Quarterly Outlook

Upending the global order at blinding speed

John J. Hardy

Global Head of Macro Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

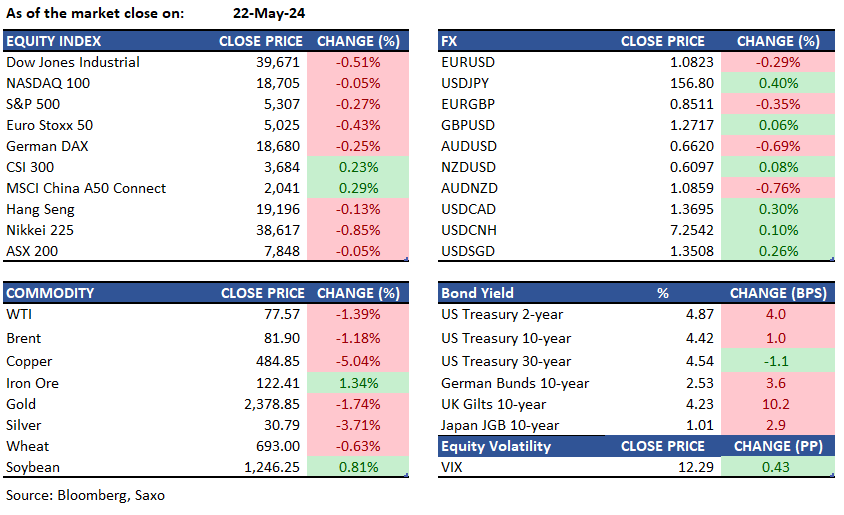

Equities: For the third day in a row, trading in the financial markets has been relatively quiet, with volumes continuing to be below average. Investors are holding off on making big moves as they wait for the earnings report from NVIDIA, a major player in the semiconductor and AI chip market. This report is expected to influence the wider tech industry. The low trading volumes and minimal movement in stock prices show that investors are cautious and prefer to wait before taking any significant action. Uncertainty in the market intensified following cautious comments from Goldman Sachs CEO David Solomon, who suggested the Federal Reserve might not lower interest rates this year and expressed concerns about the U.S. economy's vulnerabilities and slow global growth. Market indices briefly fell because of his remarks, which were made during a period of already low trading activity. Apprehension increased further after the release of the FOMC meeting minutes, which indicated that while the Fed plans to keep interest rates steady for now, there is a readiness to raise them if needed to address inflation, signaling a potential shift to a more restrictive monetary policy. The markets reacted negatively with S&P 500 falling to day low, showing an aversion to a potential tightening of monetary policy.

FX: The U.S. dollar hit a one-week peak, buoyed by the Federal Reserve's meeting minutes that revealed uncertainty among members about inflation and the current level of policy tightness. Meanwhile, the pound saw relative strength as UK inflation figures exceeded expectations, causing a delay in anticipated Bank of England rate cuts and incorporating a risk premium for the upcoming July election. GBP/USD remained steady after an initial surge to a two-month high in response to the UK CPI data. The Australian dollar fell 0.8% to a one-week low against the dollar, amidst a 1% decline in both gold and oil prices. The euro dipped 0.3% to 1.0824 following comments from ECB's Olli Rehn, who cited slowing inflation and wage growth as strong indicators for a potential easing of monetary policy and rate cuts in June. USD/JPY rose 0.2% to about 156.60, fueled by higher Treasury yields and strong performance against other currencies, although gains tempered as it approached the May 14 high of 156.74 and with significant dollar call options set to expire on Friday.

Commodities: WTI crude oil futures fell to $77.57 per barrel, while Brent crude dropped to $81.90 per barrel. Natural gas saw a significant increase of 6.40% to $2.8420, adding to the substantial gains seen in May. Barron's highlighted the growing role of AI and its reliance on natural gas to power data centers, which could be a key driving force. Gold dropped 1.74% to $2,378 per ounce and Silver fell 3.7% to $30.80, driven by widespread profit-taking in the metals market. Copper declined 5.04% to $4.84 following its recent record highs, while aluminum, which has surged to its highest level since June 2022, also saw a slight easing in the metals pullback.

Fixed income: Treasuries were relatively stable in Asian markets following a dip on Wednesday that saw yields rise, particularly at the shorter end of the curve. The two-year Treasury yield, sensitive to policy changes, increased by four basis points as the Federal Reserve's latest minutes suggested a pause in rate cuts. The US 2-year yield reached 4.87%, with the 10-year yield nudging up 1 basis point to 4.42%. The minutes indicated that many Fed officials are considering whether current policies are sufficient to reduce inflation to the target level. Meanwhile, Australian and New Zealand bonds are on track for their longest period of decline in three months, echoing the downtrends in UK and US bonds. Japanese bond futures dropped before the Bank of Japan's scheduled bond purchases, and the country's benchmark yield hit 1% for the first time in nearly a decade.

Macro:

Macro events: New Zealand 1Q Retail Sales, Singapore 1Q GDP, Japan May P Jibun Bank PMIs, Australia May Inflation Expectations, Singapore April CPI, UK S&P Global / CIPS Manufacturing PMI, US new home sales, initial jobless claims, Eurozone S&P Global Services PMI, S&P Global Manufacturing PMI, consumer confidence, France S&P Global Manufacturing PMI, Germany S&P Global / BME Manufacturing PMI

Earnings: Xiaomi, NetEase, Lenovo, Singtel, ITC, Wizz Air, Julius Baer, Allegro TD Bank, Intuit, Workday

News:

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.