Quarterly Outlook

Q3 Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: Riksbank Policy Announcement; Australia CPI (Aug), US Building Permits Revision (Aug), New Home Sales (Aug),

Earnings: Micron, Cintas and Jefferies

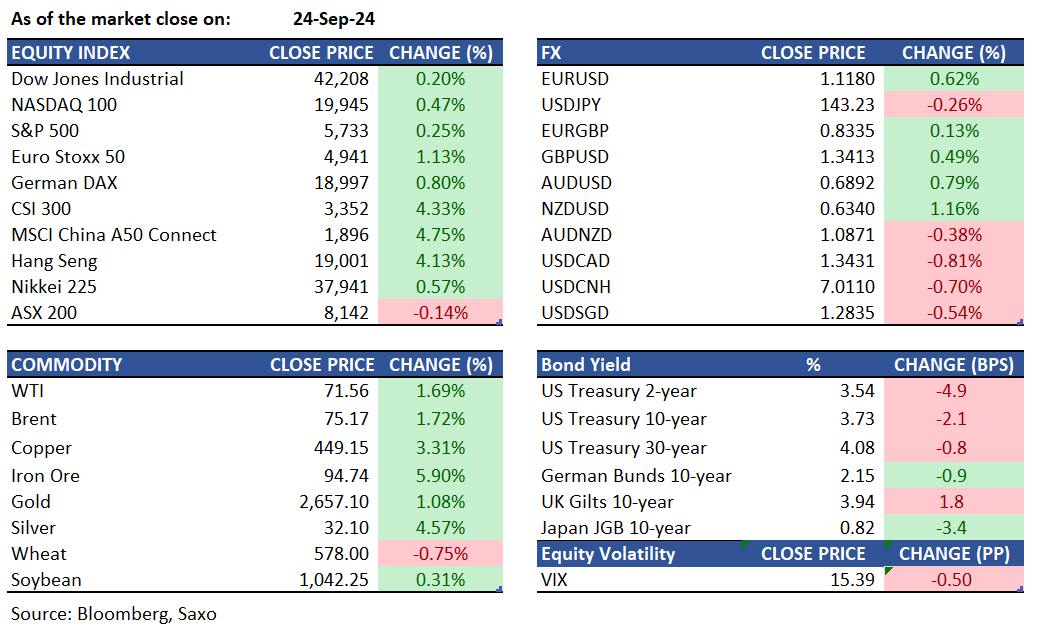

Equities: On Tuesday, the S&P 500 gained 0.2%, reaching a new record high, while the Nasdaq 100 rose by 0.5%, largely driven by a 4% surge in Nvidia shares. The Dow Jones also climbed, finishing 83 points higher. This uptick in the market followed disappointing consumer confidence data, which fell to a three-year low, prompting traders to bet on additional interest-rate cuts this year. Fed officials, including Austan Goolsbee, suggested that further rate cuts might be necessary, particularly with a focus on the labor market. Nvidia's share price jumped about 4% due to reports that its CEO had ceased selling shares. Estee Lauder saw a 6.11% rise, and Chinese stocks such as Alibaba (up 7.9%) and JD.com (up 13.9%) rallied following China's announcement of aggressive growth-stimulating measures, with Hang Seng Index closing higher by 4.1%. Conversely, Visa shares dropped by 5.5% amid rumors of a potential DOJ lawsuit over its debit card practices. Despite the positive market movements, concerns about geopolitical risks persisted, with JPMorgan CEO Jamie Dimon issuing cautionary warnings about the global economy.

Fixed income: Treasuries surged in a bull steepening move following the release of consumer confidence data. Fed swaps for the November meeting turned more dovish, now indicating a 50% chance of a half-point rate cut compared to a quarter-point cut. Yields closed near their daily lows, with the front end of the curve outperforming the long end, supported by a strong 2-year note auction. This has heightened expectations for the upcoming 5- and 7-year note auctions on Wednesday and Thursday. The Treasury's $69 billion auction of 2-year notes was awarded at a yield of 3.520%, the lowest since August 2022, bringing the 2-year yield close to its 2024 lows. Treasury yields improved by up to 5 basis points on the front end of the curve and showed slight gains across the long end. Both the 2s10s and 5s30s spreads ended near their session highs, steepening by 3.2 basis points and 3 basis points respectively. The 10-year yield was approximately 2 basis points lower compared to Monday's close, trading around 3.73%.

Commodities: WTI crude oil futures increased by 1.69% to $71.56, and Brent Crude futures rose by 1.72% to $75.17, driven by China's extensive economic stimulus measures and rising geopolitical tensions in the Middle East. China's central bank announced its largest stimulus package since the pandemic, including increased funding and significant rate cuts, to counter fears of a prolonged economic slowdown. Gold reached new record highs, climbing 1.08% to $2,657, as commodities benefited from China's stimulus efforts. Silver surged 4.6% to $32.1 on Tuesday, its highest level since late May, as Middle East tensions led investors to seek safe-haven assets.

FX: The risk-on environment got another leg of support after Fed’s 50bps rate cut last week as China authorities announced a slew of stimulus measures to support the ailing economy and markets. The US dollar, as a result, traded lower across the board and Chinese yuan led the gains. Offshore yuan broke past the 7 per dollar level for the first time in 16 months. The Australian dollar was choppy following a hawkish statement from the Reserve Bank of Australia but a less hawkish speech from the Governor, but eventually the Chinese bazooka stimulus helped pushed the commodity currency higher. The Japanese yen was the underperformer in the risk-on environment, also as BOJ’s Ueda continued to sound caution on the pace of further rate hikes.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.