Quarterly Outlook

Upending the global order at blinding speed

John J. Hardy

Global Head of Macro Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

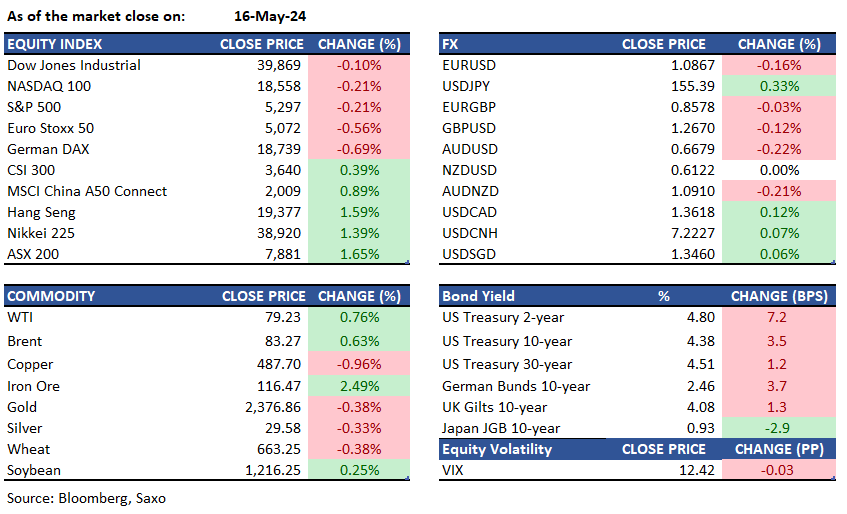

Equities: The Dow Jones Industrial Average briefly surpassed 40,000, a significant milestone for the bull market, before retracting. The S&P 500 also fell below the 5,300 mark after initially rising. Walmart Inc. saw an increase due to a positive outlook, while GameStop Corp. and AMC Entertainment Holdings Inc. experienced declines as the meme-stock trend waned. The Standard & Poor's 500 fell by 0.2% to 5,297.10, with Amazon.com Inc. and Martin Marietta Materials Inc. contributing to the decline. The majority of shares fell, and most sectors, particularly information technology, were lower.

Stocks in Asia opened lower on Friday as traders reevaluated the future of interest rates, with shares in Japan and Australia declining. However, equities in Hong Kong were expected to see further gains due to bullish corporate results. The Golden Dragon index of US-listed Chinese companies rose 2.5% in New York, with Alibaba Group Holding Ltd.'s US-traded shares increasing by 7.1%. Baidu Inc. and JD.com Inc. also saw gains after surpassing profit forecasts, indicating that the Hang Seng Index may reach a fresh nine-month high following a previous advance.

Reddit saw an 11% increase after announcing a partnership with OpenAI to enhance Reddit content for ChatGPT and new products. On the other hand, Applied Materials Inc., the largest US maker of chipmaking machinery, did not meet investor expectations with its latest forecast despite a previous rally in the shares this year.

FX: The dollar rebounded from a one-month low as Treasury yields strengthened following comments from the Fed about maintaining steady rates until inflation recedes. The Bloomberg Dollar Spot Index rose 0.1% after an earlier 0.3% decline to a one-month low, with the greenback supported by profit taking on short positions. Yields on 10-year US Treasury bonds increased by four basis points to 4.38%. Various Federal Reserve officials, including Thomas Barkin, John Williams, and Loretta Mester, emphasized the need for more evidence before adjusting interest rates to address inflation. Jobless claims and building permits came in near forecast, while import prices in April saw the largest monthly increase in two years. The greenback strengthened against most G-10 peers, partly due to corporate flows, while the offshore yuan weakened amid geopolitical developments involving China, Russia, and the US. Implied mostly eased as risk reversals moved contrary to the dollar's gains.

Investors have mixed opinions about the possibility of the Bank of Japan repeating its unexpected move earlier this week by reducing government bond purchases in a regular buying operation. The speculation was fueled by a weak yen and a wide yield gap between Japan and the US, but eased after US inflation data on Wednesday.

Commodities: Gold rose slightly higher after a Thursday drop. Meanwhile, silver rose and traded above $29.50 per troy ounce, marking its highest settlement in over a decade. Brent crude oil traded above $83 a barrel following a two-day increase that saw futures rise by around 1%, while WTI was trading below $80. The recent sessions have seen a competition between lower US crude stockpiles and indications of easing US inflation, alongside concerns about weaker demand growth forecasts from organizations such as the International Energy Agency. U.S. natural gas futures surged by about 3% to a 15-week high of $2.495 per mmBtu on Thursday, driven by a smaller-than-expected storage build and a further decline in output.

Fixed income: Treasury yields closed near their highs following several economic data points, with the 10-year yield at around 4.38%, up from morning lows around 4.31%, while the 2-year yield increased by 5.5 basis points to 4.79%. In the face of anticipated Federal Reserve cuts, recent data revealed that China sold off nearly $55 billion in US Treasuries in the first quarter, marking a record-high selloff.

Macro:

Macro events: China Industrial Production, China Retail Sales, China Unemployment Rate, Eurozone Inflation Rate, Canada New Housing Price Index, Fed Waller Speech

Earnings: Meituan, Applied Materials, Copart Inc, H World Group

News:

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.