Quarterly Outlook

Q3 Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: China Industrial Profit (Jul), German GfK Consumer Sentiment (Sep), US Consumer Confidence (Aug), Treasury 2-year Auction, ECB’s Knot and Nagel

Earnings: Scotiabank, Allot, Scan source, Haidilao, SentinelOne, OVH, Box, Ncino, Ambarella, Nordstrom, Semtech, Ooma, Joyy, Vnet, Hain Elestial, Cadeler, CNFH

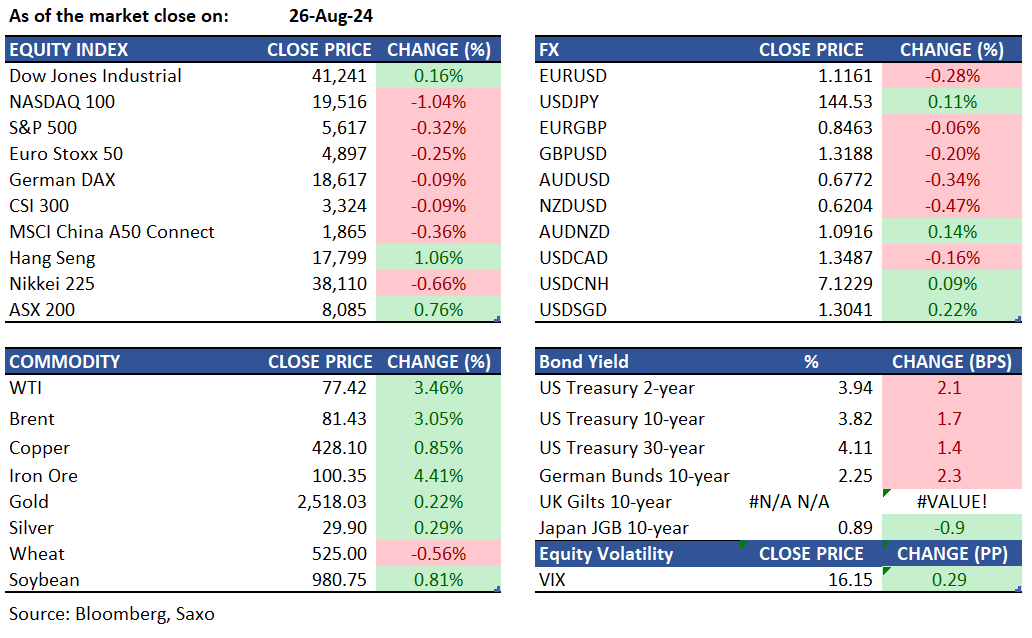

Equities: U.S. stocks ended mixed on Monday as markets awaited mid-week earnings from semiconductor giant NVDA and later inflation data (PCE). Dow Jones hit a new intraday high, while the S&P and Nasdaq fell due to weakness in Technology, with the Semiconductor index dropping over 2%. The Russell 2000 initially surged on hopes of Fed rate cuts following Chairman Powell's dovish comments but faded by the close. Utilities and REITs reached their best levels since September 2022 before pulling back, while Consumer Staples hit all-time highs. Financials also traded at all-time highs before paring gains. Technology was the biggest drag, with the Philly Semiconductor index falling over 2.5%. U.S.-listed Chinese stocks declined due to weak earnings from Temu parent PDD. The market is awaiting NVDA earnings, software earnings including CRM, GDP data on Thursday, and PCE inflation data on Friday.

Fixed income: Treasuries posted minor losses, starting a week expected to be influenced by upcoming supply. The final three Treasury coupon auctions for the month begin on Tuesday, and early September often sees substantial corporate bond issuance. Yields rose by about 1 basis point from Friday's close during Monday's trading, staying near the lower end of their year-to-date ranges. The daily yield range for the 10-year note was less than 5 basis points, one of the smallest this year compared to an average of 8.6 basis points. Japan and Australia are preparing to issue debt as rising oil prices boost inflation expectations. Treasury futures remained stable ahead of a two-year note auction. Japan's Ministry of Finance will sell ¥400 billion in debt with maturities ranging from 15.5 to 39 years, while the Australian Office of Financial Management will auction A$100 million of an inflation-indexed note due in November 2032.

Commodities: Oil prices surged due to Middle East tensions, with WTI crude rising 3.46% to $77.42 and Brent crude increasing 3.05% to $81.43. The spike was driven by Israel's pre-emptive strike on Hezbollah in Lebanon and a 48-hour state of emergency declaration. Additionally, Libya's eastern-based government announced the closure of all oil fields, halting production and exports. Conversely, U.S. natural gas futures fell to a three-week low due to forecasts of lower demand next week. Gold prices edged up 0.22% to $2,518, near recent all-time highs, supported by safe-haven demand amid Middle East geopolitical risks. Silver traded above $29.5. The U.S. dollar remained at multi-month lows against the euro and pound, influenced by Fed rate cut prospects following dovish comments from Fed Chairman Powell at the Jackson Hole symposium.

FX: The US dollar was slightly higher after heavy selling in the last week with little new data for markets to digest. Fed speakers continue to leave the door open for a larger rate cut in September, and if economic momentum weakens, markets could price in a 50 basis points rate cut from the Fed at the next meeting. This could mean more downside pressure on the US dollar, and we discussed in this article what that could mean for global portfolios and how to mitigate risks. The Canadian dollar outperformed among the major currencies, riding on the back on gains in crude oil coming from concerns around Libyan supply. Geopolitical risks also drove the safe-haven Swiss franc higher. Meanwhile, activity currencies like kiwi dollar and Australian dollar were in losses on Monday, even as British pound still outperformed the activity currency complex. The Japanese yen weakened slightly, but the move has been restrained so far after sharp gains in the currency last week. For more FX analysis, read our Weekly FX Chartbook.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.