. The gold allocation is reduced by 1% to fund the equity overweight.