Quarterly Outlook

Upending the global order at blinding speed

John J. Hardy

Global Head of Macro Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: US Durable Goods Orders, US Jobless Claims, US Q2 Advance GDP, German Ifo

Earnings: American Airlines, AbbVie, Honeywell, Raytheon Technologies, Southwest Airlines

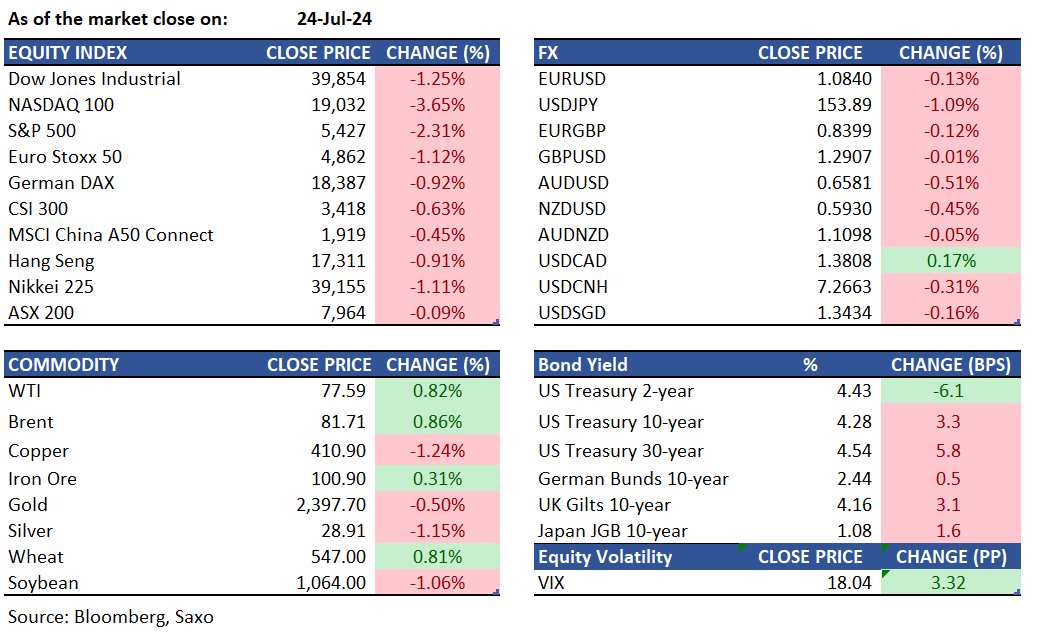

Equities: US stocks plunged on Wednesday due to a broad tech sell-off after underwhelming megacap earnings raised doubts about the AI-driven bull market. The S&P 500 sank 2.3%, marking its worst day since December 2022, while the Nasdaq 100 fell 3.6%, its worst since October 2022. The Dow tumbled 503 points. Alphabet dropped 5% on higher-than-expected AI spending and disappointing YouTube ad revenue. Tesla shares plummeted 12.3% after reporting a 7% drop in auto revenue, a profit miss, and delays in the Robotaxi project. Visa fell 3.9% due to decreased payments volume. Chip stocks also suffered, with Nvidia sinking 6.8%, Broadcom losing 7.6%, and Arm falling 8.1%. The CAC 40 fell 1.1% to close at 7,514, driven by disappointing earnings from luxury giant LVMH. Shares of LVMH plummeted 4.5% after reporting a 1% year-on-year increase in quarterly sales to EUR 20.98 billion, missing expectations. Other luxury stocks also faced losses. IBM reports earnings later today.

Fixed income: Treasury yields ended Wednesday mixed, with the yield curve steepening sharply on expectations of further Fed easing this year. The yield on newly auctioned 2-year notes fell below 4.40%, its lowest since February, partly due to former New York Fed President William Dudley's call for rate cuts this month. Long-term yields rose in the afternoon amid heavy futures trading, pushing curve spreads to their widest levels of the year. The 2-year/10-year spread ended around -14 basis points, nearing its least inverted level since July 2022, while the 5-year/30-year spread steepened to nearly 39 basis points, a level last seen in May 2023.

Commodities: Oil prices stabilized after their first gain in four sessions, supported by a drop in US crude inventories and Russia's pledge for additional production cuts. Brent crude stayed above $81 a barrel, while West Texas Intermediate hovered near $77. US crude inventories fell by 3.74 million barrels, marking the fourth consecutive weekly drop. Gold prices held steady as traders awaited key data that could signal when the Federal Reserve might lower interest rates. Bullion remained around $2,400 an ounce in early Asian trading, following a 0.5% decline on Wednesday. The upcoming personal consumption expenditures data is expected to show easing price pressures, potentially increasing bets on rate cuts. Copper futures recorded their longest daily losing streak in over four years, settling at their lowest price in more than three months on Wednesday. The metal is down over 20% from its May highs, driven by concerns over weakening demand amid China's economic slowdown. Copper prices fell for an eighth consecutive session, the longest streak since February 2020.

FX: The US dollar had a mixed session on Wednesday as it plunged earlier amid continued gains in the Japanese yen but recovered later amid a risk-off sentiment driven by a plunge in US equities. The risk-off sentiment also drove other safe-havens like the Japanese yen and Swiss franc higher, and the British pound also remained resilient with the UK PMIs coming in stronger than Europe and even the US. Meanwhile, commodity currencies Australian dollar and kiwi dollar continued to plunge as commodity prices retreated as a result of China’s gloomy economy. The Canadian dollar also weakened after the Bank of Canada’s dovish rate cut. The move in Japanese yen is key to watch, with markets expecting the Fed to tilt dovish next week in contrast to the Bank of Japan likely announcing a rate hike. We discussed the Powell Put and its implication in this article yesterday.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.