Quarterly Outlook

Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro: US PCE was in-line with expectations. Core PCE rose by 0.1% M/M, easing from 0.3% (revised up from 0.2%), with the Y/Y easing to 2.6% from 2.8%. Headline was flat M/M, down from 0.3% prior, with the Y/Y at 2.6%, down from 2.7%. This is a welcome relief for the Fed and focus turns to non-farm payroll jobs data due at the end of the week.

Macro events: EZ, UK & US Manufacturing Final PMI (June), German Prelim. CPI (June), US ISM Manufacturing PMI (June)

Earnings:N/A

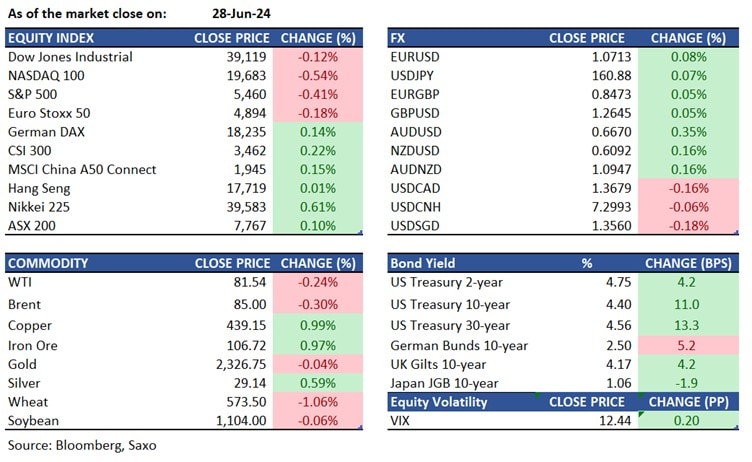

Equities: Stocks in the US ended lower on the final trading day of June as investors processed a slew of economic data. The S&P experienced a 0.4% decline after reaching a new high of 5.5K, while the Nasdaq 100 fell by 0.7% after briefly reaching a record level of 19,980. In the meantime, the Dow Jones dropped by 41 points. The decline was led by communication services, with Alphabet (-1.7%), Meta (-2.9%), Netflix (-1.4%), and Walt Disney (-2.8%) all experiencing drops. On the other hand, energy and real estate stocks saw slight gains. Most of the large-cap stocks closed in negative territory, including Nvidia (-0.3%) and Amazon (-2.3%). Looking at the monthly performance, the S&P gained 2.9%, the Dow rose by 0.7%, and the Nasdaq rallied by 4.9%. For the first half of 2024, the S&P increased by 15.1%, the Nasdaq by 20%, and the Dow gained 3.7%.

Fixed income: The US yield curve bear-steepened on Friday, with the 2-year yield up 4 basis points at 4.75%, while the 10-year rate jumped 11 basis points to 4.40%. Yields on Australia’s 3-year note rose by 7 basis points to 4.15%, while the 10-year debt increased by 9 basis points to 4.40%. Meanwhile, New Zealand’s 10-year yield remained steady at 4.67%. Futures of Japan’s 10-year notes finished the night session down 29 ticks to close at 142.57, resulting in a yield increase of about 3 basis points. The benchmark yield for Japan fell for the first time in seven sessions on Friday, down 2 basis points at 1.05%.

Commodities: On Friday, oil fell due to weak U.S. fuel demand and profit-taking at the quarter's end. The U.S. PCE price index remained flat in May, hinting at potential rate cuts in September. Concerns about rising U.S. crude and gasoline inventories impacted oil prices, which WTI ended the week down by 0.2% after a two-week gain, but saw a 6% increase for the month and over 13% for the first half of 2024. Gold approached $2,340 per ounce on Friday, marking nearly a 5% gain in the second quarter and a 14% surge in the first half of the year. This was driven by expectations of rate cuts by major central banks and increased gold demand by key central banks in Asia.

FX: The US dollar is starting the week lower after ending last week nearly unchanged. EURUSD has opened the week higher, climbing to 1.0740, with Marine Le Pen’s far-right party’s victory in the first round of the French elections turning out to be less extreme that feared. EURCHF climbed higher to 0.9660, the highest in over two weeks, as safe-haven Swiss franc declined. AUDUSD has been a stand-out performer last week, and is trading above 0.6650. GBPUSD remains in focus this week with UK elections the next key political event to watch.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.

Q3 Macro Outlook: Less chaos, and hopefully a bit more clarity