Quarterly Outlook

Q3 Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Summary: Global recession probability peaked back in September, and with stimulus flowing through the economic pipes the recession has most likely been averted this time.

The fire engulfing Australia has alarm bells ringing in every capital in the world. With millennials demanding action on climate change, we are sensing the beginning of a new period that creates great opportunities in equities. We have no strong view on climate change, but recognise that political capital is being mobilised to improve the environment. If we have learned anything since the financial crisis it is to not fight governments.

Governments will increase investments and subsidies for “green” industries, starting a new mega trend in equity markets. We believe that these green stocks could, over time, become some of the world’s most valuable companies — even eclipsing the current technology monopolies as regulation accelerates during the coming decade. Investors should consider tilting their portfolios towards green stocks so they don’t miss this long-term opportunity.

Several industries will drive a less carbon-intensive future, the most obvious of which are solar, wind, fuel cells, electric vehicles, hydro, nuclear, bioplastic, recycling, water, building materials and food. Some of these industries are mature and experiencing a renaissance while others are emerging technologies that come with high risk. We have identified 49 stocks that give investors exposure to these green industries. These stocks should be seen as inspiration and not investment recommendations.

The positive catalysts for these green industries are clear. High growth, massive government support, changing consumer choices, millennials demanding change and technological advancement lowering costs of green technologies. Plus, likely more climate change turbocharging these overall drivers. But what about the risks?

The risk factors impacting the different industries are both systemic and idiosyncratic. From a risk perspective, relative to the general equity market the hydro, nuclear, recycling and water industries are less risky as their demand profiles are more stable than the overall business cycle. Solar, wind, electric vehicles and building materials are more cyclical than the general market and would be impacted more negatively during a recession.

The fuel cell, bioplastic and food (in this case plant-based) industries have far more idiosyncratic risks as they are more nascent than the other industries. The fuel cell industry is heavily dependent on government subsidies as the industry rolls down the technology curve in terms of cost of production. Thus, the industry is very high risk. The bioplastic industry is a small and fragmented, and publicly listed bioplastic companies could easily lose out to larger names in the traditional chemical industry.

Except for nuclear and wind turbines, all of the industries trade at a valuation premium to the global equity market. This premium obviously reflects investors’ optimism about future cash flows in those industries, though with high expectations comes higher risk if these expectations are not met.

Another important point about these companies is that they are operating in the physical world. Unlike, say, the software industry, where return on capital is insanely high and easily scales. These greener industries all require vast amounts of capital to operate — and as such, the low interest rate environment has helped fund growth. If interest rates rise again, this should have a negative effect on their operating conditions and especially on equity valuations.

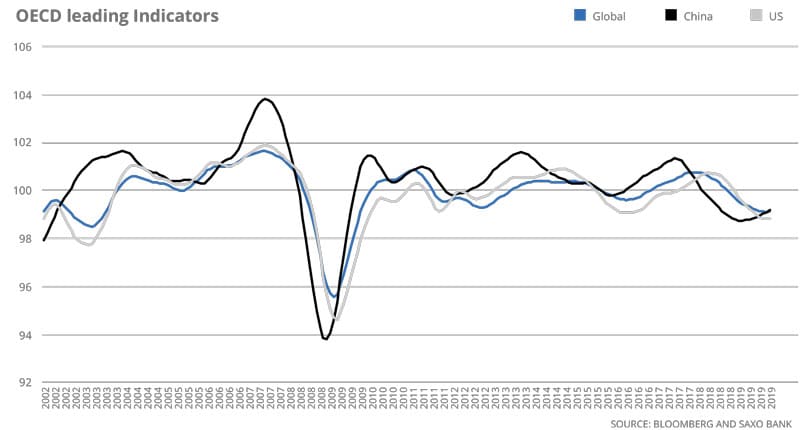

Central banks and governments have decided to throw out the old playbook of not adding stimulus in the late stage of an expansion in which the labour market is tight. Both monetary and fiscal policy is readily being deployed in 2020 across all the world’s largest economies. This is not the time to be underweight equities. With the OECD’s leading indicators moving from contraction to recovery back in October, the historical backdrop tells us that the best period for equities against bonds is ahead of us.

During the recovery phase emerging market equities tend to outperform developed market equities by a wide margin. European equities typically outperform the market during the late expansion and early slowdown, but this time we go against history and recommend investors to also overweight European equities. We already provided this view back in our Q4 Outlook when we looked at the USD and how it impacts equity returns. A weaker USD, which the world needs, has historically led US equities to underperform against European and emerging-market equities. Our tactical asset allocation strategy Stronghold, which clients can invest into through SaxoSelect, also increased its allocation to emerging market equities in January.

With the Fed’s aggressive balance sheet expansion and the growing US fiscal deficit the USD should weaken. Indeed, it has weakened 1.3% since September measured by the Fed’s US trade-weighted real broad dollar index. Another recent factor that could add to USD weakness is rising prices across many commodities.

Global recession probability peaked back in September, and with stimulus flowing through the economic pipes the recession has most likely been averted this time. This brings us to the other risk that could derail equities in 2020: inflation, which seems to be picking up again. In May 2019 we wrote a big read on 105 years of US inflation and equity returns. The conclusions are that equities tend to respond positively to short-term inflation shocks but negatively to sustained inflation rate above 3%. Higher inflation rates and inflation shocks have historically led to more equity volatility. So in 2020, we will be watching inflation closely.