Key points:

- Macro: Switzerland finalises 15% tariff deal with US

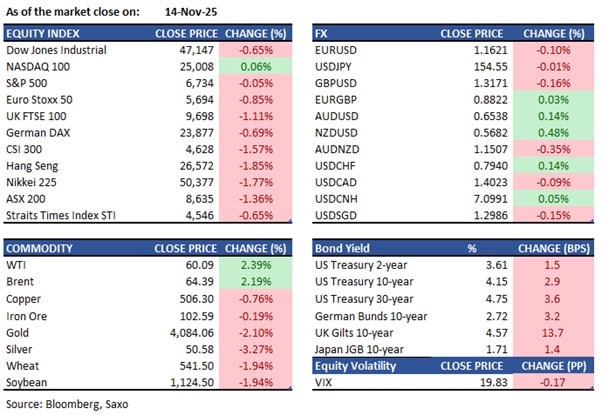

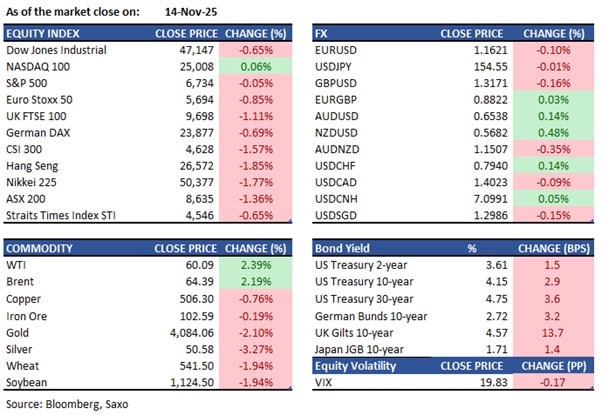

- Equities: Tech rebounded late Friday with Nasdaq 100 flat while Dow fell 280 points.

- FX: Swiss tariffs reduced, CHF dipped; GBP climbs, UK reverses planned tax hike

- Commodities: Gold gained 0.4% to $4,100, rebounding after two days of losses

- Fixed income: Renewed concerns about UK fiscal credibility weakened gilts

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

Macro:

- Japan's GDP shrank 0.4% in Q3 2025, reversing a 0.6% increase in Q2 but slightly better than the expected 0.6% decline. This first drop since Q1 2024 was due to weak private consumption, which rose 0.1% after a 0.4% increase, amid ongoing cost pressures.

- The Swiss government finalized a 15% tariff deal with the Trump administration, ending a dispute since August over increased tariffs on Swiss exports.

- Trump stated no further tariff rollbacks are needed. Top US officials held talks with Chinese counterparts on Friday, and he is discussing soybeans with China, reports Reuters.

- According to Nikkei, the Japanese government is reportedly contemplating a stimulus package totaling approximately JPY 17 trillion, with a supplementary budget expected to be around JPY 14 trillion.

Equities:

- US - US stocks pared early losses Friday but ended mixed as investors reassessed chances of a December rate cut. The S&P 500 and Nasdaq were flat, while the Dow fell 280 points. Tech rebounded, with Nvidia, Microsoft, Oracle, and Palantir up 1.1%–2.4%, partially reversing Thursday’s slump. Defensive names lagged: United Healthcare dropped 3.2%, Home Depot 1.6%. Market breadth stayed uneven as some large caps hit highs while others sank to yearly lows, reflecting stretched AI valuations and fading easing hopes. The government shutdown’s end removed one uncertainty but delayed data releases, leaving traders without clear signals ahead of the Fed decision.

- EU - European stocks fell sharply for a second day Friday as concerns over inflated US tech valuations and Fed pushback on rate-cut expectations weighed on sentiment. Eurozone banks led losses amid rising bond yields, with UniCredit down 4.5% and Intesa Sanpaolo, Santander, and BBVA off 2.5%–3.5%. Tech names mirrored US declines: SAP, Prosus, Infineon, and Nokia dropped 1.5%–4%. Richemont surged over 7% on strong US and China sales, while Allianz gained 1% after record nine-month results. Despite the pullback, the STOXX 50 rose 2.3% and STOXX 600 added 1.8% for the week, both hitting record highs earlier.

