Balanced ETF portfolios EUR Q1 2023 commentary

| Asset classes | Stocks (developed and emerging equity), bonds, non-traditional |

| Instruments | ETFs |

| Investment style | Macro, diversified investment focus |

| Quarterly return (net of fees) | |

| Defensive | 1.81% |

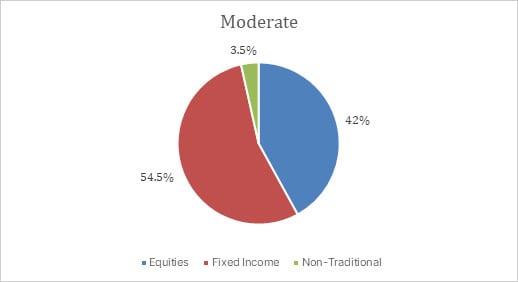

| Moderate | 3.09% |

| Aggressive | 4.28% |

Market overview

After a strong start to the quarter, markets turned south in February as higher-than-expected inflation data led to markets pricing in tighter monetary policy and higher interest rates. Further cracks in the economy as a result of higher interest rates were exposed in March when a number of US regional banks failed.

Deteriorating sentiment towards Financials culminated in the forced take-over of Credit Suisse. However, as wider contagion fears eased, most asset classes finished the month in positive territory. Equities were amongst the top-performing asset classes, driven by continued economic strength, favourable earnings and positive market momentum; this was particularly true of European equities, which outperformed those of the US. In the US, large-cap technology stocks fared particularly well, whilst at the other extreme, turmoil in the banking sector led to Financials underperforming.

Emerging Markets equities lagged broadly behind their developed markets peers, despite finishing the period in positive territory. There was notable dispersion within the universe, with Asian equities outperforming Latin American equities. Performance of Fixed Income assets was mixed, with significant losses mid-quarter and strong gains at both the start and end of the period.

Commodity markets produced varied returns over the quarter. While certain commodities, particularly gold, functioned as a “safe haven” and remained robust despite market volatility, oil lost ground as a result of weaker-than-expected demand out of China, paired with an oversupply from OPEC+ oil production. After rallying throughout 2022, the US dollar started the quarter on a weaker note and produced a negative return over January. Despite recovering in February, as markets priced in further rate hikes, the dollar finished weaker at quarter-end, as those expectations swung the other way, following stress in the banking sector.

The portfolios delivered positive performance over Q1 2023. The main contributors to performance over the quarter were US equities, followed by European equities, particularly the European ESG enhanced allocation.

The performance contribution of the commodities allocation was negative, driven by losses in the energy sector over the quarter.

Portfolio Allocation (31/03/2023)