Quarterly Outlook

Q3 Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Global Head of Macro Strategy

The US dollar rally held together reasonably yesterday outside of USDJPY, which was shaken by gyrations in risk appetite as the S&P 500 suffered a brief meltdown through the 200-day moving average that has been the obvious focal point for whether risk appetite will come completely unglued and suffer another large correction. The JPY strength was rather broad and saw EURJPY, our highlighted chart yesterday, continuing to suffer weakness, and yesterday’s bounce in sympathy with the late NY session bounce in equities, has largely come undone again as that pair looks rather heavy. The sub-130.00 support zone is the last area before a lot of empty space on the chart.

The US ISM non-manufacturing survey disappointed with a drop to 56.8 vs. 58.0 expected, but that is still a strong reading, so hard to call it a major development. Among the sub-components, New Orders were strong at 60.0 while the employment index disappointed with a local low of 53.6.

Today, focus swings to the US April jobs report and specifically, the average hourly earnings data series. Risks of a surprise in the data are large given the nature of its calculation. This data point and the weekly close should set in motion whether the week finishes with a bang for the USD rally, potentially setting up another 2-3% or more of upside before resistance comes in, or whether these latest key levels across major USD pairs will remain intact.

Elsewhere, Turkey suffered a downgrade from the S&P ratings agency in the wake of its latest ugly inflation data, which showed core inflation stretching above 14%. The Turkish lira has been setting record lows for a few days in a row and the risk of a negative spiral is clearly present as long as the political leadership in Turkey insists on pursuing impossible fiscal initiatives and the central bank isn’t allowed to take appropriate measures. Turkey’s external debt situation looks every riskier with every downtick in the currency. A bit of broader EM noise is in evidence on Argentina’s woes, as the central bank there has hiked rates to a dizzying 33+% just days after another hike to shore up the currency

