Macro: It’s all about elections and keeping status quo

Markets are driven by election optimism, overshadowing growing debt and liquidity concerns. The 2024 elections loom large, but economic fundamentals and debt issues warrant cautious investment.

Head of Equity Strategy

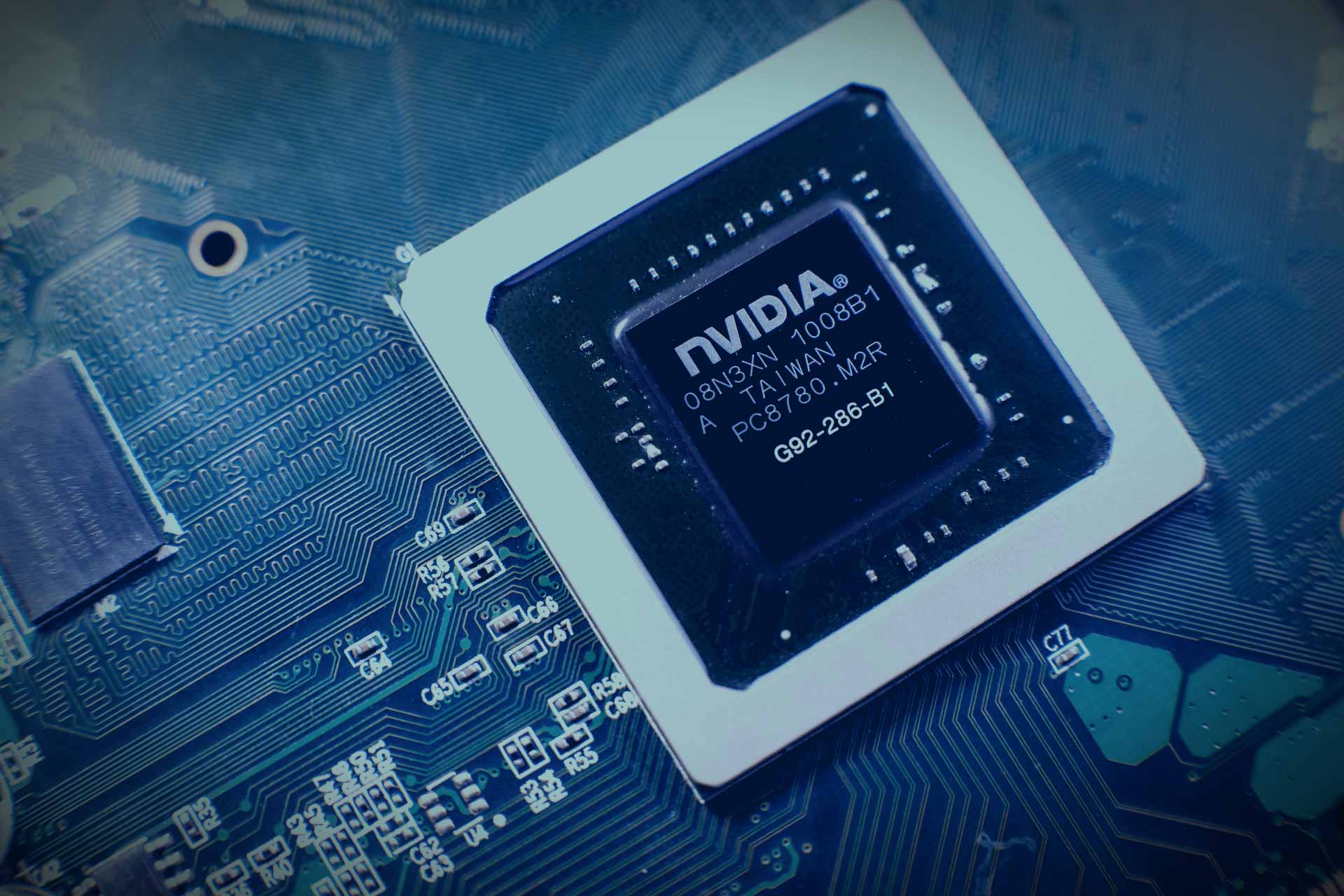

Summary: Inflationary pressures are building in the global economy and the ongoing chip shortage is getting worse according to Samsung and to a degree where the company is considering to postpone the launch of its Note smartphone. Green transformation stocks have had a difficult year and with the news today of Plug Power having applied the accounting for three years sentiment could worsen even more. Pinduoduo is overtaking Alibaba as the biggest e-commerce company in China in a blowout Q4 earnings release and end to a fast growing year despite the pandemic.

Samsung is announcing this morning that it may have to postpone its high-end smartphone Note as the global chip shortage is getting worse to a degree where Samsung’s mobile chief say the imbalance is serious. The global supply issues in the semiconductor industry hit initially the car industry which will produce fewer cars because of the chip shortage, that was initially created last year due to lockdowns impacting demand negative causing carmakers to pull orders for computer chips. The car industry was surprised about the rebound in demand and reordered computer chips, but chipmakers had already reallocated supply to higher profit pools in higher end laptops, smartphones, and crypto mining.

But now the chip shortage is beginning to impact the broader consumer electronics market including Qualcomm which is a key supplier in the global smartphone industry. This is evidence of supply constraints coupled with high demand and could cause prices to soar rapidly ultimately ending with higher consumer prices for electronics. The S&P Semiconductor Select Index (only US semiconductor companies) is up 26.3% annualised since the end of 2008 on a total return basis highlighting the blistering growth of semiconductors in the age of digitalisation. We remain very bullish on the semiconductor industry and expect the imbalance to be sorted by the second half of this year.

Plug Power has been one of the best US stocks the past three years as the company has gone from $272mn in market value at the end of 2018 to more than $40bn at the peak back in January this year. This rise was never matched by rising fundamentals and because of this the equity valuations went into the stratosphere causing the stock to be adopted in our bubble stock equity basket due to a 12-month forward EV/Sales ratio of 68x at the time and negative earnings expectations. Plug Power is also part of our green transformation basket which we updated back in late January this year.

The company says that the accounting error going back three years is related to our costs are classified and service contracts are accounted for etc. According to the company there is no impact on cash flows and the cash position, and no irregularities or misconduct were found. Shares are down 18% in pre-market trading and is down already 42% on yesterday’s close from the closing high in January. The news will obviously impact sentiment on green transformation stocks as investors could increase the risk premium on this segment which has so far been struggling this year after a strong rally in 2020.

The Chinese e-commerce giant Pinduoduo, which is part of our e-commerce equity theme basket, has reported Q4 earnings reaching 788mn annual active buyers on their platform exceeding that of Alibaba. The Q4 monthly active user number reaches 720mn vs est. 686mn, and Q4 revenue hit CNY 26.6bn vs est. CNY 19.3bn. EPS is -0.15 in line with estimates highlighting that at the same scale as Alibaba the company is not profitable which is a bit of a worrying sign, but analysts remain confident that Pinduoduo will reach break-even this year and balloon to profitability in 2022 on accounting earnings. In terms of cash flows the company is already wildly profitable. Shares are down around 5% in pre-market.