Outrageous Predictions

Dumb AI triggers trillion-dollar clean-up

Jacob Falkencrone

Global Head of Investment Strategy

Alibaba Earnings Preview: Will BABA Beat Expectations? - A Trader's Guide

Introduction

Alibaba Group Holding Limited is a global conglomerate with diverse operations. It runs major e-commerce platforms like Taobao and Tmall, offers cloud services through Alibaba Cloud, and owns digital media platforms like Youku. Alibaba also provides logistics solutions via Cainiao Network, local consumer services like Ele.me, and has a significant stake in Ant Group, which operates Alipay.

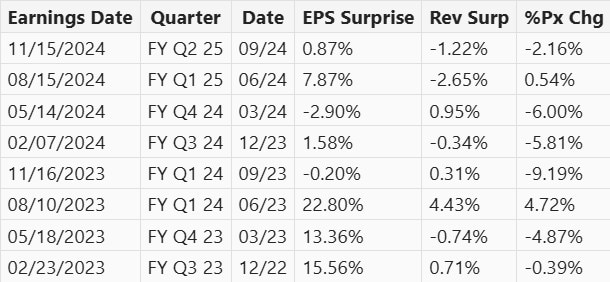

Earnings consensus

Alibaba has consistently outperformed earnings estimates. For the quarter ending June 2024, it reported an EPS of CNY 15.06, beating the estimate of CNY 14.93, with revenue at CNY 236.50 billion. For quarter ending Sept 2024, EPS was CNY16.44, surpassing the CNY 15.24 estimate, with revenue slightly below the expected $243.23 billion. Analysts expect an EPS of $19.117 for Q4 2024. Alibaba has shown strong revenue growth, profit margins, and cash flow, with a free cash flow of $101.73 billion for the trailing twelve months.

Source:Bloomberg

Price Action

Alibaba (ADR) reached a high of $117.82 in 2024, with resistance around $125. The price is testing this resistance for the fifth time. Alibaba started the year at $84.39 and is now at $111.32, resulting in a YTD return of 31%. 1 year return is at 52%.

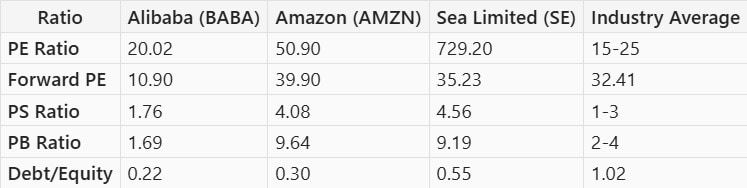

Financial Ratios

Alibaba's lower forward P/E ratio suggests potential undervaluation compared to Amazon and Sea Limited, which have higher ratios reflecting greater growth expectations. The industry average forward P/E ratio is 32.41, providing a benchmark for comparison.

Options Activity

Volatility Skew (Puts vs Calls), Source:SaxoTraderPro

There is an upward sloping volatility skew for BABA options. When the volatility skew favors calls, it indicates that the market anticipates a rise in the stock price. Consequently, call options (which benefit from a rising underlying stock price) become pricier than put options (which benefit from a falling underlying stock price). This occurs because more investors are purchasing call options, increasing their prices due to higher demand.

Trade Inspiration

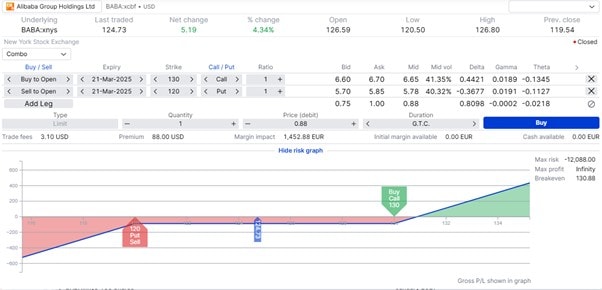

Synthetic Long - A synthetic long stock strategy involves buying a call option and selling a put option. This mimics the owning stock, allowing for leveraged exposure with less capital. It requires margin for the put and carries the risk of having to buy the stock if its price drops significantly.

Trade example:

Risks/ Payoffs:

The breakeven price will be $130.88, but if volatility increases, the breakeven price could be lower. If the price drops to $120, you will purchase the stock at that price, which is a discount compared to the current price of $124.73.