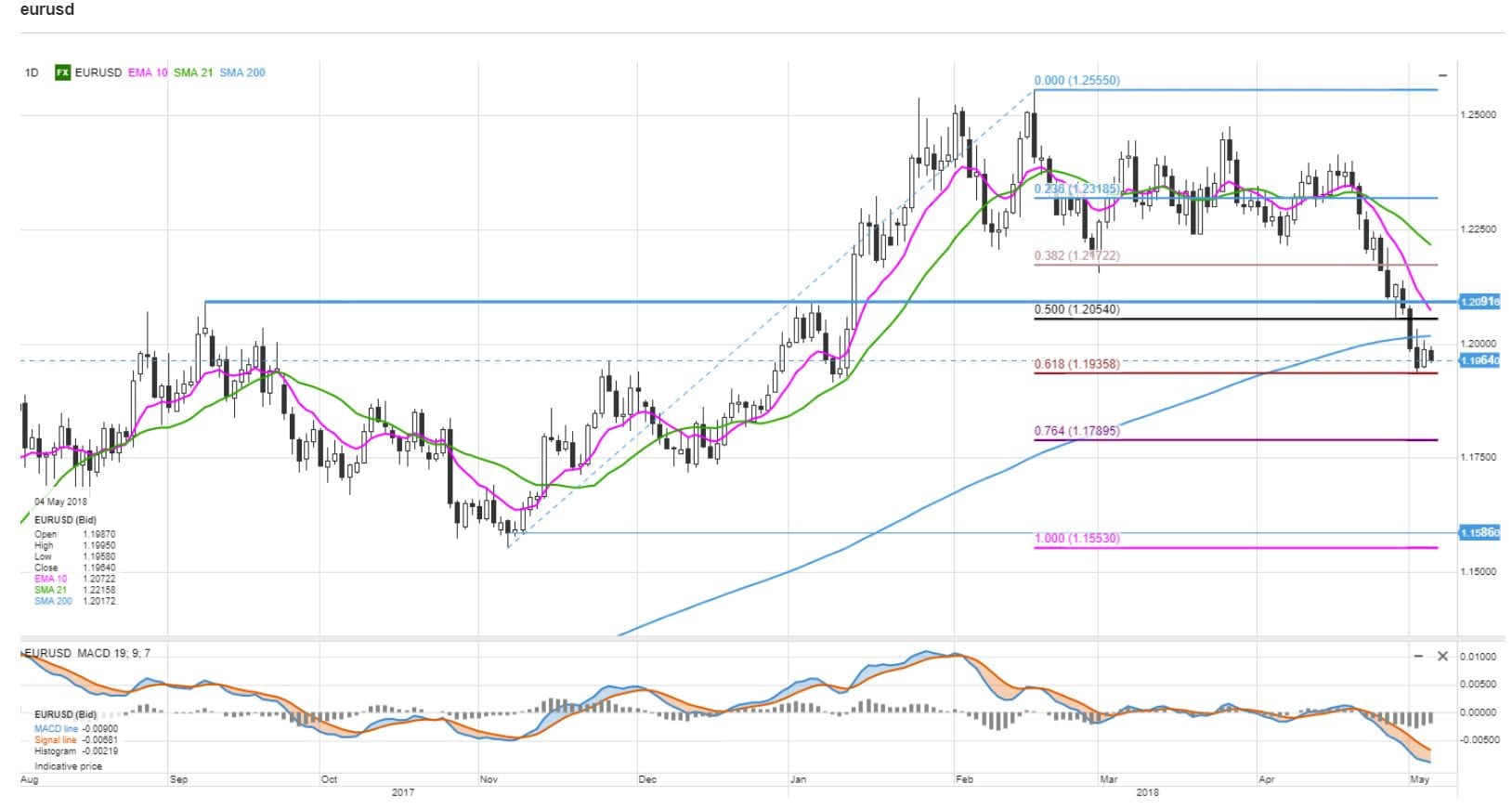

Chart: EURUSD

EURUSD touched the 61.8% retracement of the latest rally near 1.1940 yesterday, perhaps the last support of note ahead of the prior range support below 1.1600. The bulls have a lot of work now to do to dig themselves out of this latest hole – a rise back above 1.2200 for starters. Until then, the USD rally is in the drivers’ seat at these pivotal levels.

Source: Saxo Bank

The G-10 rundown

USD – the rally is still largely intact outside of doubts around USDJPY as we look to the Average Hourly Earnings data and whether it makes fresh waves in Fed expectations or the longer end of the curve. (that 3.0+% level on the 10-year benchmark).

EUR – the euro continues to suffer, looking heavy against the USD, but also versus a rebounding JPY after the weak CPI figures yesterday. Even EURSEK managed to reverse (more below).

JPY – the JPY is finding its legs ahead of 110.00 in USDJPY and on the wobbles in risk appetite – the damage so far in USDJPY is rather limited, but rather significant in the likes of EURJPY and GBPJPY. If no US yield drama comes into play on the jobs data today, then JPY crosses will likely be a proxy for risk appetite.

GBP – last chance area for any straggling sterling bulls as the 200-day moving average in GBPUSD was tested yesterday and that 1.3500 level has significance stretching back decades. The market has priced out most of the odds of a rate hike next Thursday.

CHF – all quiet here as market doesn’t seem to be in the mood to test 1.2000 in EURCHF after the negative data surprises out of Europe. It will take an improvement in EU data, perhaps to get the ball rolling again, if it can roll.

AUD – for the cycle, the 0.7500 area in AUDUSD the focus here, a break of which sets in motion a test toward as low as 0.7000 depending on the greenback’s ambitions and the state of risk appetite and commodity prices.

CAD – a very nervous range ahead of the US jobs figures – a strong close for the week keeps the pressure on the upside, though 1.300-1.3100 is nearby as the key upside structural pivot.

NZD – a bit of mischief in AUDNZD above the local highs, but the bigger pivot awaits above in the 1.0800-50 area. In NZDUSD, meanwhile, the 0.7000 level is the equivalent to 0.7500 in AUDUSD.

SEK – EURSEK finally posting a chunky reversal as volatility has picked up – probably due to the weak EU inflation release, suggesting that the Riksbank may find it challenging to out-dove the ECB on policy, especially at these very weak levels in SEK. Feels like this reversal could have legs, at least until next.

NOK – EURNOK pulled back from the brink yesterday after a rather terse Norges Bank statement that stated point blank that nothing has changed in the outlook. Norwegian rates are a tad lower, but the weak Euro is probably doing the most to see EURNOK back off the range highs. Next point of interest lower not until 9.50-55.