Quarterly Outlook

Equity outlook: The high cost of global fragmentation for US portfolios

Charu Chanana

Chief Investment Strategist

Peter Garnry

Chief Investment Strategist

Summary: Investors with pure equity exposure are at risk to a potential global recession.

In April 2008, the USD weakness in real terms that started in February 2002 ended months before a historical credit crunch and tailspin that required astronomical policy effort to mitigate. Since then, the USD has strengthened by 22% in real terms. And in August 2019, it reached a high enough level for the US Treasury Secretary Steve Mnuchin to declare that the US government does not intend to intervene in the USD for now — although he also said that the Trump administration had weighed up intervention. In other words, the US is planning to intervene if the Fed does not manage to weaken the USD through monetary policy.

This quarterly outlook examines how this situation will impact equity markets.

The Fed uses the trade-weighted broad USD index to measure how strong the USD is relative to its trade partners’ currencies.

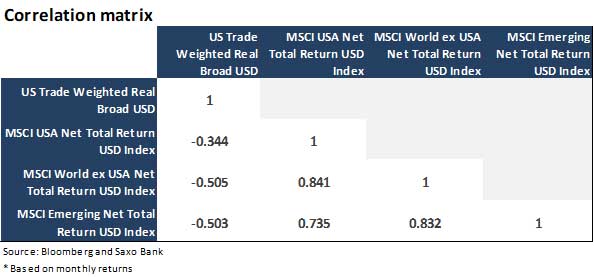

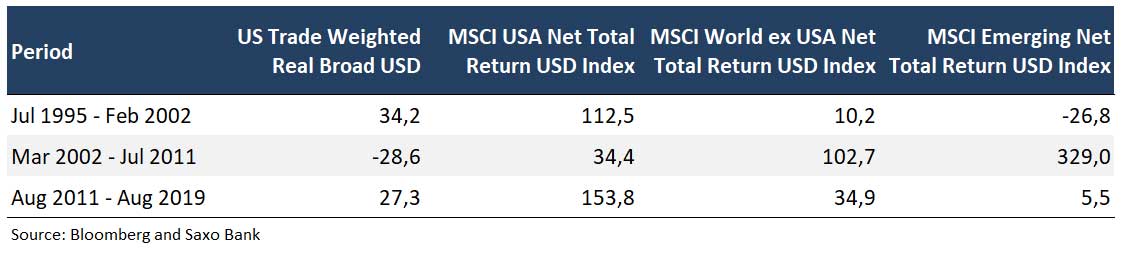

Over the period from July 1995 to August 2019, equity returns in the US, the world ex-US and emerging markets have had a negative correlation to the USD. In other words, whenever the USD weakens equity markets should strengthen. As the world’s reserve currency, largest trading currency and the currency used in commodity markets, the USD is an important component in financial conditions. Since the 2008 crash, emerging market countries have seen a large increase in issuance of USD bonds which has added another growth constraint from the USD.

If we break the period into regimes of stronger or weaker real USD, then a clear pattern appears. Whenever the USD strengthens, the US equity market outperforms the world ex-US and emerging markets and vice versa. As explained in our Quarterly Outlook, some form of USD intervention is the next logical policy step. Monetary policy has lost its effectiveness and fiscal stimulus is coming to slowly to offset the weakness in the global economy (the OECD’s leading indicators have been declining for 18 straight months). A great irony of any USD intervention is that it will partly help China, which is not exactly the strategy of the Trump administration but as with everything in life there are always trade-offs.

