Balanced ETF portfolios CHF Q4 2020 commentary

| Asset classes | Stocks (developed and emerging equity), bonds, non-traditional |

| Instruments | ETFs |

| Investment style | Macro, diversified investment focus |

| Quarterly return (net of fees) | |

| Defensive | 3.1% |

| Moderate | 5.5% |

| Aggressive | 7.2% |

Market overview

Global equities finished the year on a strong footing amidst positive vaccine news, agreements regarding a Brexit deal and a pandemic relief plan in the US. Developed markets were up 3.5% in local currency terms and 4.3% in USD terms. Emerging markets gained 6.1% in local currency terms and 7.4% in USD terms. The USD ended the month down 2.1% as investors expect the Fed to keep interest rates low. Moreover, markets are optimistic regarding a recovery from the COVID-19 pandemic, which could make the greenback a laggard against other major currencies. Within fixed income markets, US treasuries ended the month down 0.3% while UK gilts ended the month up 1.6%. The Euro ended the month up 2.3% against USD as the latter depreciated and the EU entered into an investment agreement with China that will provide European businesses with preferential treatment compared to US companies. Sterling climbed 2.4% against USD over the month as the UK and the EU agreed on a Brexit deal.

Amidst rising COVID-19 cases in the US, manufacturing data (an indicator of economic health) reduced into year end. On the political front, US lawmakers finally agreed on a pandemic relief plan that will extend many of the CARES support measures such as renewing direct payments to households and generous unemployment benefits. EU governments found a compromise regarding the EU’s recovery fund and seven-year budget. This paves the way for a EUR 1.8 trillion financial support package if ratified by national parliaments of the 27 member states. Services remained the principal drag on economic output for the eurozone while manufacturing continued to expand over the month.

Within fixed income, 10-year government bond performance (a common reference point for reviewing bond performance) was muted in developed regions except for the US, UK and Italy. Hopes of economic recovery and an agreement regarding a stimulus deal led treasury yields to move modestly higher (rising yields creates loss for bond investors). With more stringent lockdown measures imposed in the UK, gilt yields declined as economic uncertainty heightened for the nation. Benchmark 10-year yields rose to 0.91% in the US, while they declined in the UK to 0.2%, whilst Japan ended at 0.02%. German Bund yields remained flat over the month, negative at -0.58%.

In the UK, a new and more infectious strain of the COVID-19 virus was discovered. As a result, many countries barred flights from the UK and strict lockdown measures were imposed within the country. Regarding UK economic data, manufacturing finished on a slight high, while service sector activity continued to decline. Additionally, the latest unemployment data showed a slight rise.

The oil rally triggered by positive vaccine news continued into December. The commodity (Brent) ended the month up 8.8% at $52/barrel. Growing worries about the new strain of the coronavirus have boosted the appeal of safe havens such as gold. Furthermore, the weak dollar bolstered the demand for the precious metal. Gold finished the year strong, returning 24.8% YTD and 7% over December, ending the month at $1898/ ounce.

Portfolio performance

| Returns net of fees | Defensive | Moderate | Aggressive |

| Oct | -1.4% | -2.4% | -3.3% |

| Nov | 3.5% | 6.5% | 8.9% |

| Dec | 1.0% | 1.5% | 1.8% |

| 2020 | -0.6% | 0.7% | 0.6% |

| Since Inception (Aug 2016) | 6.5% | 15.6% | 22.9% |

The multi asset portfolios produced positive returns in Q4 but suffered in October.

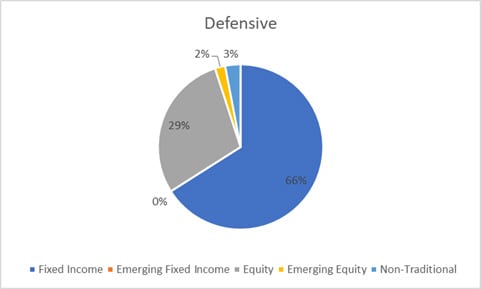

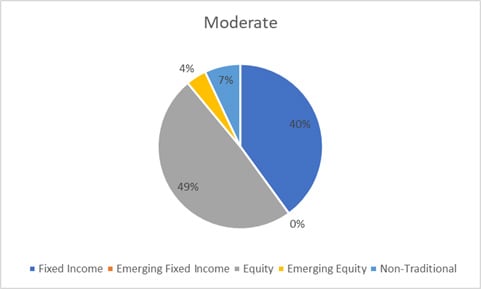

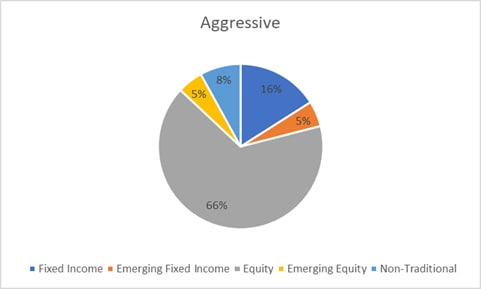

Portfolio Allocation and top portfolio holdings (as of 10 Nov 2020)

Rebalance Commentary and Outlook

The aim of this rebalance was to increase the resilience of the portfolios against the possibility of prolonged volatility after the US election. As such, the investment management team (the “team”) broadly added to duration funded by government bond investments. This is implemented within the fixed income sleeve, by rotating out of Swiss government bonds in favor of longer-dated CHF hedged U.S. treasuries in all profiles. Additionally, in the Moderate, the team funded the additions to high duration U.S. treasuries with a combination of 1-3 year and 3-7 year Swiss government bonds, whereas in the Aggressive profile, these are funded out of a combination of 3-7 year and 7-15 year Swiss government bonds.