Quarterly Outlook

Q3 Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

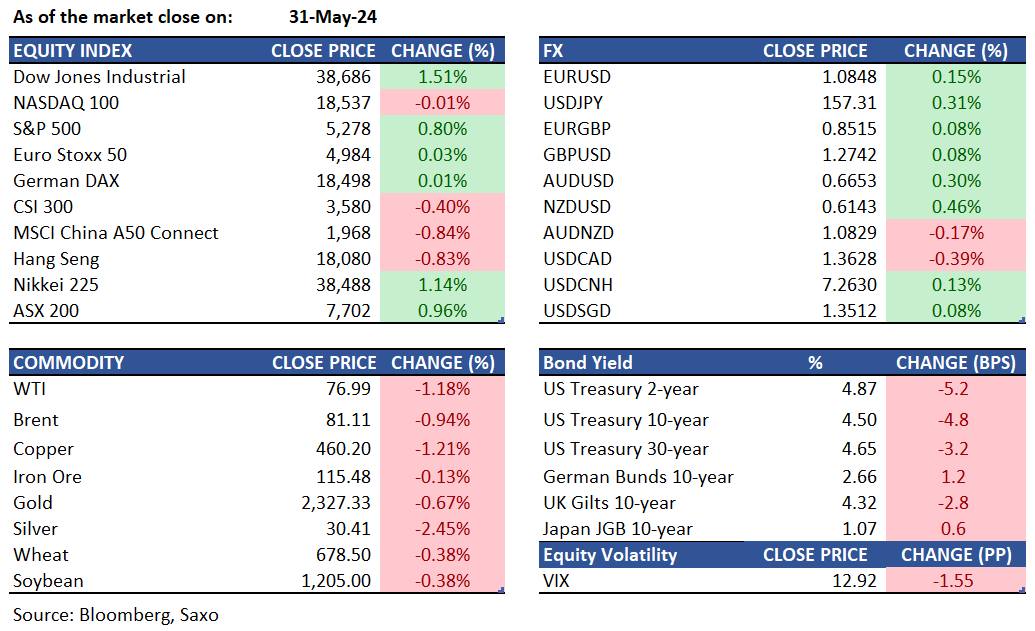

Equities: U.S. stocks saw a significant surge in the last 1 hour of trading, finishing the week near their day highs. Despite this late surge, S&P 500 still ended the week lower but still made considerable gains for the month of May, gaining 4.8%. Despite the strong reversal, signs of vulnerability emerged within the large cap tech sphere during the week, underscored by Dell Technologies' sharp 20% decline post a bleak margin forecast and an earnings guidance miss, impacting sentiment across related segments including PC manufacturers and data center AI contenders. The software industry faced its own set of challenges with Salesforce's guidance cut causing a widespread pullback across the industry. The SOX Index managed to recover from a short-lived downturn, showing that investors remained optimistic despite the unpredictable changes during the week. Last Friday’s April PCE inflation data came in at 2.7% yoy in line with expectations and remained unchanged from the previous month, leading to a decline in 10-year Treasury yields below 4.5%. Meanwhile, the Chicago PMI, indicating the manufacturing sector's health, dropped to its lowest since May 2020 at 35.4, below estimates of 41.1. Following last week's focus on inflation, this week shifts to employment, with anticipated updates on JOLTS job openings Tuesday, private ADP job growth Wednesday and the May NFP report on Friday.

FX: The US dollar ended the week again in minor decline, with CHF leading the G10 pack higher and JPY underperformed. USDJPY trades back above 157.20 this morning as buying interest continues below 157 amid carry interest despite intervention threat as we noted here. Election outcomes in India and Mexico could signal policy continuity, and further fuel interest in carry trading strategies, pressuring funding currencies such as Yen. EUR is heavily in focus this week with ECB expected the start cutting rates, but Eurozone inflation came in higher-than-expected for May at 2.6% YoY and may mean that the ECB will have to take a data-dependent approach post this week’s rate cut. EURUSD trades around 1.0850 with immediate resistance at 1.0880 and a series of supports near 1.08 and just below that. For more on our ECB preview and impact on bonds and EUR, read this article. GBPUSD was neutral last week as equity sentiment was weak, but pair trades above 1.2740. USDCAD also in focus as it approaches 1.36 despite oil prices taking a hit after OPEC meeting, and BOC meets this Wednesday.

Commodities: Oil prices continued to decline after OPEC+ announced a plan to gradually restore some suspended production starting in October. Despite concerns about demand and strong supply from outside the group, production cuts will remain in place for the third quarter and then be phased out over the next 12 months, according to the Saudi Energy Ministry. Meanwhile, gold dropped by 0.67% to $2,337 and silver fell by 2.45% to $30.41, despite a decrease in the dollar and Treasury yields. Despite the weekly decline, gold managed to achieve its fourth consecutive monthly gain, rising by 1.8%. The top commodity loser was Arabica coffee futures, which tumbled by 5.5%.

Fixed income: U.S. Treasury securities advanced on Friday, contributing to their monthly advance, following the release of encouraging inflation figures that sustained forecasts of a potential Federal Reserve interest rate reduction within the year.

April's data indicated that the central bank's favored inflation gauge remained unchanged at an annual rate of 2.7%. Yields on government bonds, spanning various maturities, receded by a minimum of five basis points, touching the week's nadir, as market participants modestly increased their bets on a Federal Reserve rate cut of 25 basis points, possibly by September. Both two-year and five-year Treasury yields dipped to the day's lowest points in late New York trading, propelled by month-end purchasing that bolstered the bond market.

Yields on two-year Treasury notes declined to sub-4.87%, marking the lowest point in over a week. Earlier last week, yields on these shorter-term securities neared the 5% threshold, driven by waning anticipation of Fed rate reductions that had previously dampened demand for newly issued notes and bonds. On Friday, the yield on the 10-year Treasury note dropped below 4.5%, retreating from its weekly high which had surpassed 4.63%.

Macro:

Macro events: China Final Caixin Manufacturing PMI (May), EZ/UK/US Final Manufacturing PMIs (May), US ISM Manufacturing PMI (May)

Earnings: SAIC, GitLab, HealthEquity, Bark, Lavoro

News:

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.