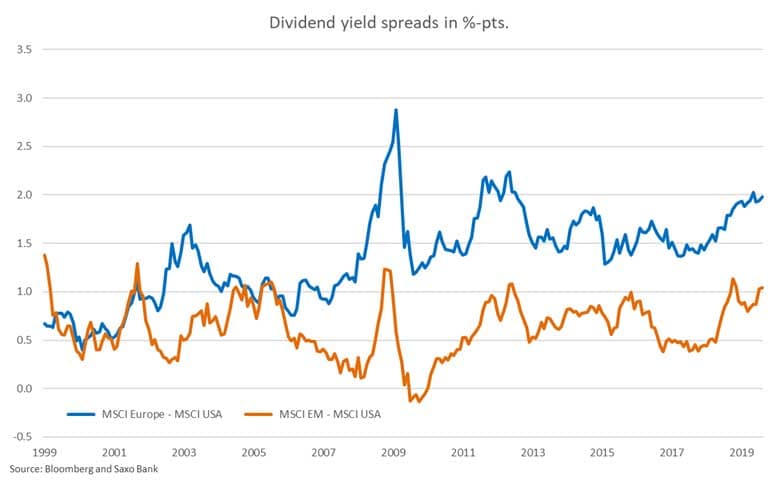

When the strong USD regime ends, investors should overweight European and especially emerging market equities. There is also good support for this strategic position from a valuation perspective as the valuation spread — measured on the dividend yield — has soared to historically attractive levels for the world ex-US and emerging markets.

As we have been writing over many quarters, US equities are expensive in both relative and absolute terms. They remain expensive due to multiple factors ranging from higher share of buybacks, safe-haven status, higher profit growth driven by technology monopolies and finally a healed financial sector. Valuation metrics are difficult to use as timing tools because the market can often remain insane for long periods and maybe we are going through such a period. But rich valuation premiums to other equity markets are typically not a good starting point for relative superior returns in the future.

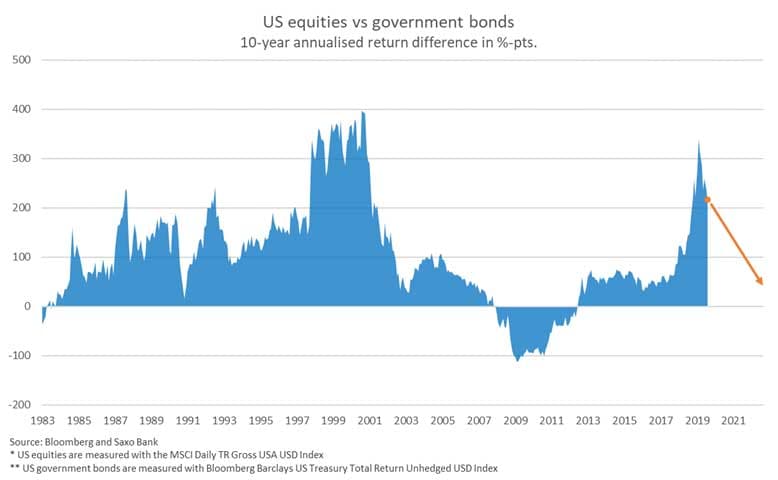

In February 2019, equity markets celebrated the 10-year anniversary of the equity market bottom during the financial crisis. The celebration occurred with a historic equity outperformance over aggregate US government bonds of 339% or 16% annualised. This is one of the best 10-year periods for US equities relative to government bonds since 1973, only marginally topped by the dot-com peak. It is quite likely that the next 10 years will not offer attractive equity returns in terms of outperformance and especially not when factoring in the downside risk relative to upside risk.

Our team’s tactical asset allocation strategy, Stronghold, went online during the summer on our trading platforms through Saxo Bank’s managed portfolio service SaxoSelect. The model behind Stronghold is based on a pure mathematical framework aimed at reducing drawdowns while trying to maximise returns. The model has a strict risk budget and therefore cuts risk quickly if the market structure become highly correlated across asset classes.

The EUR version of the model is up 10.6% as of mid-September and increased exposure in equities slowly over the first half of the year. But in the last three months, its equity exposure has been reduced to around 40% with the main exposure in minimum volatility stocks. The portfolio is balanced as of September also reflecting our general stance to clients. Remain invested in equities but in high quality and minimum volatility stocks. Investors attempting to escape low yields with pure equity exposure are running portfolios that are at risk to policy mistakes and a potential global recession — which has a probability of around 25-40% within the next 6-12 months.