Quarterly Outlook

Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Global Macro Strategist

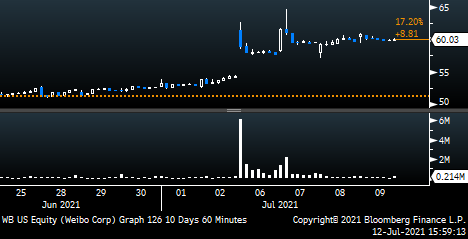

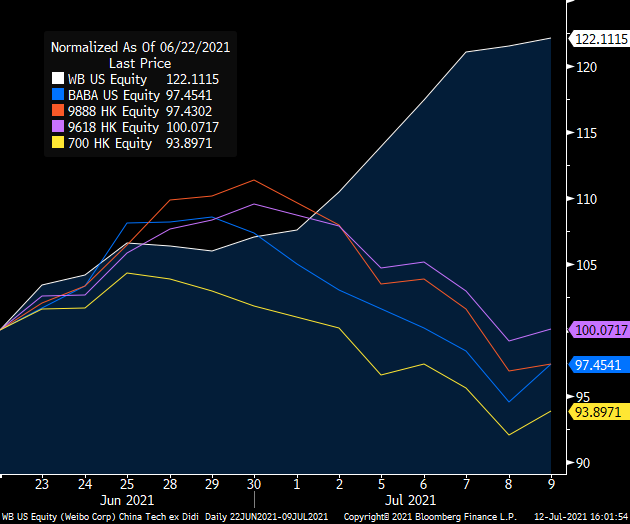

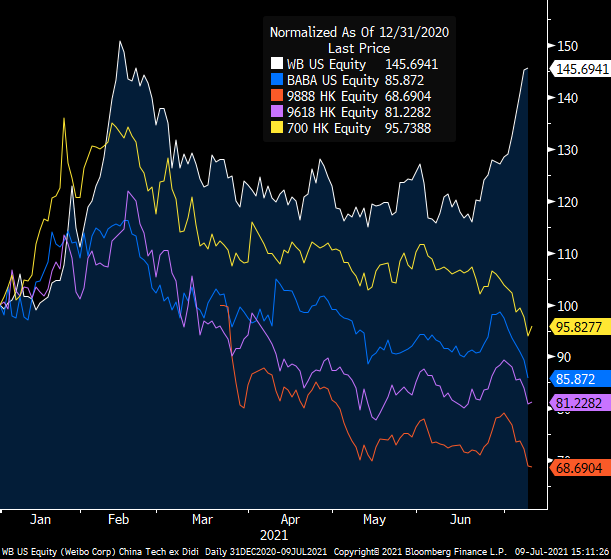

Summary: Latest Macro Dragon Reflections, checks in on the divergence in the China Tech space that seems to be getting headwinds from all parts of the globe. It highlights the short squeeze an incredible sector outperformance on Weibo $60.03, +47% YTD, in some case that relative outperformance being as high as +65% as the rest of the space is firmly in the red YTD. This includes recently listed DiDi $12.03 which is -14% from the IPO strike of $14.00.

-

Start<>End = Gratitude + Integrity + Vision + Tenacity | Process > Outcome | Sizing > Position.

This is The Way

Namaste,

KVP

Q3 Macro Outlook: Less chaos, and hopefully a bit more clarity