- HK - Hang Seng dropped 500 points (1.9%) to 26,572 on Friday, its steepest fall since mid-October, ending a four-day rally. The decline followed Wall Street’s slump as hopes for a U.S. rate cut faded, compounded by China’s warning of external risks and restructuring pressures. October data showed factory output and retail sales at 14-month lows, while fixed investment fell 1.7%, the sharpest drop on record. All sectors slid, with tech and consumer stocks down over 2%. SMIC lost 2.7%, XPeng 6.9%, and Kuaishou 2.9%.

Earnings this week:

Monday

US: Arbe

Asia: XPeng, Geely Automobile, Li Auto, Japan Real Estate Investment Corp

Tuesday

US: Home Depot

Asia: Xiaomi, Trip.com, PDD Holdings, NetEase, Baidu

Wednesday

US: Nvidia, Palo Alto, Lowe’s, Target, Viking

Asia: Kuaishou, Lenovo, ZTO Express, Tokio Marine, SOMPO, MS&AD Insurance

Thursday

US: Walmart, Warner Music Group, Intuit

Asia: Webull

Friday

US: BJ’s Wholesale Club

Asia: Meituan

FX:

- Dollar Index rose slightly Friday but finished lower for the second week. Gains against GBP, CHF, and EUR were offset by losses against CAD. U.S. news had little impact as UK developments influenced USD. The Fed faces a tricky December policy decision with market pricing now reflecting a 40% chance of a 25bps cut. Inflation and labor market concerns are key factors.

- Swiss tariffs were cut to 15% with a $200 billion investment in the U.S. as the Trump administration eyes lower tariffs on select goods. CHF fell post-deal, with traders taking profits; EURCHF remained above 0.9200.

- UK Chancellor Reeves backtracked on the proposed income tax hike, supported by optimistic wage growth forecasts. GBP climbed from 1.3109 to 1.3160 against the dollar, while EURGBP stayed steady. Gilts dropped over a point, anticipating volatility in the UK fiscal landscape.

Commodities:

- Oil prices decreased after operations resumed at the Russian port of Novorossiysk on the Black Sea, following a Ukrainian strike that caused damage and halted activities last week. Brent crude slipped below $64 a barrel after rising over 2% on Friday post-attack, while WTI approached $59. Two tankers docked on Sunday, marking a return to operational activity, with Reuters also reporting the resumption of crude loading.

- Gold rose by 0.4% to $4,099.25, recovering from two days of losses due to diminishing hopes for a US Federal Reserve rate cut. Market anticipation for lower rates waned as Fed officials showed little conviction. Meanwhile, silver gained, while palladium and platinum remained flat.

Fixed income:

- Treasury futures ended at their daily lows after early buying was swiftly reversed amid recovering equities and rising gilt yields. Initial gains were spurred by heavy trading volumes, while renewed concerns over the UK government's fiscal credibility led to gilt underperformance. The London session wrapped up with gilt futures near session lows and UK yields up by 8 to 16 basis points across the curve in an aggressive bear steepening move, driven by speculation about the UK budget and mixed signals on tax policy. Meanwhile, Japan plans to issue around 250 billion yen in 10-year inflation-indexed bonds, and New Zealand Treasury is tapping into the May 2036 nominal government bond.

For a global look at markets – go to Inspiration.

This content is marketing content and should not be considered investment advice. Trading financial instruments carries risks and historic performance is not a guarantee for future performance. The instrument(s) mentioned in this content may be issued by a partner, from which Saxo receives promotion, payment or retrocessions. While Saxo receives compensation from these partnerships, all content is conducted with the intention of providing clients with valuable options and information.