Outrageous Predictions

A Fortune 500 company names an AI model as CEO

Charu Chanana

Chief Investment Strategist

Peter Garnry

Chief Investment Strategist

Summary: The world needs a weaker USD, and the Fed will provide one over time. This speaks in favour of European equities.

Q2 2020 was surely the “rebirth” of economies on a new platform of state capitalism, funded by very supportive monetary policies melting fiscal and monetary institutions closer to each other in the name of crisis management. All-out stimulus to fight the biggest economic contraction since the 1930s has fostered animal spirits and speculation on a scale we have not seen since 2000, maybe even since the roaring 1920s.

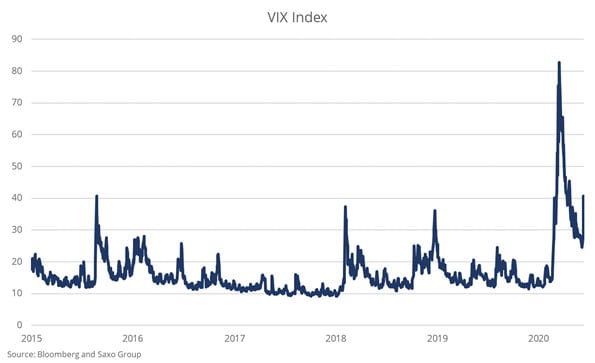

However, as we write this outlook, the S&P 500 has just had its worst session since March and the VIX has exploded higher, so the impact from Covid-19 is far from over. Our economy and financial system remain very fragile.

It’s generally accepted that the 22 level is the VIX’s long-term equilibrium. In other words, that’s the level where the equity market flips from being bullish (positive returns and low volatility) to bearish (negative returns and high volatility). The VIX broke above 22 on 24 February and never dropped back below – despite the impressive rally in equities.

While you could argue, as some have done, that we were never in a bear market because the decline was arrested so fast, the implied volatility market suggests we are still structurally bearish. History suggests that this period offers negative equity returns, alongside high volatility.

As we enter Q3, markets remain fragile. The VIX is indicating a very volatile summer, where Q2 earnings releases will finally reveal the real damage to the corporate sector and potentially give us a rough sketch of what’s ahead.

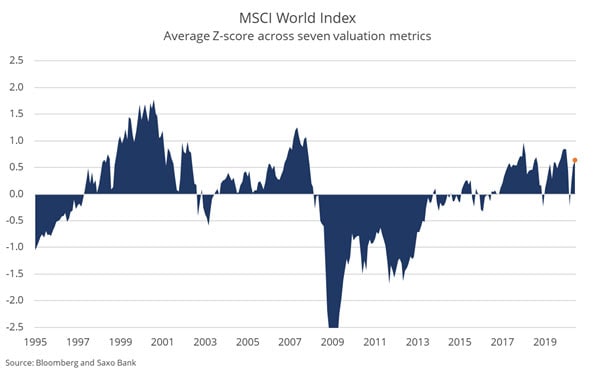

Valuations have bounced back to levels where the risk-reward ratio is not attractive in a historical context. History suggests that there is a 33% probability, at current valuation levels, that the international equity investor will experience negative real rate return over the next 10 years.

Could valuations go even higher, proving this relationship wrong? Absolutely, and with potential yield-curve control by the Fed coming the game for equities could change. In a recent research note we showed that yield-curve control was very positive for US equities in the period 1942-1951, while it has been bad for Japanese equities in the period since September 2016. The main difference between the two periods is that the US ran massive fiscal deficits while Japan’s government actually tightened its fiscal impulse into the economy. If yield-curve control comes with large fiscal deficits it could be very positive for equities, especially emerging market stocks that are reliant on low USD rates and good financial conditions.

While yield-curve control could offer the cure to high nominal growth and high inflation – by deleveraging the public-debt-to-GDP ratio – it could also go awfully wrong if done at very low interest rate levels. A 2018 study by BIS showed how the percentage of global listed companies becoming “zombies” has risen dramatically since the early 1990s, especially since the Great Financial Crisis. It seems the price of low rates, which lower the financial pressure on companies, is unproductive use of capital and massive misallocation of capital and labour. Not a good recipe for the future.

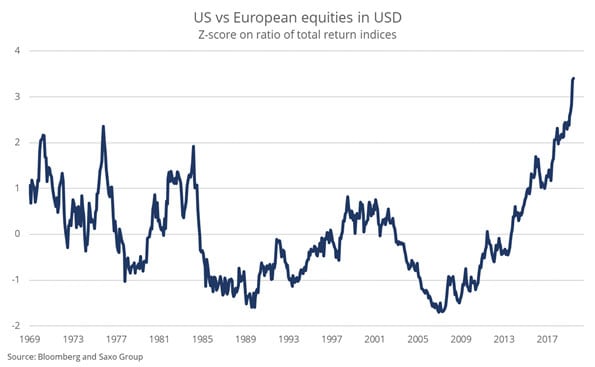

The past year has pushed the outperformance of US equities over European equities to an extreme spread in a historical context. European equities have lost out to US equities to the tune of five standard deviations on a relative basis since 2007. The drivers have been a strong USD, higher valuations on US equities relative to European equities, higher US earnings growth combined with large buyback programmes and a tectonic shift in market capitalisation towards technology companies – where Europe has lagged.

Measured on 12-month trailing EV/EBITDA, US equities are valued 65% higher than European equities. This massive valuation spread requires a flawless US earnings path from here.

US equities generally have lower financial leverage than European companies, which is obviously a positive in an uncertain macro environment. However, valuation is the key factor in explaining future returns, so with the historic outperformance of US equities combined with rich valuations we believe investors should begin to overweight European equities – despite the political risks in the EU.

The world needs a weaker USD, and the Fed will provide one over time. This speaks in favour of European equities. Plus, European companies are better positioned in the green transformation and healthcare’s focus on robotics. While Europe has been asleep on IT, there are signs that it is finally getting momentum.

Localisation as a theme will take a decade to play out, in the economy but certainly also in equity markets. One theme that makes sense in this transition is investing in small caps with a domestic revenue profile in non-cyclical parts of the economy (healthcare, consumer staples and utilities). The transition to a more localised global economy will create an uncertain path for many companies and therefore the good old strategy of investing in high-quality companies with low financial leverage is also attractive in our view.

We believe that certain sectors of the economy, such as the green transformation, will also continue to do well because the current economic model is a net drag on the environment. Our initial list of “green stocks” from January 2020 still provides a solid starting point for inspiration. Other industries such as healthcare, robotics and 3D printing will also get a boost from policies of self-reliance and domestic-oriented production in the developed world.

Companies with a strong digital presence and business model will also naturally do very well in our view – take a look at our recent list of online companies to start finding those long-term stocks. However, with extreme valuations among some online companies investors should be cautious on what we call “bubble stocks”.

Finally, gold will likely do quite well in this future landscape of State capitalism and localisation. But beware the myth of buying gold miners. One of our recent research notes shows that they are not doing better than spot gold, despite their balance sheet leverage. So investors wanting gold exposure should be wary.